FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

This slide is so confusing, can you explain every steps and calculation?

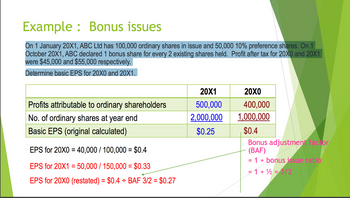

Transcribed Image Text:Example: Bonus issues

On 1 January 20X1, ABC Ltd has 100,000 ordinary shares in issue and 50,000 10% preference shares. On 1

October 20X1, ABC declared 1 bonus share for every 2 existing shares held. Profit after tax for 20X0 and 20X1

were $45,000 and $55,000 respectively.

Determine basic EPS for 20X0 and 20X1.

20X1

20X0

Profits attributable to ordinary shareholders

500,000

400,000

No. of ordinary shares at year end

Basic EPS (original calculated)

2,000,000

1,000,000

$0.25

$0.4

EPS for 20X0=40,000 100,000 = $0.4

EPS for 20X1 = 50,000 / 150,000 = $0.33

EPS for 20X0 (restated) = $0.4 ÷ BAF 3/2 = $0.27

Bonus adjustment factor

(BAF)

= 1 + bonus issue ratio

= 1 + 1 = 3/2

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- BEPS - rights issue A company has 1,000,000 shares in issue at that start of the year. During the year, a rights issue of one new share for every four shares was made at a price of £5 per share. The pre-issue market price was £6.50 per share. The theoretical ex-rights price (TERP) is: Select one: O a. £5.00 b. £6.20 C. £5.30 O d. £6.00arrow_forwardPROVIDE COMPUTATIONarrow_forwardpurchased for P120 per Problem 16-14 (AICPA trading. These 50,000 shares were rights to the investor. and two of these rights. Each share had a market value of P130 and each right had market value of P20 on the date of issue. a What total cost should be'recorded for the new shares that are acquired by exercising the rights? a. 2,250,000 b. 3,250,000 c. 3,050,000 d. 5,500,000arrow_forward

- 1. Avalanche Inc. revealed the following information for the year ended December 31. 2021 Preference share. P100 par-P2.4 million; Share premium, preference - P700,000; Ordinary share, P15 par-P3.5 million, Share premium, ordinary-P1.5 million. Subscribed ordinary share - P100,000, Retained earnings - P2 million, Subscription receivable, ordinary - P20,000 How much is the legal capital? A.P6 million B.PB 1 million CP5.9 million D.P8 2 million 2.At the beginning of 2021, DAI Corp. was organized with authorized capital of 200,000, P500 par value shares. The following transactions transpired during its first year of business. February 4- Issued 15.000 shares at P510 per share April 10- Issued 3,000 shares for services received (FMV of the services is P1.7 million). October 23-Issued 5,000 shares in exchange for a land (FMV) the land is P3 million) What amount should be reported as share premium? A.11.500.000 B. 23.000 C.850.000 D.12.350.000 3. At the beginning of 2021, DAI Corp. was…arrow_forwardp50arrow_forwardA company issued 10000, 10% preference share of Rs.10 each, cost of issue is Rs. 2per share. Calculate cost of capital if these shares are issued (a) at 10% premium and (b) at 5% discount.arrow_forward

- Style Company reported the following information on December 31, 2021: Ordinary share capital 110,000 sharesConvertible noncumulative preference share capital 20,000 shares10% convertible bonds payable P2,000,000 Share options to purchase 60,000 shares at P15 were outstanding. Market price of ordinary share was P22 on December 31, 2021 and average P20 during the year. No value was assigned to the share options. The entity paid preference dividends of P5 per share. The preference share is convertible into 40,000 ordinary shares. The 10% bonds are convertible into 30,000 ordinary shares. The net income for 2021 is P650,000. The tax rate is 30%. Required: 18. Compute the amount that should be reported as basic earnings per share for 2021.19. Compute the total number of potential ordinary shares.20. Compute the amount that should be reported as…arrow_forwardFinancial Management Question. QUESTION ONE You are provided with the following information relating to V ltd Equity and liabilities 12% debentures (shs1000 at par) 16,000 10% preferences shares 6,250 Ordinary shares (Shs 10 par) 12,500 Retained earnings 28,125 Additional information The debentures are currently selling at Shs 950 in the market Company paid a dividend of Shs 5.00 per ordinary share and they are expected to grow at a rate of 10% per annum. The corporation tax is 40% Required Effective Cost of debt Cost of equity Weighted Average cost of capitalarrow_forward.arrow_forward

- 9. The following data pertain to BUENO Corporation: Redeemable Preference Share Capital, P100 par; 5,000 shares issued and outstanding Preference Share Premium Retained Earnings P500,000 50,000 100,000 June 5 Redeemed and retired 500 preference shares at P150 per share. 30 Redeemed and retired 500 preference shares at P90. Direction: a) Journal entries b) Prepare the shareholders' Equity Section as of June 30.arrow_forwardCamiguin company reported the following capital structure on December 31, 2018:Ordinary share capital 110 000 sharesconvertible noncumulative preference share capital 20 000 shares10% convertible bonds payable P2 000 000 share options to purchase 20 000 shares at P15 were oustanding. Market price of Camiguin share was P22 at December 31, 2018 and averaged P20 during the year. No value was assigned to the share options. the entity paid the annual dividend of P5 on the preference share. the preference shares are convertible into 20 000 ordinary shares. the 10% bonds are convertible into 30 000 ordinary shares. the net income for 2018 is P650 000. the income tax rate is 30%. what amount should be reported as diluted earnings per share?a.5.00b.4.76c.4.19d.4.27arrow_forwardPROVIDE COMPUTATIONarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education