Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

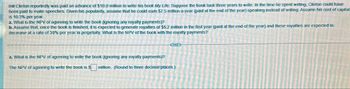

Transcribed Image Text:Bill Clinton reportedly was paid an advance of $10.0 million to write his book My Life. Suppose the book took three years to write. In the time he spent writing, Clinton could have

been paid to make speeches. Given his popularity, assume that he could eam $7.5 million a year (paid at the end of the year) speaking instead of writing. Assume his cost of capital

is 10.3% per year.

a. What is the NPV of agreeing to write the book (ignoring any royalty payments)?

b. Assume that, once the book is finished, it is expected to generate royalties of $5.2 million in the first year (paid at the end of the year) and these royalties are expected to

decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments?

a. What is the NPV of agreeing to write the book (ignoring any royalty payments)?

The NPV of agreeing to write the book is $

million. (Round to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- please use equations. no excel. thanks!arrow_forwardAn engineer received a bonus of $12,000 that he will invest now. He wants to calculate the equivalent value after 24 years, when he plans to use all the resulting money as the down payment on an island vacation home. Assume a rate of return of 9%% per year for each of the 24 years. Find the amount he can pay down, using the tabulated factor, the factor formula, and a spreadsheet function. B)Anood invests $10,000 in a fund that pays 9% compounded annually. If she makes 11 equal annual withdrawals from the fund, how much can she withdraw if the first withdrawal occurs 1 year after her investment?arrow_forwardNick has been offered a unique investment opportunity. If Nick invests $10,400 today, Nick will receive $600 one year from now, $1,690 two years from now, and $12,400 ten years from now. (a) If the cost of capital is 6.7% per year, the NPV is $ SHould he take this opportunity? (b) If the cost of capital is 3.2% per year, the NPV is $ SHould he take this opportunity?arrow_forward

- You want to set aside money in order to present your son with a 25,000 trip upon his graduation from high school in 3 years. If your opportunity cost of capital is 9% per year, how much do you need to set aside? Round your answer to the nearest dollar?arrow_forwardAshley projects that she can get $100,000 cash per year for 5 years on a real estate investment project. If Ashley wants to earn a rate of return of 9%, what is the maximum that she should pay for the investment? (rounded to the nearest dollar)A. $360,478 B. $446,429 C. $560,000 D. $388,965arrow_forwardRoger has a levered cost of equity of 0.14. He is thinking of investing in a project with upfront costs of $7 million, which pays $2 million per year for the next 9 years. He is going to borrow $5 million to offset the startup costs at a rate of 0.08. His tax rate is 0.4. He will repay this loan at the end of the project. What is the NPV of this project, using the FTE method?arrow_forward

- Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required: 1. Patz Corporation is considering the purchase of a computer-aided manufacturing system. The cash benefits will be 800,000 per year. The system costs 4,000,000 and will last eight years. Compute the NPV assuming a discount rate of 10 percent. Should the company buy the new system? 2. Sterling Wetzel has just invested 270,000 in a restaurant specializing in German food. He expects to receive 43,470 per year for the next eight years. His cost of capital is 5.5 percent. Compute the internal rate of return. Did Sterling make a good decision?arrow_forwardRonald has an investment opportunity that promises to pay him $45,000 in five years. He could earn a 8% annual return investing his money elsewhere. What is the most he would be willing to invest today in this opportunity? (EV of $1. PV of $1. EVA of $1, and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answer to 2 decimal places.) Present valuearrow_forwardBrian owns a tanning salon that is expected to produce annual cash flows forever. The tanning salon is worth $636,600.00 and the cost of capital is 6.40%. Annual cash flows are expected with the first one due in one year and all subsequent ones growing annually by 2.30%. What is amount of the annual cash flow produced by the tanning salon in 1 year expected to be? O $55,384.20 (plus or minus $10) O $26,100.60 (plus or minus $10) O $155,268.29 (plus or minus $10) O $15,526,829.27 (plus or minus $10)arrow_forward

- Stuart daniels estimates that he will need $22,000 to set up small business in 8 years. a) how much ( in $) must stuart invest now at 8% interest compound quartely to achieve his goal ? b) how much compound interest ( in $) will he earn on the investment.arrow_forwardAn investor is purchasing an industrial building. He needs to replace the roof today at a cost of $50,000. The economic life of the roof is 20 years. Inflation is 3.0%. He has an investment account that yields 6.0 % . How much must he put aside monthly to cover the future cost of the roof?arrow_forwardAn investor is purchasing an industrial building.He needs to replace the roof today at a cost of $50,000. The economic life of the roof is 20 years. Inflation is 3.0%. He has an investment account that yields 6.0%. How much must he put aside monthly to cover the future cost of the roof?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning