Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

None

Transcribed Image Text:ces

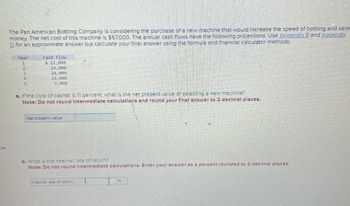

The Pan American Bottling Company is considering the purchase of a new machine that would increase the speed of bottling and save-

money. The net cost of this machine is $57,000. The annual cash flows have the following projections. Use Appendix B and Appendix

D for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Year

1

2

4

Cash Flow

$ 21,000

24,000

28,000

14,000

9,000

a. If the cost of capital is 11 percent, what is the net present value of selecting a new machine?

Note: Do not round Intermediate calculations and round your final answer to 2 decimal places.

Net present value

b. What is the internal rate of return?

Note: Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

Internal rate of return

%6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forwardThe Pan American Bottling Company is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $69,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 Cash Flow $ 29,000 29,000 29,000 34,000 20,000 a. If the cost of capital is 13 percent, what is the net present value of selecting a new machine? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Net present value b. What is the internal rate of return? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Internal rate of return c. Should the project be accepted? O Yes O No %arrow_forwardThe Pan American Bottling Company is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $57,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 Cash Flow $ 22,000 24,000 26,000 32,000 14,000 a. If the cost of capital is 11 percent, what is the net present value of selecting a new machine? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Net present value b. What is the internal rate of return? Note: Do not round intermediate calculations, Enter your answer as a percent rounded to 2 decimal places. Intemal rate of return %arrow_forward

- The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $60,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year Cash Flow 1 $ 23,000 2 26,000 3 29,000 4 15,000 5 8,000 a. If the cost of capital is 13 percent, what is the net present value of selecting a new machine? b. What is the internal rate of return?arrow_forwardPlease give me answer very fast in 5 min saurarrow_forwardHome Security Systems is analyzing the purchase of manufacturing equipment that will cost $56,000. The annual cash inflows for the next three years will be: Year 1 2 3 Cash Flow $ 28,000 26,000 21,000 Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the financial calculator method. a. Determine the internal rate of return. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Internal rate of return %arrow_forward

- Home Security Systems is analyzing the purchase of manufacturing equipment that will cost $36,000. The annual cash inflows for the next three years will be: Year 1 2 3 Cash Flow $ 18,000 16,000 11,000 Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the financial calculator method. a. Determine the internal rate of return. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Internal rate of return % b. With a cost of capital of 12 percent, should the equipment be purchased? O Yes O Noarrow_forwardJack Sprat Inc. wants to know if they invest 11,548 in new exercise equipment, plus $2.000 for installation. how long before they will receive their initial invest back from future cash flows? What is the payback period for the initial costs? Projected Cash flows Year 1: 5,000 Year 2: 7,000 Year 3: 4,000 Year 4: 1,000 Post your answer as number of years with 2 decimal places, for example 5.55arrow_forwardRequired information [The following information applies to the questions displayed below.] A company is considering investing in a new machine that requires a cash payment of $50,939 today. The machine will generate annual cash flows of $21,208 for the next three years. What is the internal rate of return if the company buys this machine? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)arrow_forward

- JS er st un gs Sunland, Inc. management is considering purchasing a new machine at a cost of $4,370,000. They expect this equipment to produce cash flows of $791,390, $796,950, $866,730, $1,116,300, $1,212,360, and $1,300,900 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is tA $arrow_forwardCurrent Attempt in Progress Bramble Corp. is considering purchasing equipment. The equipment will produce the following cash inflows: Year 1, $35,500; Year 2, $39,500; and Year 3, $49,000. Bramble requires a minimum rate of return of 10%. What is the maximum price Bramble should pay for this equipment? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 5.27541. Round answer to 2 decimal places, e.g. 25.25.) Maximum price $arrow_forwardA nursery would like to build another commercial greenhouse to expand its operations. It estimates that building another greenhouse will cost $180,000. To operate another greenhouse, the nursery estimates an additional labor and utilities will cost $30,000 per year. The greenhouse is expected to produce an additional $60,000 of revenue at the end of year 1; this revenue is expected to increase by $10,000 each year. Choose a cash flow diagram.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning