EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

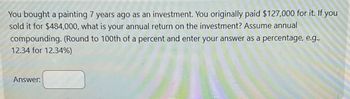

Transcribed Image Text:You bought a painting 7 years ago as an investment. You originally paid $127,000 for it. If you

sold it for $484,000, what is your annual return on the investment? Assume annual

compounding. (Round to 100th of a percent and enter your answer as a percentage, e.g.,

12.34 for 12.34%)

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If you invest $13,276.21 and want to receive $82,006.97 at the end of 31 years, at what APR must you invest? Enter your answer as percentage with two decimal places but without the percent symbol. For example, if your answer is 90.1234%, enter 90.12arrow_forwardYou just purchased a parcel of land for $54,000. To earn a 11% annual rate of return on your investment, how much must you sell the land for in 5 years? Assume annual compounding. (Round to nearest penny, e.g. 1234.56)arrow_forwardYou are able to invest $100 at the end of 1 year into an investment earning 6%. At the endof year 2, you are going to add $1,000 to this investment and at the end of year 3, you are going to addanother $1,000. What will the investment be worth at the end of year 3?arrow_forward

- You have $68,513 you want to invest. You are offered an investment plan that will pay you 4.58 percent per year for the first 20 years and 6.81 percent per year for the last 21 years. How much will you have (in $) at the end of the two periods? Answer to two decimals. < Previousarrow_forwardFind the future value if $7000 is invested for 6 years at 11% compounded annually. (Round your answer to the nearest cent.) $ Need Help? DETAILS MY NOTES What is the future value if $8200 is invested for 15 years at 10% compounded semiannually? (Round your answer to the nearest cent.) Need Help? Read It ASK Warrow_forwardCurly's Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $25,000 per year forever. Assume the required return on this investment is 6 percent. Required: How much will you pay for the policy? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Policy value todayarrow_forward

- You are scheduled to receive $10,000 in three years. When you receive it, you will invest it for six years at 7.2 percent per year. How much will you have in nine years? (hint: draw a timeline) Multiple Choice $18,696.19 $17,290.61 $13,788.43 $15,176.40 $16,611.93arrow_forwardIf you invest $9,700 per period for the following number of periods, how much would you have received at the end? Use Appendix C. (Round "Factor" to 3 decimal places. Round the final answers to the nearest whole dollar.) a. 11 years at 9 percent Future value $ b. 16 years at 11 percent Future value $ c. 30 periods at 10 percent Future value $arrow_forwardKen Francis is offered the possibility of investing $10,062 today; in return, he would receive $18,500 after 9 years. What is the annual rate of interest for this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "PV of a single amount" to 4 decimal places and percentage answer to the nearest whole number.) Present Value 1 Future Value 1 p (PV of a Single Amount) Interest Rate %arrow_forward

- What is the IRR for a $1,075 investment that returns $190 at the end of each of the next 6 years?(Perform all calculations using 5 significant figures and round your answer to two decimal places): Answer: ____________%arrow_forwardAn investor placed $2,000 per year at the end of each year into an investment account. Immediately after the 15th payment, the value of money in the account was $58,720. What is the average annual rate of return the investor has earned on the account? Group of answer choices 7.0% 9.0% 5.1% 6.3%arrow_forwardYou are saving for a new house. You place $47,000 into an investment account at the end of each year for five years. How much will you have after five years if the account earns (a) 5%, (b) 7%, or (c) 9% compounded annually? Note: Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places. (FV of $1, PV of $1, FVA of $1, and PVA of $1) a. b. C.. Annuity Annual Interest Payment Rate Compounded $ 47,000 47,000 47,000 5% 7% 9% Annually Annually Annually Period Invested 5 years 5 years 5 years Future Value of Annuity $ 59,985.23 65,919.93 72,315.33 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College