Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

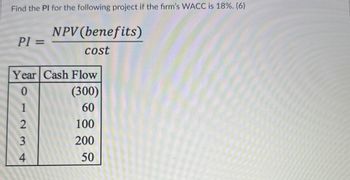

Transcribed Image Text:Find the PI for the following project if the firm's WACC is 18%. (6)

NPV (benefits)

PI =

cost

Year Cash Flow

0

(300)

1234

60

2

100

200

50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 14. A project has estimated the following benefit possibilities for the year: Benefits ($) Probability. 100 0.25 0.35 0.25 O $3,642 150 O $193.50 O $176 220 Expected benefit is: 290 $391.00 0.15arrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forward5. LL Consider the following cash flows of a project: Year Year 1. 50 0. 2. 3. 4. 1. Find the internal rate of return for this investment. 0. 20. Multiple Choice < Prev 10 of 15 Next here to search F11 F12 F4 F5 69 81 9F-arrow_forward

- 7arrow_forwardA project has the following cash flow n 0 1 2 3 Cash flow -25,000 0 X X What is the value of X that will result in 15% rate of return?arrow_forwardA project requires an investment of 4 at times o and 6. It has a single positive cash flow of 12 at time 3. What is the (positive) Internal Rate of Return on this project? A B C D E 0.09 0.11 0.23 0.38 0.50arrow_forward

- Compute the NPV for Project X and accept or reject the project with the cash flows shown below if the appropriate cost of capital is 10 percent. Time: 1 2 4 Cash flow: -150 -150 250 225 200arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forwardWhich alternative should be selected using the incremental rate of return analysis, if MARR =11.0%? Do- nothing A B C D First Cost 0 $10,000 $4000 $10,000 $7000 Annual benefit 0 1,806 828 1,880 1,067 Life 10 Years ROR 12.5% 16.0% 13.5% 8.5% a. B, because its ROR is the highest b. Something other than C, because C costs the most initially c. C, because the C-B increment has a ROR of 11.78% and the A-B increment has a ROR of 10.5% d. C because C has the highest annual benefitarrow_forward

- I need help with H-1.arrow_forward3. A. B. C. time Capital Budgeting Project S Project L D. 0 -1000 -1000 1 500 100 2 400 200 3 300 300 4 200 400 5 100 500 USE NPV METHOD, assuming the WACC is 10%. Which project will you invest? Use IRR method, which project will you invest? Assuming WACC is 10%, use MIRR, which project will you invest? Use payback period method, which project will you invest?arrow_forwardJames plans to receive a monthly annuity of $779 for the next 25 years as part of his inheritance. The interest rate is 10.78 per annum compounded monthly Calculate the present value (PV) of this annuity. $72.26 O$779.00 $867.16 $289.05 O $1.11arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education