Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

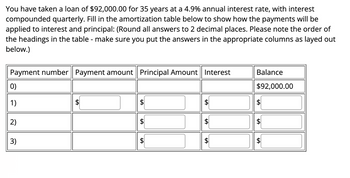

Transcribed Image Text:You have taken a loan of $92,000.00 for 35 years at a 4.9% annual interest rate, with interest

compounded quarterly. Fill in the amortization table below to show how the payments will be

applied to interest and principal: (Round all answers to 2 decimal places. Please note the order of

the headings in the table - make sure you put the answers in the appropriate columns as layed out

below.)

Payment number Payment amount Principal Amount Interest

0)

1)

2)

3)

$

LA

tA

+A

LA

$

Balance

$92,000.00

tA

LA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A $178,000 mortgage loan is offered at an APR of 4%. Follow the instructions below the table. The loan payment formula was used to calculate the monthly payments for the loans and results are reported in the table below. You do NOT have to verify the given payment entries (you already used the formula for calculating payments in the first part Loan term in years Monthly Payment on $178,000 loan (in $) Total amount paid back over the full loan term (in $) Interest over the full loan term (in $) Difference in monthly payment from option above (in $) t = 15 years Pmt = $ 1316.64 F = I = No entry here t = 30 years Pmt = $ 849.80 F = I = Difference in MONTHLY payment t = 40 years Pmt = $ 743.93 F = I = Difference in MONTHLY payment t = 50 years Pmt = $ 686.56 F = I = Difference in MONTHLY payment For each loan term option, calculate the total amount paid back over the…arrow_forwardRoss Land has a loan of $8,500 compounded quarterly for four years at 4%. What is the effective interest rate for the loan? Click here to view page 1 of the future value table. Click here to view page 2 of the future value table. The effective interest rate is %. (Round to two decimal places as needed.)arrow_forwardA mortgage of $656,000 is amortized over 25 years by making end-of-month payments of $4,120. Your calculator must be set to 2 decimals before doing any calculations that are going to involve Amortization. a.) What is the annual rate of interest compounded semi-annually? (Correct to exactly 4 decimal places.) Once you have seen what this is, to 4 decimal places, set your calculator back to 2 decimal places before using the AMORT function. b.) What is the value of the final (partial) payment? The final payment required to make the outstanding balance equal exactly zero. (Use the BAII+: Do not calculate this by hand.) c.) What is the total interest cost for the debt over 25 years (300 payments)? (Use the BAII+: Do not calculate this by hand.)arrow_forward

- Complete the following from the first three lines of an amortization schedule for the following loan:You borrow $ 330000 with an annual interest rate of 6% over 20 years Starting principal = $ 330000New balance after month 1 payment = New balance after month 2 payment = New balance after month 3 payment =arrow_forwardAnna borrows 188000 from a bank for a term of 21 years. The loan is to be repaid by level annual repayments, paid in arrears, and the interest rate is 5% per annum effective. Calculate the capital outstanding immediately after the 6th payment. Give your answer to two decimal places.arrow_forwardou were paying your fully amortising loan at 8.2% per annum for 12 years. The current monthly payment is $1,492 per month. What is the remaining loan balance at the end of year 2? Please rounded your answer to two decimal points (e.g. 8000.158 is rounded to 8000.16)arrow_forward

- i need the answer quicklyarrow_forwardTo pay for remodeling, the company will take out a $500,000 five-year loan at 9.5% interest, compounded quarterly. The terms of the loan have been entered in the Loan Analysis worksheet. In cell B8, calculate the quarterly payment on the loan based on the loan conditions already entered. Complete the amortization schedule in cells B11 through E30. Column B contains the interest payment for each quarter, and column C contains the principal payment. Column D contains the remaining principal at the start of each month. The initial principal remaining is $500,000. The subsequent remaining principal values are reduced by the principal payment made in the previous quarter. Calculate the ending balance in cell D31. Use the IPMT function in cell B11 to calculate the interest amount paid per period. Copy this formula to cell B30. Use the PPMT function in cell C11 to calculate the principal amount paid per period. Copy this formula to cell C30. Write a formula in cell D11 to indicate the…arrow_forwardThe simple interest charged on a 5-month loan of $51,000 is $356. Find the simple interest rate. (Round your answer to one decimal place.)arrow_forward

- CZ Enterprises borrows $202,775 at an interest rate of 10% today and will repay this amount by making 10 semiannual payments. Payments begin in six months. What is the amount of the payments that CZ will need to make? (Use the present value and future value tables, a financial calculator, a spreadsheet or the formula method for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answer to the nearest cent, $X.XX.) CZ will need to make payments of $ 26,260.31.arrow_forwardTo pay for remodeling, the company will take out a $500,000 five-year loan at 9.5% interest, compounded quarterly. The terms of the loan have been entered in the Loan Analysis worksheet. In cell B8, calculate the quarterly payment on the loan based on the loan conditions already entered. Complete the amortization schedule in cells B11 through E30. Column B contains the interest payment for each quarter, and column C contains the principal payment. Column D contains the remaining principal at the start of each month. The initial principal remaining is $500,000. The subsequent remaining principal values are reduced by the principal payment made in the previous quarter. Calculate the ending balance in cell D31. Use the IPMT function in cell B11 to calculate the interest amount paid per period. Copy this formula to cell B30. Use the PPMT function in cell C11 to calculate the principal amount paid per period. Copy this formula to cell C30. Write a formula in cell D11 to indicate the…arrow_forwardYour company is planning to borrow $1 million on a 5-year, 11%, annual payment, fully amortized term loan. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What fraction of the payment made at the end of the second year will represent repayment of principal? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education