Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

HELP

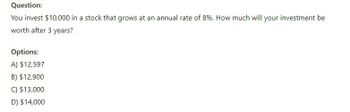

Transcribed Image Text:Question:

You invest $10,000 in a stock that grows at an annual rate of 8%. How much will your investment be

worth after 3 years?

Options:

A) $12,597

B) $12,900

C) $13,000

D) $14,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Suppose that you are willing to pay $450.33 today for a share of stock which you expect to sell at the end of one year for $500.25. If you require an annual rate of return of 15 percent, what should be the estimate of the amount of the annual dividend which you expect to receive by the end of Year 1 prior to the sale of the stock? Assume that the estimated return equals the required rate of return. Options: a. $17.63 b. $1.60 c. $10.99 d. $19.25 e. $3.60arrow_forwardTesla stock is currently selling for $799.83. You are thinking about buying it and you hope to sell it in 4 years. If your required return on investments of this risk is 16.58%, what must you sell it for?? Round to 2 decimal places. Include a dollar sign ($) or percent (%) as appropriate. Answer:arrow_forwardusing the chart, how much should the call option worth. please show how to solve this in excel and the formulasarrow_forward

- An investor wants to purchase a stock that sells for $48. What is the value of a one-year put option to buy the stock at $45, if debt currently yields 8% and the standard deviation of stock returns is 11%? a. $3.84 b. $6.68 c. $5.28 d. $3.00arrow_forward5. The price of Gamma Corp. stock will be either $62 or $86 at the end of the year. Call options are available with one year to expiration. T bills currently yield 4 percent. (SHOW YOUR WORK) suppose the current price of the company’s stock is $70. What is the value of the call option if the exercise price is $65 per share? Suppose the exercise price is $75 in part (a). What is the value of the call option now?arrow_forwardTopic 2: Return measures2. Which of the following investments do you prefer?(a) Purchase a zero-coupon bond, which pays $1000 in ten years, for a price of $550.(b) Invest $550 for ten years in a bank savings account at a guaranteed annual interestrate of 5.5%.1arrow_forward

- D4) Finance Calculate the price of a 3-month American put option on a non-dividend-paying stock when the stock price is $50, the strike price is $50, the risk-free interest rate is 5% per annum, and the volatility is 25% per annum. Use a binomial tree with a time interval of 1 month.arrow_forwardSubject:- financearrow_forwardsolve a,b,c and d please. Round to the nearest dollararrow_forward

- What makes for a good investment? Use the approximate yield formula or a financial calculator to rank the following investments according to their expected returns. Buy a stock for $30 a share, hold it for three years, and then sell it for $60 a share (the stock pays annual dividends of $2 a share). Buy a security for $40, hold it for two years, and then sell it for $100 (current income on this security is zero). Buy a one-year, 5 percent note for $1,000 (assume that the note has a $1,000 par value and that it will be held to maturity).arrow_forwardThe current price of a non-dividend-paying stock is $25. Over the next six months it is expected to rise to $30 or fall to $21. An investor buys put options with a strike price of $27. What is the value of each option? The risk-free interest rate is 5% per annum with continuous compounding. Answer to 3dps. Group of answer choices 1.578 2.840 3.018 0.935arrow_forwardanswer in text form please (without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning