FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

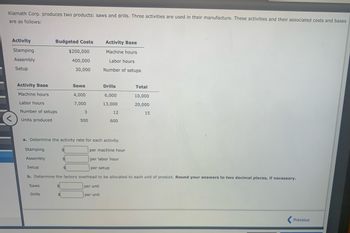

Transcribed Image Text:Klamath Corp. produces two products: saws and drills. Three activities are used in their manufacture. These activities and their associated costs and bases are as follows:

| Activity | Budgeted Costs | Activity Base |

|--------------|----------------|-----------------|

| Stamping | $200,000 | Machine hours |

| Assembly | 400,000 | Labor hours |

| Setup | 30,000 | Number of setups|

| Activity Base | Saws | Drills | Total |

|-----------------|------|--------|-------|

| Machine hours | 4,000| 6,000 | 10,000|

| Labor hours | 7,000| 13,000 | 20,000|

| Number of setups| 3 | 12 | 15 |

| Units produced | 500 | 600 | |

a. Determine the activity rate for each activity.

- Stamping: $______ per machine hour

- Assembly: $______ per labor hour

- Setup: $______ per setup

b. Determine the factory overhead to be allocated to each unit of product. Round your answers to two decimal places, if necessary.

- Saws: $______ per unit

- Drills: $______ per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts Direct Labor- Hours per unit 0.60 0.60 Additional information about the company follows: a. Rims require $17 in direct materials per unit, and Posts require $14. b. The direct labor wage rate is $20 per hour. Activity Cost Pool Machine setups Special processing General factory c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Annual Production Activity Cost Pool Machine setups Special processing General factory 26,000 units 84,000 units $ 14.00 Activity Measure Number of setups Machine-hours Direct labor-hours X Answer is not complete. Activity Rate Required: 1. Compute the activity rate for each activity cost pool. (Round your answers to 2 decimal places.) Estimated Overhead Cost $ 39,480 $…arrow_forwardA company produces pool pumps. Overhead costs have been identified as follows: Activity Pool Cost Material handling Machine maintenance Setups Cost Driver Number of moves Number of machine hours 14 Number of production runs $ 70,840.00 73,000.00 82,038.00 Total Activity 460 36,500 66 Number of moves Economy 10,080 162 The company makes three models of pumps with the following activity demands: Units produced Standard 21,000 132 Premium 3,545 166 Machine hours 9,550 21,800 5,150 Production runs 17 17 32 Required: a. Calculate the activity rate for each activity. b. Determine the amount of indirect costs assigned to each of the products. Complete this question by entering your answers in the tabs below. Required A Required B Determine the amount of indirect costs assigned to each of the products. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places.arrow_forwardCampbell Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Cost Cost driver Unit Level $75,400 Req A and B 2,900 labor hours Production of 870 sets of cutting shears, one of the company's 20 products, took 160 labor hours and 7 setups and consumed 19 percent of the product-sustaining activities. Complete this question by entering your answers in the tabs below. Req C Allocated overhead Direct cost Total cost per unit Desired profit Sales price Required 8. Had the company used labor hours as a companywide allocation base, how much overhead would It have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using…arrow_forward

- Carlise Corp., which manufactures ceiling fans, currently has two product lines, the Indoor and the Outdoor. Carlise has to overhead of $132,720. Carlise has identified the following information about its overhead activity cost pools and the two product lines: Quantity/Amount Consumed by Indoor Line Quantity/Amount Consumed by Outdoor Line Activity Cost Pools Cost Driver Materials handling Number of moves Quality control Number of inspections Machine maintenance Number of machine hours Required: 1. Suppose Carlise used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) Indoor Model Outdoor Model Total Cost Assigned to Pool $21, 120 $71,760 4,600 inspections $39,840 29,000 machine hours 19,000 machine hours 600 moves 500 moves 5,800 inspections Overhead Assignedarrow_forwardCompute the activity rate for each activity cost pool. (Round your answers to 2 decimal places.)arrow_forwardProduct Costs using Activity Rates Hercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $30 per machine hour Assembly $35 per direct labor hour Setup $90 per setup Inspecting $20 per inspection Production scheduling $19 per production order Purchasing $5 per purchase order The activity-base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 600 400 Direct labor hours 190 223 Setups 30 30 Inspections 15 25 Production orders 40 30 Purchase orders 318 85 Units produced 500 320 Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product. Total…arrow_forward

- 8. Tri-Bikes manufactures two different levels of bicycles – the Standard and the Extreme. The total overhead of $300,000 has traditionally been allocated by direct labor hours, with 150,000 hours for the Standard and 50,000 hours for the Extreme. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $180,000 of overhead, with 4,000 hours used on the Standard product and 1,000 hours used on the Extreme product. It was also estimated that the setup cost pool would have $120,000 of overhead, with 1,000 hours for the Standard and 1,500 hours for the Extreme. PLEASE NOTE: Predetermined overhead rates will be rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). The rates will include their proper label according to the textbook examples (no abbreviations). All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). What is the overhead cost per product,…arrow_forwardSanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay: Line Item Description SupportDepartmentsS1 SupportDepartmentsS2 ProducingDepartmentsAssembly ProducingDepartmentsPainting Direct costs $200,000 $140,000 $115,000 $96,000 Normal activity: Square footage — 500 1,875 625 Machine hours 337 — 3,200 12,800arrow_forwardBrannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? $144.00 $18.00 $180.00 $30.00arrow_forward

- Pasternik Company produces and sells two products, Alpha and Zeta. The following information is available relating to its setup activities: Alpha Zeta Units produced 250 20,000 Batch size (units) 10 500 Total direct labor hours 1,000 39,000 Cost per setup $2,000 $2,000 Use of activity-based costing would allocate the following amounts of setup cost to each unit (rounded to the nearest cent): Alpha Zeta A) $200.00 $4.00 B) $500.00 $1,025.64 C) $6.42 $6.50 D) $80.00 $50.00 E) $8.00 $0.10arrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $190 and $155, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 122,000 units of each product. Its average cost per unit for each product at this level of activity is given below: Alpha Beta Direct materials $ 40 $ 24 Direct labor 34 28 Variable manufacturing overhead 21 19 Traceable fixed manufacturing overhead 29 32 Variable selling expenses 26 22 Common fixed expenses 29 24 Total cost per unit $ 179 $ 149 The company’s traceable fixed manufacturing overhead is avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 15. Assume Cane’s customers would buy a maximum of 94,000 units of Alpha and 74,000 units of Beta. Also assume the company’s raw material available for production is limited to 228,000 pounds. If Cane uses its 228,000…arrow_forwardHaggstrom, Inc., manufactures steel fittings. Each fitting requires both steel and an alloy that allows the fitting to be used under extreme conditions. The following data apply to the production of the fittings. Direct materials per unit 3 pounds of steel at $0.55 per pound 0.5 pounds of alloy at $1.90 per pound Direct labor per unit 0.02 hours at $30 per hour Overhead per unit Indirect materials Indirect labor Utilities Plant and equipment depreciation Miscellaneous $0.60 0.75 0.55 0.90 0.70 Total overhead per unit $3.50 The plant and equipment depreciation and miscellaneous costs are fixed and are based on production of 250,000 units annually. All other costs are variable. Plant capacity is 300,000 units annually. All other overhead costs are variable. The following are forecast for year 2. Contract negotiations with the union are expected to lead to an increase in hourly direct labor costs of 4 percent, mostly in the form of additional benefits. Commodity prices, including steel,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education