FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

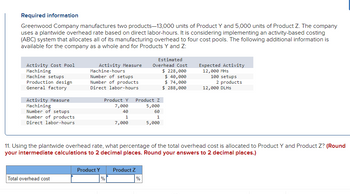

Greenwood Company manufactures two products—13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide

| Activity Cost Pool | Activity Measure | Estimated Overhead Cost | Expected Activity | |

|---|---|---|---|---|

| Machining | Machine-hours | $ 228,000 | 12,000 | MHs |

| Machine setups | Number of setups | $ 40,000 | 100 | setups |

| Production design | Number of products | $ 74,000 | 2 | products |

| General factory | Direct labor-hours | $ 288,000 | 12,000 | DLHs |

| Activity Measure | Product Y | Product Z |

|---|---|---|

| Machining | 7,000 | 5,000 |

| Number of setups | 40 | 60 |

| Number of products | 1 | 1 |

| Direct labor-hours | 7,000 | 5,000 |

11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y and Product Z? (Round your intermediate calculations to 2 decimal places. Round your answers to 2 decimal places.)

Transcribed Image Text:Required information

Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company

uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing

(ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is

available for the company as a whole and for Products Y and Z:

Activity Cost Pool

Machining

Machine setups

Production design

General factory

Activity Measure

Machining

Number of setups

Number of products

Direct labor-hours

Activity Measure

Machine-hours

Number of setups

Number of products

Direct labor-hours

Total overhead cost

Product Y

Product Y Product Z

7,000

5,000

40

60

1

1

7,000

5,000

%

Estimated

Overhead Cost

$ 228,000

Product Z

%

$ 40,000

$ 74,000

$ 288,000

11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y and Product Z? (Round

your intermediate calculations to 2 decimal places. Round your answers to 2 decimal places.)

Expected Activity

12,000 MHS

100 setups

2 products

12,000 DLHS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give image formatarrow_forwardRequired information Greenwood Company manufactures two products-15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Number of setups Number of products Direct labor-hours Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 227,700 $ 153,908 Product Y Product Z 8,700 60 1 8,700 2,300 210 1 1,300 Expected Activity 11,000 MHS 270 setups $ 91,000. $ 257,000 2 products 10,000 DLHS 14. Using the ABC system, what percentage of the Product Design cost is assigned to Product Y and Product Z? (Round your answers to 2…arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below, along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor. Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers Activity Rate $10 per direct labor-hour $90 per batch $286 per order $ 2,602 per customer The company just completed a single order from Interstate Trucking for 2,800 custom seat cushions. The order was produced in four batches. Each seat cushion required 0.3 direct labor-hours. The selling price was $141.10 per unit, the direct materials cost was $102 per unit, and the direct labor cost was $14.20 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forward

- Aragon makes handheld calculators in two models--basic and professional--and wants to refine its costing system by allocating overhead using departmental rates. The estimated $1,149,500 of manufacturing overhead has been divided into two cost pools: Assembly Department and Packaging Department. The following data have been compiled: LOADING... (Click the icon to view the data.) Read the requirements LOADING... . Compute the predetermined overhead allocation rates using machine hours as the allocation base for the Assembly Department and direct labor hours for the Packaging Department. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each department. (Abbreviation used: Qty = quantity. Enter the allocation rates to the nearest cent.) Predetermined OH Estimated overhead costs ÷ Estimated qty of the allocation base =…arrow_forwardTeach Gear Inc. produces 3 types of office equipment; Bronze, silver and Gold and uses an activity-based product costing system. They have identified 5 activities. Each activity, it costs and related activity driver is summarized below: Activity Material handling Material insertion Activity Units to be produced Orders to be shipped Number of parts per unit Machine hours per unit Labor hours per unit Cost Tasks: Automated Machinery finishing Packaging The following data are provided for each product line: Activity driver Number of parts Number of parts 350,000 Machine hours 150,000 Labor hours 90,000 Orders shipped Bronze P120,000 240,000 6,000 1,200 4. 1 2 Silver 4,000 800 5 2 3 Gold 2,000 400 8 3 لنا Make a narrative recommend the unit cost per unit of Bronze, Silver and Gold using the ABC system. In support of your recommendation show your solution presenting: 1. The computation of the activity cost rates 2. the computation of the estimated volume (TOTAL PARTS, TOTAL MACHINE HOURS,…arrow_forwardplease provide answer with explanation , calculation and steps clearly and correctly answer in text formarrow_forward

- Requlred Informatlon Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure, Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 242,400 $ 114,400 86,000 $ 302,400 Expected Activity 12,000 MHs 220 setups 2 products 12,000 DLHS Activity Measure Machining Number of setups Number of products Direct labor-hours, Product Y 8,200 40 Product Z 3,800 180 1. 3,800 8,200 4. What is the activity rate for the Machine Setups activity cost pool? 灣灣彩 Activity rate per setup 15 of 15 Axt > < Prev 4 5 9. 92 F AQI…arrow_forwardMaxey & Sons manufactures two types of storage cabinets-Type A and Type B-and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Descriptions Anticipated volume (units) Direct-material cost per unit Direct-labor cost per unit Descriptions The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow. Setups Machine hours Outgoing shipments Type A 140 48,000 200 Required 1 Required 2 Required 3 Type A 24,000 $ 28 33 The firm's total overhead of $13,860,000 is subdivided as follows: manufacturing setups, $3,024,000; machine processing, $8,316,000; and product shipping, $2,520,000. Required: 1. Compute the unit manufacturing cost of Type A and Type…arrow_forwardRequired information [The following information applies to the questions displayed below.] Hickory Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $829,500 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Product design Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 246,000 Expected Activity 12,000 MHS $ 89,000 $ 357,000 14,400 250 setups 2 products DLHS $ 137,500 General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y Product Z 7,500 40 1 8,500 4,500 210 1 5,900 2. Using the plantwide overhead rate, how much manufacturing…arrow_forward

- Assume a company manufactures only two products—14,000 units of Product C and 6,000 units of Product D. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products C and D: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 300,000 15,000 MH Machine setups Number of setups $ 150,000 200 Setups Product design Number of products $ 78,000 2 Products Activity Measure Product C Product D Machine-hours 9,000 6,000 Number of setups 50 150 Number of products 1 1 Using the ABC system, how much overhead cost would be assigned from the Machine Setups cost pool to Product D? Multiple Choice $115,200 $112,500 $122,500 $102,500arrow_forwardRequlred Informatlon Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Estimated Overhead Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Expected Activity 12, 000 МHs 220 setups 2 products 12,000 DLHS Cost $ 242,400 $ 114,400 $ 86,000 $ 302,400 Activity Measure! Machining Number of setups Number of products Direct labor-hours, Product Y 8,200 40 1. 8,200 Product Z 3,800 180 3,800 3. What is the activity rate for the Machining activity cost pool? (Round your answer to2 declmal places.) Activity rate per MH 15…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education