FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

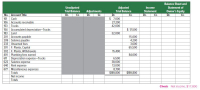

The Adjusted

work sheet by extending the account balances into the appropriate financial statement columns and by

entering the amount of net income for the reporting period.

Transcribed Image Text:Balance Sheet and

Unadjusted

Trial Balance

Cr.

Adjusted

Trial Balance

Income

Statement of

Adjustments

Dr.

Cr.

Owner's Equity

Cr.

Statement

No. Account Title

101 Cash

106 Accounts receivable

153 Trucks

154 Accumulated depreciation-Trucks

183 Land

201 Accounts payable

209 Salaries payable

233 Unearned fees

301 F. Planta, Capital

302 F. Planta, Withdrawals

401 Plumbing fees earned

611 Depreciation expense-Trucks

622 Salaries expense

640 Rent expense

677 Miscellaneous expenses

Dr.

Dr.

Cr.

Dr.

Cr.

Dr.

$ 7,000

27,200

42,000

$ 17,500

32,000

15,000

4,200

3,600

65,500

15,400

84,000

6,500

38,000

13,000

8,700

$189,800

Totals

$189,800

Net income

Totals

Check Net Income, $17,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- . If the supplies account indicated a balance of $2,250 before adjustment on May 31 and supplies on hand at May 31 totaled $950, the adjustment would be: DATE DESCRIPTION DEBIT CREDITarrow_forwardThe balances for the accounts that follow appear in the Adjusted Trial Balance columns of the end-of-period spreadsheet. Indicate whether each account would flow into the income statement, statement of owner’s equity, or balance sheet.1. Accumulated Depreciation2. Cash3. Fees Earned4. Insurance Expense5. Prepaid Rent6. Supplies7. Tina Greer, Drawing8. Wages Expensearrow_forwardOn June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forward

- Please Answer In Excel Sheet....!arrow_forwardList the two primary types of accounts found in the income statement. Provide the following information for each of the two accounts: Norm (normal) balance – debit or credit Balance at the beginning of the year Balance at the end of the year after the accounts are closedarrow_forwardLamp Light Company maintains and repairs warning lights, such as those found on radio towersand lighthouses. Lamp Light prepared the following end-of-period spreadsheet at December 31,2018, the end of the fiscal year: Instructions1. Prepare an income statement for the year ended December 31.2. Prepare a retained earnings statement for the year ended December 31.3. Prepare a balance sheet as of December 31.4. Based upon the end-of-period spreadsheet, journalize the closing entries.5. Prepare a post-closing trial balance.arrow_forward

- Salary expense has a balance of $65,400 in the trial balance debit column of a worksheet. The adjustments credit column contains a $500 credit to salary payable. The adjusted trial balance column will show:arrow_forwardUse the information from the Adjusted Trial Balance and Financial Statement templates provided in the module under Test 2 information you completed to answer questions 36 - 50. (Also copied below.) For Question 36, how much revenue should be recorded on the Income Statement? Elliptical Consulting Adjusted Trial Balance For the Year Ended June 30, 2019 Account Title Debit Credit Cash 27,000 Accounts Receivable 53,500 Supplies 900 Office Equipment 30,500 Accumulated Depreciation – Office Equipment 6,000 Accounts Payable 3,300 Salaries Payable 375 Jayson Neese, Capital 82,200 Jayson Neese, Drawing 2,000 Fees Earned 60,000 Salary Expense 32,375 Supplies Expense 2,100 Depreciation Expense 1,500 Miscellaneous Expense 2,000 Totals 151,875 151,875 Notice that the accounts are listed in order of the accounting…arrow_forwardThe following selected accounts appear in the adjusted trial balance columns of the worksheet for Ashram Company. Indicate with an "X" the financial statement column (income statement Dr., balance sheet Cr., etc.) to which each balance should be extended. Income Statement Balance Sheet Account Dr. Cr. Dr. Cr. Accumulated Depreciation Depreciation Expense Owner's Capital Owner's Drawings Service Revenue Supplies Accounts Payable > > > > > > > > > > > > > > > > > > >arrow_forward

- Performance Plastics Company (PPC) has been operating for three years. The beginning account balances are: $ 44, 500 9,050 61,500 7,900 5,650 82, 000 152,000 32,750 47,500 100,000 150,000 97,850 Cash Accounts Receivable Inventory Supplies Notes Receivable (due in three years) Equipment Buildings Land Accounts Payable Notes Payable (due in three years) Common Stock Retained Earnings During the year, the company had the following summarized activities: a. Purchased equipment that cost $25,350, paid $9,450 cash and signed a two-year note for the balance. b. Issued an additional 2,600 shares of common stock for $26,000 cash. c. Borrowed $61,000 cash from a local bank, payable June 30, in two years. d. Purchased supplies for $6,200 cash. e. Built an addition to the factory buildings for $69,750; paid $33,250 in cash and signed a three-year note for the balance. f. Hired a new president to start January 1 of next year. The contract was for $95,000 for each full year worked.arrow_forwardUse the information from the Adjusted Trial Balance and Financial Statement templates provided in the module under Test 2 information you completed to answer questions 36 - 50. (Also copied below.) For Question 36, how much revenue should be recorded on the Income Statement? Elliptical Consulting Adjusted Trial Balance For the Year Ended June 30, 2019 Account Title Debit Credit Cash 27,000 Accounts Receivable 53,500 Supplies 900 Office Equipment 30,500 Accumulated Depreciation – Office Equipment 6,000 Accounts Payable 3,300 Salaries Payable 375 Jayson Neese, Capital 82,200 Jayson Neese, Drawing 2,000 Fees Earned 60,000 Salary Expense 32,375 Supplies Expense 2,100 Depreciation Expense 1,500 Miscellaneous Expense 2,000 Totals 151,875 151,875 Notice that the accounts are listed in order of the accounting…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education