FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Preparing financial statements from the

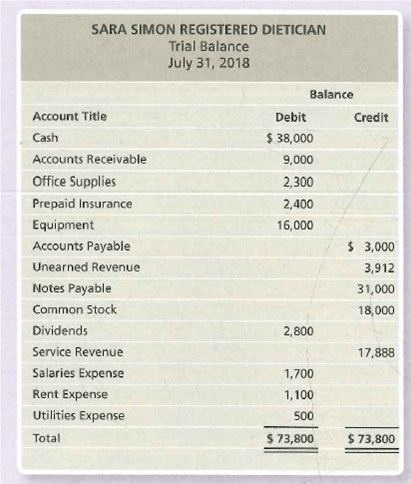

The trial balance as of July 31, 2018, for Sara Simon, Registered Dietician is presented below:

Requirements

- Prepare the income statement for the month ended July 31, 2018.

- Prepare the statement of

retained earnings for the month ended July 31, 2018. The beginning balance of retained earnings was $0. - Prepare the

balance sheet as of July 31, 2018. - Calculate the debt ratio as of July 31, 2018.

Transcribed Image Text:SARA SIMON REGISTERED DIETICIAN

Trial Balance

July 31, 2018

Balance

Account Title

Debit

Credit

Cash

$ 38,000

Accounts Receivable

9,000

Office Supplies

2,300

Prepaid Insurance

2,400

Equipment

16,000

Accounts Payable

$ 3,000

Unearned Revenue

3,912

Notes Payable

31,000

Common Stock

18,000

Dividends

2,800

Service Revenue

17,888

Salaries Expense

1,700

Rent Expense

1,100

Utilities Expense

500

Total

$ 73,800

$ 73,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forwardsarrow_forwardRecover Rehabilitation Hospital has the following balances that are extracted from its December 31, 2019, trial balance: Account Debit Credit Nursing Services Expense. . . . . . . . . . Professional Fees Expense. . . . . . . . . . . . . . . . . . . . . . . General and Administrative Expense . . . . . . . . . . . . Depreciation Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . Interest Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Asset Whose Use Is Limited . . . . . . . . . . . . . . . . . . . . . Repairs and Maintenance Expense . . . . . . . . . . . . . . . . Provision for Uncollectible Accounts . . . . . . . . . . . . . . Contractual Adjustments . . . . . . . . . . . . . . . . . . . . . . . . . Patient Service Revenues. . . .. . . . . . . . . . .. . . . . . . . Seminar Income.. . . .. . . . . . . . . . .. . . . . . . . Child Day Care Income. . . .. . . . . . . . . . .. . . . . . . . Parking Fees. . . .. . . . . . . . . . .. .…arrow_forward

- When preparing a report form of a Balance Sheet for a merchandising business, assume that the Adjusted Trial Balance has the following accounts and balances: Accounts Payable, $22,000; Customers Refund Payable, $3,000, Wages Payable, $2,000; Mortgage Notes Payable (due in 10 years), $123,000 (current portion of the note, $3,000). What would be the Total Liabilities for this Balance Sheet? $25,000 $120,000 $126,000 $150,000arrow_forwardSalary expense has a balance of $65,400 in the trial balance debit column of a worksheet. The adjustments credit column contains a $500 credit to salary payable. The adjusted trial balance column will show:arrow_forwardSelected accounts and related amounts for Druid Hills Co. for the fiscal year ended May 31, 20Y8, are presented in Problem 6-5A. Adjunt problem 6-5A Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare closing entries as of May 31, 20Y8.arrow_forward

- Record the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education