FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

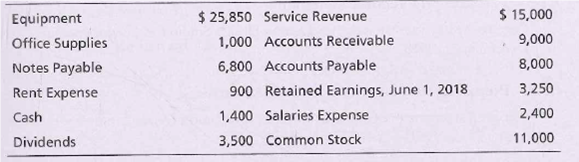

Use the following information to answer Exercises E1-31 through E1-33.

The account balances of Wilson Towing Service at June 30, 2018, Follow:

Preparing the income statement

Requirements

- Prepare the income statement for Wilson Towing Service for the month ending June 30, 2018.

- What does the income statement report?

Transcribed Image Text:$ 25,850 Service Revenue

1,000 Accounts Receivable

6,800 Accounts Payable

$ 15,000

9,000

8,000

3,250

2,400

11,000

Equipment

Office Supplies

Notes Payable

Rent Expense

900 Retained Earnings, June 1, 2018

1,400 Salaries Expense

Cash

Dividends

3,500 Common Stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do the following questions with handwritten working outarrow_forwardPlease help me. Thankyou.arrow_forwardPlease help make a proper Chart of Accounts and Trial Balance for Lucky Lou’s Company for the month ending May 31, 2023: Financial Statement Account Name (in alphabetical order) Balance Accounts Payable 1200- _________________ Accounts Receivable 3200- _________________ Accumulated Depreciation-Equip 1150- _________________ Accumulated Depreciation-F&F 890- _________________ Advertising Expense 400- _________________ Cash 2600- _________________ Depreciation Expense 650- _________________ Equipment 10000- _________________ Furniture and Fixtures 8400- _________________ Insurance Expense 700- _________________ Inventory 8720- _________________ LL, Capital 9300- _________________ LL, Drawing 1100- _________________ Notes Payable 20000- _________________ Prepaid Insurance 1500- _________________ Rent Expense 4000- _________________ Sales 23100- _________________ Supplies 300- _________________ Supplies Expense 180- _________________ Utilities Expense 2300-…arrow_forward

- Aylmer has some customers that pay for services in advance of work started. At December 31, 2020, the accountant reviewed unearned revenue to see how much revenue had been earned. Calculate the amount and the journal entries too. Please include all steps of calutlations for my reference. Thanks!arrow_forwardThe transactions of Spade Company appear below. A. K. Spade, owner, invested $17,000 cash in the company in exchange for common stock. B. The company purchased supplies for $493 cash. C. The company purchased $ 9,401 of equipment on credit. D. The company received $2,006 cash for services provided to a customer. E. The company paid $9, 401 cash to settle the payable for the equipment purchased in transaction c. F. The company billed a customer $3,604 for services provided. G. The company paid $530 cash for the monthly rent. H. The company collected $1,514 cash as partial payment for the account receivable created in transaction f. I. The company paid a $900 cash dividend to the owner (sole shareholder). *fill out chart* HINT: Accounts must be listed in financial statement order: Assets first, followed by liabilities, equity, revenues, and expenses.arrow_forwardmake a proper Chart of Accounts for ABC Company: Accounts Payable, Accounts Receivable, Advertising Expense, Cash, C.C. Capital, C.C. Drawing, Equipment, Inventory, Prepaid Insurance, Rent Expense, Sales, Supplies, Utilities Expense. We will work on this in class. Upload here if you don't finish in clasarrow_forward

- The account balances and income statement of Willard Towing Service at June 30, 2018, follow: (Click the icon to view the account balances.) (Click the icon to view the June income statement.) Read the requirements. i Data Table Requirement 1. Prepare the statement of owner's equity for Willard Towing Service for the month ending June 30, 2018. Assur Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. Willard Towing Service 23,950 Service Revenue 2$ 14,000 Equipment Statement of Owner's Equity Office Supplies 1,300 Accounts Receivable 7,000 Month Ended June 30, 2018 Notes Payable 6,000 Accounts Payable 6,000 Willard, Capital, June 1, 2018 3,500 Rent Expense 550 Willard, Capital, June 1, 2018 3,500 Owner contribution Cash 1,500 Salaries Expense 2,200 14000 Net income for the month Willard, Withdrawals 4,500 (4,500) Print Done Owner withdrawal 13000 Willard, Capital, June 30, 2018 %24arrow_forwardDiane, the administration manager of Jack’s Mowing collated all of the invoices raised by Jack’s Mowing during September 2022 and prepared a summary of fees charged, categorized for each client. The summary prepared by Diane is an example of: Select one : A. Business Intelligence B. Big data C. Information D. Dataarrow_forwardNumber 101 Cash 106 Accounts receivable 126 Computer supplies Prepaid insurance Prepaid rent office equipment 128 131 163 164 Accumulated depreciation-office equipment Computer equipment 167 168 Accumulated depreciation-Computer equipment 201 Accounts payable 210 236 301 302 403 612 613 623 637 Account Title 640 652 655 676 677 684 901 Wages payable Unearned computer services revenue S. Rey, Capital S. Rey, Withdrawals Computer services revenue Depreciation expense-office equipment Depreciation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Income summary Totals Debit $ 51,334 6,268 670 1,485 805 8,200 20,000 7,200 410 1,250 3,775 495 2,415 3,275 2,598 839 170 1,185 $ 112,374 Credit $ 410 1,250 1,300 480 2,400 71,000 35,534 $ 112,374 Required: 1. Prepare an Income statement for the three months ended December 31, 2021. 2. Prepare a statement of owner's…arrow_forward

- The following partial work sheet covers the affairs of Masanto and Company for the year ended June 30. Required: 1. Journalize the six adjusting entries. 2. Journalize the closing entries. 3. Journalize the reversing entry as of July 1, for the salaries that were accured in the June adjusting entry.arrow_forwardUse the information from the Adjusted Trial Balance and Financial Statement templates provided in the module under Test 2 information you completed to answer questions 36 - 50. (Also copied below.) For Question 36, how much revenue should be recorded on the Income Statement? Elliptical Consulting Adjusted Trial Balance For the Year Ended June 30, 2019 Account Title Debit Credit Cash 27,000 Accounts Receivable 53,500 Supplies 900 Office Equipment 30,500 Accumulated Depreciation – Office Equipment 6,000 Accounts Payable 3,300 Salaries Payable 375 Jayson Neese, Capital 82,200 Jayson Neese, Drawing 2,000 Fees Earned 60,000 Salary Expense 32,375 Supplies Expense 2,100 Depreciation Expense 1,500 Miscellaneous Expense 2,000 Totals 151,875 151,875 Notice that the accounts are listed in order of the accounting…arrow_forwardPlease see the picture below. This question utilizes excel. Please help with this.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education