Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

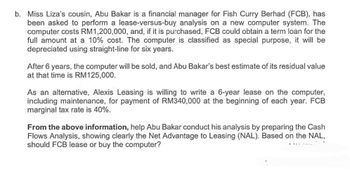

Transcribed Image Text:b. Miss Liza's cousin, Abu Bakar is a financial manager for Fish Curry Berhad (FCB), has

been asked to perform a lease-versus-buy analysis on a new computer system. The

computer costs RM1,200,000, and, if it is purchased, FCB could obtain a term loan for the

full amount at a 10% cost. The computer is classified as special purpose, it will be

depreciated using straight-line for six years.

After 6 years, the computer will be sold, and Abu Bakar's best estimate of its residual value

at that time is RM125,000.

As an alternative, Alexis Leasing is willing to write a 6-year lease on the computer,

including maintenance, for payment of RM340,000 at the beginning of each year. FCB

marginal tax rate is 40%.

From the above information, help Abu Bakar conduct his analysis by preparing the Cash

Flows Analysis, showing clearly the Net Advantage to Leasing (NAL). Based on the NAL,

should FCB lease or buy the computer?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Cryptocurrency Finder is buying the first computer for their new server farm. Suppose the company paid $5,000for this computer, which it expects to last for three years. Describe how the company would account for the $5,000 expenditure under (a) the cash basis and (b) the accrual basis. State in your own words why the accrual basis is more realistic for this situation.arrow_forwardYou are the manager of Synlait. Your accountant has indicated that one of the milking machines worth $1m needs to be replaced. You as the manager are required to agree to and sign off the purchase of a replacement machine priced at $25m. Before you make the decision, you need to understand the impact of the purchase and its financing on the financial statements. The milking machine will be financed by paying 20% in cash and the balance as a signed note agreeing to pay the balance at the end of the year. Interest of 5% p.a. will start accruing in the month following the purchase. The old machine will be sold for cash of $1m. Indicate, using the accounting equation, the impact of this transaction on the Balance Sheet and Income Statement. That is, the impact of the sale of the old machine, the purchase of the replacement machine and the first month of interest, but you can ignore depreciation.arrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that manufacturessophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which isprivately owned, has approached a bank for a loan to help it finance its growth. The bank requires financialstatements before approving such a loan. You have been asked to help prepare the financial statements andwere given the following list of costs:1. Depreciation on salespersons’ cars.2. Rent on equipment used in the factory.3. Lubricants used for machine maintenance.4. Salaries of personnel who work in the finished goods warehouse.5. Soap and paper towels used by factory workers at the end of a shift.6. Factory supervisors’ salaries.7. Heat, water, and power consumed in the factory.8. Materials used for boxing products for shipment overseas. (Units are not normally boxed.)9. Advertising costs.10. Workers’ compensation insurance for factory employees.11. Depreciation on chairs…arrow_forward

- Radley Co. is growing its business and is currently deciding how to finance this programme. Following some research, the business decides that it can either (1) issue bonds and use the money to buy the necessary assets, or (2) lease the assets for an extended period of time. Please respond to the following questions without understanding the relative costs involved: a. What benefits might leasing the assets have over purchasing them? b. What drawbacks can leasing the assets have in comparison to buying them? c. How would leasing the assets vary from issuing bonds and buying the assets in terms of how it will impact the Statement of Financial Position?arrow_forwardNeed all answer. ........arrow_forward!!!USING RATE OF RETURN (ROR) METHOD!!! A company that sells computers has proposed to a small public utility company that it purchase a small electronic computer for P1,000,000 to replace ten calculating machines and their operators. An annual service maintenance contract for the computer will be provided at a cost of P100,000 per year. One operator will be required at a salary of P96,000 per year and one programmer at a salary of P144,000 per year. The expected economical life of the computer is 10 years. The calculating machine costs P7,000 each when new, 5 years ago, and presently can be sold for P2,000 each. They have an estimated life of 8 years and an expected ultimate trade-in value of P1,000 each. Each calculating machine operator receives P84,000 per year. Fringe benefits for all labor cost 8% of annual salary. Annual maintenance costs on the calculating machines have been P500 each. Taxes and insurance on all equipment is 2% of the first cost per year. If the capital…arrow_forward

- man.1arrow_forwardSuppose you work for a data processing company who needs a new supercomputer now. Your company can either buy the supercomputer for $400,000 or lease it from a computer leasing company through an operating lease. The maintenance will be provided by the leasing company. Your company will not incur any other costs except the lease payment. But the annual maintenance cost will cost the leasing company$25,000 per year for four years. The lease terms require your company to make four annual payments at the beginning of each year. The computer could be depreciated for tax purposes straight-line over four years and it will have no residual value at the end of year 4. The interest rate is 12%. Suppose the tax rate paid by your company is 21% but the leasing company pays only 15% tax due to carried over losses from their previous operation. What is the pre-tax lease payment amount that will help the leasing company break even within 4 years if it requires 8% return. What is the NPV of the…arrow_forwardCAN HELP TO SLOVE THIS QUESTIONSarrow_forward

- Alissa Stack has identified an industrial building to purchase to be leased to Jesse's Shoes for light manufacturing. She has located a property that Jesse's shoes will leased (triple-net) for $2,000,000 per year. She believe she can purchase property for a 6.25% cap rate. What is the price of the of the industrial building?arrow_forward(Related to Checkpoint 18.2) (Calculating the cost of short-term financing) The R. Morin Construction Company needs to borrow $110,000 to help finance the cost of a new $165,000 hydraulic crane used in the firm's commercial construction business. The crane will pay for itself in one year, and the firm is considering the following alternatives for financing its purchase: Alternative A. The firm's bank has agreed to lend the $110,000 at a rate of 13 percent. Interest would be discounted, and a 15 percent compensating balance would be required. However, the compensating-balance requirement is not binding on the firm because it normally maintains a minimum demand deposit (checking account) balance of $27,500 in the bank. Alternative B. The equipment dealer has agreed to finance the equipment with a 1-year loan. The $110,000 loan requires payment of principal and interest totaling $128,909. a. Which alternative should Morin select? b. If the bank's compensating-balance requirement had…arrow_forwardYour cousin has created a business specialised in 3-D printing of metal spare parts for repair shops. For the purchase of one machine, she is considering two different models (project A and B). You are to assist her in making the best choice. Assume an investment horizon of 6 years and a required rate of return of 10%. Assume no corporate or business tax on purchase, income or resale. No computation is required for the depreciation of the machine. After talking to technical professionals and the marketing manager, you have gathered the following information: (*) Operating cash flow margin % is equal to operating cash flow divided by sales. Operating cash flows are equal to sales minus all the recurring cash cost associated to production and sales. Operating cash flow margin % is constant over the period. Please show your workings carefully. a) Compute the Net Present Value of both project A and B b) Compute the Internal Rate of Return of both projects. Explain your result c) Assume…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College