Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Do not use Ai

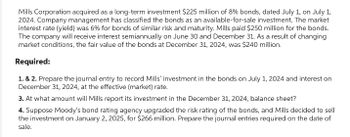

Transcribed Image Text:Mills Corporation acquired as a long-term investment $225 million of 8% bonds, dated July 1, on July 1,

2024. Company management has classified the bonds as an available-for-sale investment. The market

interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $250 million for the bonds.

The company will receive interest semiannually on June 30 and December 31. As a result of changing

market conditions, the fair value of the bonds at December 31, 2024, was $240 million.

Required:

1. & 2. Prepare the journal entry to record Mills' investment in the bonds on July 1, 2024 and interest on

December 31, 2024, at the effective (market) rate.

3. At what amount will Mills report its investment in the December 31, 2024, balance sheet?

4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell

the investment on January 2, 2025, for $266 million. Prepare the journal entries required on the date of

sale.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardTanner-UNF Corporation acquired as a long-term investment $260 million of 7% bonds, dated July 1, on July 1, 2018. The market interest rate (yield) was 9% for bonds of similar risk and maturity. Tanner-UNF paid $220 million for the bonds. The company will receive interest semiannually on June 30 and December 31. Company management is holding the bonds in its trading portfolio. As a result of changing market conditions, the fair value of the bonds at December 31, 2018, was $230 million. Record the entry to adjust the fair value.arrow_forwardTanner-unf corporation acquired as a long-term investment 245 million of 8% bonds, dated July 1, on July1, 2018. The market interest rate (yield) was 10% for bonds of similiar risk and maturity. Tanner-UNF paid 200 million for the bonds. the company will receive interest semiannually on June 30 and December 31. Company management is holding the bonds in its trading profolio. as a result of changing market conditions the fair value of the bonds at december 31, 2018 was 205 million. 1 and 2 prepare journal entry to record Tannner-UNF'S investment in bonds on July 1,2018 and interest on December 31,2018 at the effective (market rate). 3 Prepare any additional journal entry neccessary for Tannner-UNF to report its investment in the December 31,2018 balance sheet 4 Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell investments on January 2,2019 for 180 Million. Prepare the journal entries to record the sale.arrow_forward

- Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds, dated January1, on January 1, 2018. Management has the positive intent and ability to hold the bonds until maturity. For bondsof similar risk and maturity the market yield was 10%. The price paid for the bonds was $66 million. Interest isreceived semiannually on June 30 and December 31. Due to changing market conditions, the fair value of thebonds at December 31, 2018, was $70 million.Required:1. Prepare the journal entry to record Fuzzy Monkey’s investment on January 1, 2018.2. Prepare the journal entry by Fuzzy Monkey to record interest on June 30, 2018 (at the effective rate).3. Prepare the journal entries by Fuzzy Monkey to record interest on December 31, 2018 (at the effective rate).4. At what amount will Fuzzy Monkey report its investment in the December 31, 2018, balance sheet? Why?5. How would Fuzzy Monkey’s 2018 statement of cash flows be affected by this investment?arrow_forwardFuzzy Monkey Technologies, Inc., purchased as a long-term investment $120 million of 6% bonds, dated January 1, on January 1, 2021. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $100 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2021, was $110 million.Required:1. to 3. Prepare the relevant journal entries on the respective dates (record the interest at the effective rate). 1, record fuzzys monkeys investment on bonds on january 1 2021 2. record the interest revenue on june 30 2021 3, record the interest revenue on december 31 20214. At what amount will Fuzzy Monkey report its investment in the December 31, 2021 balance sheet?5. How would Fuzzy Monkey's 2021 statement of cash flows be affected by this investment? (If more than one approach is possible,…arrow_forwardTanner-UNF Corporation acquired as a long-term investment $220 million of 6% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $180 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $190 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF’s investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2024, balance sheet. 4. Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $170 million. Prepare the journal…arrow_forward

- Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $250 million of 8% bonds, dated January 1, on January 1, 2021. Management intends to have the investment available for sale when circumstances warrant. For bonds of similar risk and maturity the market yield was 10%. The price paid for the bonds was $228 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2021, was $240 million.Required:1. to 3. Prepare the relevant journal entries on the respective dates (record the interest at the effective rate).4-a. At what amount will Fuzzy Monkey report its investment in the December 31, 2021, balance sheet?4-b. Prepare the entry necessary to achieve this reporting objective.5. How would Fuzzy Monkey's 2021 statement of cash flows be affected by this investment? (If more than one approach is possible, indicate the one that is most likely.)arrow_forwardFuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds, dated January 1, on January 1, 2021. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 10%. The price paid for the bonds was $66 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2021, was $70 million.Required:1. Prepare the journal entry to record Fuzzy Monkey’s investment on January 1, 2021.2. Prepare the journal entry by Fuzzy Monkey to record interest on June 30, 2021 (at the effective rate).3. Prepare the journal entry by Fuzzy Monkey to record interest on December 31, 2021 (at the effective rate).4. At what amount will Fuzzy Monkey report its investment in the December 31, 2021 balance sheet? Why?5. How would Fuzzy Monkey’s 2021 statement of cash flows be affected by this investment? (If more than…arrow_forwardOrange Company purchased as a long-term investment $100 million of 10% bonds, dated July 1, on July 1, 2021. Management wants to trade the investment actively in the market. For bonds of similar risk and maturity the market yield was 12%. The price paid for the bonds was $90 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2021, was $91 million. Requirements: Prepare the journal entry at the initial purchase date on July 1, 2021 Please prepare journal entry on Dec 31, 2021 when Orange Company received the interest payment 3. At what amount will Orange Company report its investment in the December 31, 2021 balance sheet? Prepare any adjusting entry, if necessary. 4. Company decides to sell the investment on January 7, 2022 when the market price increased to $92. Please prepare the TWO journal entries of sales transaction on January 7, 2022. 5. Suppose Orange Company…arrow_forward

- Tanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2024. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $210 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. At what amount will Tanner-UNF report its investment in the December 31, 2024, balance sheet? 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $190 million. Prepare the journal entry to record the sale. Complete…arrow_forwardTanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2024. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $210 million. Required: 1. Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $190 million. Prepare the journal entry to record the sale.arrow_forwardTanner-UNF Corporation acquired as a long-term investment $260 million of 6% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $220 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $230 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2024, balance sheet. 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $200 million. Prepare the journal entries…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning