Assume a company purchases honeycombs from beekeepers for $2.00 a pound. The honey can be sold in raw form for $3.20 a pound or it can be used to make honey drop candies. Each package of candies contains three-quarters of a pound of honey and can be sold for $4.40. In addition to the cost of the honey, making and selling each container of candies incurs additional variable costs of $1.10 per unit. The monthly fixed costs associated with making the candies include: Master candy-maker's salary $4,500 Depreciation of candy-making equipment Salary of salesperson dedicated to this product 2,000 $ 6,900 Total fixed costs 400 The candy-making equipment does not wear out through use and it has no resale value. Assuming the company makes and sells 8,000 containers of candy, what is the financial advantage (disadvantage) of continuing to process raw honey into candies? Multiple Choice $(6,100) $700 $300 $(5,700)

Assume a company purchases honeycombs from beekeepers for $2.00 a pound. The honey can be sold in raw form for $3.20 a pound or it can be used to make honey drop candies. Each package of candies contains three-quarters of a pound of honey and can be sold for $4.40. In addition to the cost of the honey, making and selling each container of candies incurs additional variable costs of $1.10 per unit. The monthly fixed costs associated with making the candies include: Master candy-maker's salary $4,500 Depreciation of candy-making equipment Salary of salesperson dedicated to this product 2,000 $ 6,900 Total fixed costs 400 The candy-making equipment does not wear out through use and it has no resale value. Assuming the company makes and sells 8,000 containers of candy, what is the financial advantage (disadvantage) of continuing to process raw honey into candies? Multiple Choice $(6,100) $700 $300 $(5,700)

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 2PB: Mortech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and...

Related questions

Question

Please do not give solution in image format thanku

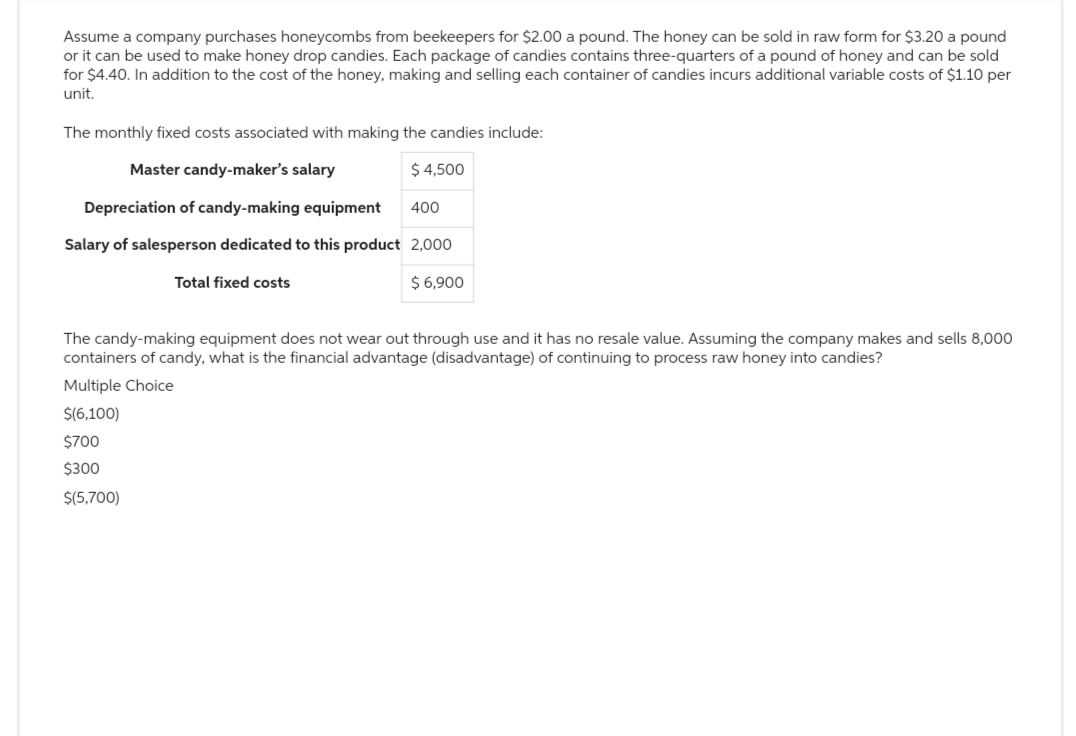

Transcribed Image Text:Assume a company purchases honeycombs from beekeepers for $2.00 a pound. The honey can be sold in raw form for $3.20 a pound

or it can be used to make honey drop candies. Each package of candies contains three-quarters of a pound of honey and can be sold

for $4.40. In addition to the cost of the honey, making and selling each container of candies incurs additional variable costs of $1.10 per

unit.

The monthly fixed costs associated with making the candies include:

Master candy-maker's salary

$ 4,500

Depreciation of candy-making equipment

Salary of salesperson dedicated to this product

Total fixed costs

400

2,000

$ 6,900

The candy-making equipment does not wear out through use and it has no resale value. Assuming the company makes and sells 8,000

containers of candy, what is the financial advantage (disadvantage) of continuing to process raw honey into candies?

Multiple Choice

$(6,100)

$700

$300

$(5,700)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning