FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

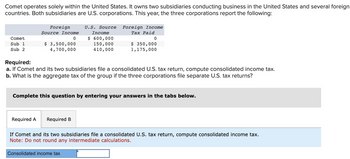

Transcribed Image Text:Comet operates solely within the United States. It owns two subsidiaries conducting business in the United States and several foreign

countries. Both subsidiaries are U.S. corporations. This year, the three corporations report the following:

Comet

Sub 1

Sub 2

Foreign

Source Income

0

$ 3,500,000

4,700,000

U.S. Source Foreign Income

Tax Paid

0

Required A Required B

Income

$ 600,000

150,000

410,000

Required:

a. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax.

b. What is the aggregate tax of the group if the three corporations file separate U.S. tax returns?

$ 350,000

1,175,000

Complete this question by entering your answers in the tabs below.

Consolidated income tax

If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax.

Note: Do not round any intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is true? The component of the current account include direct foreign investment and portfolio investment. The transaction regarding an Australian consulting firm receiving AUD5 million (i.e., Australian 5 million dollars) for consulting services provided to a German company is recorded as a debit under the current account of Australia. The transaction regarding a U.S. citizen receiving an interest payment as a result of his investment in a bond of a British firm issued in the United Kingdom is recorded as a credit under the current account of U.S.. When the BOP (balance of payment) accounts are recorded correctly, by BOP identity, under purely floating exchange rate regime, BCA (balance of current accounts) + BKA (balance of capital accounts) = - BRA (Balance of official reserve accounts).arrow_forwardA U.S.-based MNC has three subsidiaries: S1 (40 percent owned by the MNC); S2 (33 percent owned by S1), and S3 (20 percent owned by S2). The taxable income for each firm is $100 million. The local taxes for each firm are $15 million, $20 million, and $10 million, respectively. The MNC's tax rate is 40 percent. 19. Can the MNC apply all of its local taxes as a credit against its U.S. taxes? If not, which subsidiaries can it use to get a credit against its U.S. taxes. Explain your rationale briefly. 20. Based on the "grossing up" concept, calculate all tax credits applicable to the MNC.arrow_forwardCaribbean Cruise Tours (CCT) is a Canadian controlled private corporation that operates a chain of travel agencies. In its fiscal year ending December 31, 2019, the Company had the following financial results:Active business income earned in Canada $275,000Active business income earned outside Canada 25,000Taxable capital gains NilAdjusted Aggregate Investment Income 100,000Net Income For Tax Purposes $400,000Taxable Income $325,000 The company paid no foreign taxes on its foreign operations. Its Adjusted Aggregate Investment Income was $48,000 in 2018. CCT has no associated corporations.Which one of the following amounts…arrow_forward

- Problem 24-42 (LO 24-1) (Algo) Waco Leather Incorporated, a U.S. corporation, reported total taxable income of $4.8 million. Taxable income included $1.36 million of foreign source taxable income from the company's branch operations in Mexico. All of the branch income is foreign branch income. Waco paid Mexican income taxes of $244,800 on its branch income. Return to question Compute Waco's allowable foreign tax credit. Note: Enter your answer in dollars and not in millions of dollars. X Answer is complete but not entirely correct. Foreign tax credit $ 285,600arrow_forwardKrebs, Inc., a U.S. corporation, operates an unincorporated branch manufacturing operation in the U.K. In the most recent year, Krebs, Inc., reported $1,00,000 of taxable income from the U.K. branch on its U.S. tax return, along with $1,600,000 of taxable income from its U.S. operations. Krebs paid $150,000 in U.K. income taxes related to the $1,000,000 in branch income. Assuming a U.S. tax rate of 21%, what is Krebs’ U.S. tax liability. Group of answer choices $0 $150,000 $396,000 $546,000arrow_forward1. ForCo, a corporation that is incorporated in a foreign country that does not have a treaty with the United States, plans to conduct manufacturing, marketing, and sales operations in the United States. These U.S. operations produce $5 million of earnings & profits in Year 1. Assume further that the U.S. operations will have a net worth of $17 million at the beginning of Year 1 and $20 million at the end of Year 1. During Year 2, the U.S. branch does not produce any earnings & profits and its net worth is $20 million at the beginning of the year and $10 million at the end of the year. For branch profits tax purposes in Year 1, the dividend equivalent amount (“DEA”) for the U.S. branch is as follows: a. $1.5 million. b. $2.0 million c. $10 million. $20 million. d. $25 million. 2. For branch profits tax purposes in Year 2, the DEA for the U.S. branch is as follows: a. $2 million. b. $3 million. c. $10 million. d. $20 million. e. $25 million.…arrow_forward

- Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is an non-resident owner or lessor of vessels Qalvin Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P500,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a resident foreign corporationarrow_forwardSean Regan Company formed a subsidiary in a foreign country on January 1, Year 1, through a combination of debt and equity financing. The foreign subsidiary acquired land on January 1, Year 1, which it rents to a local farmer. The foreign subsidiary’s financial statements for its first year of operations, in foreign currency units (FC), are presented in Exhibit 9.3 . All revenues and expenses were realized in cash during the year. Thus, the balance in the Cash account at December 31 (FC 1,750) is equal to the beginning balance in cash (FC 1,000) plus net income for the year (FC 750). The foreign country experienced significant inflation in Year 1, especially in the second half of the year. The general price index (GPI) during Year 1 was :January 1, Year 1 100Average, Year 1 125December 31, Year 1 200 The rate of inflation in Year 1 is 100 percent [(200 − 100)/100], and the foreign country clearly meets the definition of a hyperinflationary economy. (in FC) January 1…arrow_forwardStiff Sails Corporation, a U.S. company, operates a 100%-owned British subsidiary, SeaBeW Corporation. The U.S. dollar is the functional currency of the subsidiary. Financial statements for the subsidiary for the fiscal year-end December 31, 2024, are as follows: Sales Cost of Goods Sold Beginning Inventory Purchases Cost of Goods Sold Depreciation B. Goods Available For Sale Less: Ending Inventory Selling and Admin. Expenses Income Taxes Net Income Current Assets Cash Accts. Rec. Inventories Required: A. SeaBeWe Corporation Income Statement 155,000 171,000 285,000 611,000 SeaBeWe Corporation Partial Balance Sheet 310,000 265,000 575,000 285,000 290,000 79,000 155,000 32,000 July 1, 2022 Jan. 1, 2024 June 30, 2024 Dec. 31, 2024 Average for 2024 1. Cost of Goods Sold. 2. Depreciation Expense. 3. Equipment. Other Information: 1. Equipment costing 340,000 pounds was acquired July 1, 2022, and 38,000 was acquired June 30, 2024. Depreciation for the period was as follows: Pounds 650,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education