Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 7EB

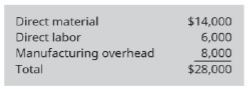

Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of

$27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently.

The manufacturing

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate the sample size based on the specifications in Buhi's contract. Make sure it is within budget, reasonable to obtain, and that you use appropriate inputs relative to market research best practices.

Use the calculator to adjust the sample size statement.

Use the agreed-upon sample size in Buhi's contract: 996.

In your secondary research, find the target population size (an estimate of those in the United States looking to purchase luggage in the category in the next two years). You will use this target population size for each sample size estimate.

Adjust the provided sample size calculator inputs to find the rest of the figures that get you to the agreed-upon sample size.

The caveats from Buhi are that you must:

Use the market research standard for your confidence level.

Use a confidence interval that is better than the market research standard for your confidence interval.

The partnership of Keenan and Kludlow paid the following wages during this year:

Line Item Description

Amount

M. Keenan (partner)

$108,000

S. Kludlow (partner)

96,000

N. Perry (supervisor)

54,700

T. Lee (factory worker)

35,100

R. Rolf (factory worker)

27,200

D. Broch (factory worker)

6,300

S. Ruiz (bookkeeper)

26,000

C. Rudolph (maintenance)

5,200

In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following:

ound your answers to the nearest cent.

a. Net FUTA tax for the partnership for this year

b. SUTA tax for this year

Given answer financial accounting question

Chapter 10 Solutions

Principles of Accounting Volume 2

Ch. 10 - ______ are the costs associated with not choosing...Ch. 10 - Which type of incurred costs are not relevant in...Ch. 10 - The managerial decision-making process has which...Ch. 10 - Which of the following is not one of the five...Ch. 10 - Which of the following is sometimes referred to as...Ch. 10 - Jansen Crafters has the capacity to produce 50,000...Ch. 10 - ______ is the act of using another company to...Ch. 10 - Which of the following is a disadvantage of...Ch. 10 - Which of the following is not a qualitative...Ch. 10 - Which of the following is one of the two...

Ch. 10 - When should a segment be dropped? A. only when the...Ch. 10 - Youngstown Construction plans to discontinue its...Ch. 10 - Mallorys Video Supply has changed its focus...Ch. 10 - A company produces two products. E and F in...Ch. 10 - When operating in a constrained environment, which...Ch. 10 - Your roommate at school believes that all fixed...Ch. 10 - Explain how to differentiate short-term decisions...Ch. 10 - Felipes Restaurant and Pie Shop needs help...Ch. 10 - What factors must any company consider before...Ch. 10 - What are some of the qualitative issues that a...Ch. 10 - In The Trouble with Outsourcing, a Schumpeter...Ch. 10 - Many outsourced jobs have resulted in offshoring...Ch. 10 - What type of qualitative issues should management...Ch. 10 - In the decision by a grocery company that is...Ch. 10 - What is of key importance for a company whose...Ch. 10 - What is a general rule to remember with respect to...Ch. 10 - Garrison Boutique, a small novelty store, just...Ch. 10 - Derek DingIer conducts corporate training seminars...Ch. 10 - Bridget Youhzi works for a large firm. Her alma...Ch. 10 - Zena Technology sells arc computer printers for...Ch. 10 - Shelby Industries has a capacity to produce 45.000...Ch. 10 - Reubens Deli currently makes rolls for deli...Ch. 10 - Almond Treats manufactures various types of...Ch. 10 - Party Supply is trying to decide whether or not to...Ch. 10 - Underground Food Store has 4,000 pounds of raw...Ch. 10 - Ralston Dairy gathered this data about the two...Ch. 10 - Rough Stuff makes 2 products: khaki shorts and...Ch. 10 - Rough Stuff makes 2 products: khaki shorts and...Ch. 10 - Ella Maksimov is CEO of her own marketing firm....Ch. 10 - You are trying to decide whether to take a job...Ch. 10 - You are working for a large firm that has asked...Ch. 10 - Dimitri Designs has capacity to produce 30,000...Ch. 10 - Aspen Enterprises makes award pins for various...Ch. 10 - Country Diner currently makes cookies for its...Ch. 10 - Oat Treats manufactures various types of cereal...Ch. 10 - The Party Zone is trying to decide whether or not...Ch. 10 - Berettis Food Mart has 6,000 pounds of raw pork...Ch. 10 - Balcom Dairy gathered this data about the two...Ch. 10 - Power Corp. makes 2 products: blades for table...Ch. 10 - Power Corp. makes 2 products: blades for table...Ch. 10 - Artisan Metalworks has a bottleneck in their...Ch. 10 - Syntech makes digital cameras for drones. Their...Ch. 10 - Marcotti Cupcakes bakes and sells a basic cupcake...Ch. 10 - Ken Owens Construction specializes in small...Ch. 10 - Boston Executive. Inc., produces executive...Ch. 10 - Gent Designs requires three units of part A for...Ch. 10 - Trifecta Distributors has decided to discontinue...Ch. 10 - Extreme Sports sells logo sports merchandise. The...Ch. 10 - Hong Publishing has purchased Lang Publishing....Ch. 10 - Clarion Industries produces two joint products, Y...Ch. 10 - Quality Clothing, Inc., produces skorts and jumper...Ch. 10 - Ac Gems in the Rough, a jewelry company, the...Ch. 10 - Sports Specialists makes baseballs and softballs...Ch. 10 - Variety Artisans has a bottleneck in their...Ch. 10 - Mortech makes digital cameras for drones. Their...Ch. 10 - Cinnamon Depot bakes and sells cinnamon rolls for...Ch. 10 - Myrna White is a mobile housekeeper. The price for...Ch. 10 - Blake Cohen Painting Service specializes in small...Ch. 10 - Regal Executive, Inc., produces executive motor...Ch. 10 - Remarkable Enterprises requires four units of part...Ch. 10 - Colin OShea has a carpentry shop that employs 4...Ch. 10 - ZZOOM, Inc., has decided to discontinue...Ch. 10 - Strawberry Sweet Company makes a variety of jams...Ch. 10 - Laramie Industries produces two joint products, H...Ch. 10 - Jamboree Outfitters, Inc., produces pocket knives...Ch. 10 - Daisy Hernandez sells girls christening dresses...Ch. 10 - Dr. Detail is a mobile car wash. The price for a...Ch. 10 - At Stardust Gems, a faux gem and jewelry company,...Ch. 10 - Sports Butts makes basketballs and footballs in a...Ch. 10 - Seda Sarkisian makes wedding cakes from her home....Ch. 10 - You are a management accountant for Time Treasures...Ch. 10 - Brindis Babysitting Center currently rents a 1200...Ch. 10 - Akimotos Bicycle Co assembles three types of...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Loan payments and the interest. Introduction: The interest rate is the amount of interest due per period as a p...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Opportunity cost of capital Which of the following statements are true? The opportunity cost of capital:

Equals...

PRIN.OF CORPORATE FINANCE

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

(Compound value) Stanford Simmons, who recently sold his Porsche, placed $10,000 in a savings account paying an...

Foundations Of Finance

The approach on how Person X (holder) can purchase insurance to protect himself against a fall in the price of ...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License