FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

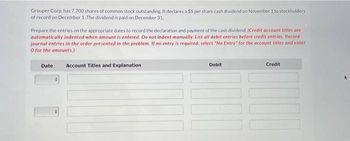

Transcribed Image Text:Grouper Corp. has 7,700 shares of common stock outstanding. It declares a $5 per share cash dividend on November 1 to stockholders

of record on December 1. The dividend is paid on December 31.

Prepare the entries on the appropriate dates to record the declaration and payment of the cash dividend. (Credit account titles are

automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries. Record

journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter

O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Flint Corporation issued 1,900 shares of stock. Prepare the entry for the issuance under the following assumptions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) (b) (c) (d) (e) No. Account Titles and Explanation (a) (b) The stock had a par value of $5.25 per share and was issued for a total of $46,500. The stock had a stated value of $5.25 per share and was issued for a total of $46,500. The stock had no par or stated value and was issued for a total of $46,500. The stock had a par value of $5.25 per share and was issued to attorneys for services during incorporation valued at $46,500. The stock had a par value of $5.25 per share and was issued for land worth $46,500. (c) (d) (e) J Debit Creditarrow_forwardOn June 1, Bramble Inc. issues 3,600 shares of no-par common stock at a cash price of $9 per share. Journalize the issuance of the shares assuming the stock has a stated value of $2 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation June 1 Debit Creditarrow_forwardDelta Corporation issued 10,000 shares of no-par common stock for $1 per share on July 13. Record the stock issuance. (Check your spelling carefully and do not abbreviate. Be sure to include the type of stock in the account names where applicable. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Jul. 13arrow_forward

- Ivanhoe Corporation has 10.50 million shares of common stock issued and outstanding. On June 1, the board of directors voted an 83 cents per share cash dividend to stockholders of record as of June 14, payable June 30. (a) Prepare the journal entries for each of the dates above assuming the dividend represents a distribution of earnings. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation ◄► A n Debit Creditarrow_forwardThe declaration, record, and payment dates in connection with a cash dividend of $49,200 on a corporation's common stock are January 12, March 13, and April 12. If no entry is required, select "No Entry Required" and leave the amount boxes blank.arrow_forwardNexis Corp. issues 1,900 shares of $12 par value common stock at $17 per share. When the transaction is recorded, what credit entry or entries are made?arrow_forward

- Stevie Systems completed the following stock issuance transactions: i (Click the icon to view the transactions.) Requirements 1. Journalize the transactions. Explanations are not required. 2. How much paid-in capital did these transactions generate for Stevie Systems? Requirement 1. Journalize the transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) June 19: Issued 1,100 shares of $3 par common stock for cash of $13.00 per share. Journal Entry Date Jun More info Jun Jul 19 11 Accounts *** Print Debit 19 Issued 1,100 shares of $3 par common stock for cash of $13.00 per share. 3 Sold 340 shares of $3.50, no-par preferred stock for $17,000 cash. Received inventory with a market value of $28,000 and equipment with market value of $11,000. Issued 3,000 shares of the $3 par common stock in exchange. Credit Donearrow_forwardSheffield Corp. has 84,000 shares of common stock outstanding. It declares a $1 per share cash dividend on November 1 to stockholders of record on December 1. The dividend is paid on December 31. Prepare the entries on the appropriate dates to record the declaration and payment of the cash dividend.arrow_forwardTamarisk, Inc. issues 9,400 shares of $106 par value preferred stock for cash at $110 per share. Journalize the issuance of the preferred stock. (Credit account titles are automatically Indented when amount Is entered. Do not Indent manually. If no entry Is requlred, select "No Entry" for the account titles and enter o for the amounts.)arrow_forward

- Bonita Corporation has 86,000 shares of common stock outstanding. It declares a $2 per share cash dividend on November 1 to stockholders of record on December 1. The dividend is paid on December 31. Prepare the entries on the appropriate dates to record the declaration and payment of the cash dividend. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"arrow_forwardFlounder Limited issued 1,930 common shares for $61,760. (a) Prepare Flounder's journal entry if the shares have no par value. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardAmerican Laser, Inc., reported the following account balances on January 1. Accounts Receivable Accumulated Depreciation. Additional Paid-in Capital Allowance for Doubtful Accounts Bonds Payable Buildings. Cash Common Stock, 10,000 shares of $1 part Notes Payable (long-term) Retained Earnings Treasury Stock TOTALS Requirement View transaction list General Journalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education