FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

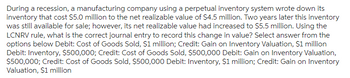

Transcribed Image Text:During a recession, a manufacturing company using a perpetual inventory system wrote down its inventory that cost $5.0 million to the net realizable value of $4.5 million. Two years later this inventory was still available for sale; however, its net realizable value had increased to $5.5 million. Using the LCNRV rule, what is the correct journal entry to record this change in value? Select the answer from the options below:

- Debit: Cost of Goods Sold, $1 million; Credit: Gain on Inventory Valuation, $1 million

- Debit: Inventory, $500,000; Credit: Cost of Goods Sold, $500,000

- Debit: Gain on Inventory Valuation, $500,000; Credit: Cost of Goods Sold, $500,000

- Debit: Inventory, $1 million; Credit: Gain on Inventory Valuation, $1 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022. (c) (in millions) Beginning inventory Ending inventory Cost of goods sold Sales revenue (a) Inventory turnover ratio Your answer is correct. Inventory turnover ratio 2020 Days in inventory $116,000 317,500 895,000 1,120,000 1,595,500 1,195,000 eTextbook and Medial Calculate the inventory turnover for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) Gross profit rate 2020 2021 2020 $317,500 2020 410,500 Calculate the inventory turnover for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) 4.1 times 4.1 times 2020 2022 89 days $410,500 476,500 1,297,500 1,894,000 Calculate the days in inventory for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) 2021 % 2021 3.1 times. 2021 3.1 Calculate the gross profit rate for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2 %) 2021 times 117 days 2022 2022 2022 2022 125 2.9 2.9 times times…arrow_forwardSolve incorrect answersarrow_forwardPlease show your workarrow_forward

- If Wakowski Company's ending inventory was actually $86,000 but was adjusted at year end to a balance of $68,000 in error, what would be the impact on the presentation of the balance sheet and income statement for the year that the error occurred, if any? If no entry is required, select "None" and leave the amount boxes blank. Balance Sheet: Merchandise Inventory $4 Current Assets Total Assets Retained Earnings Income Statement: Cost of Goods Sold Gross Profit/Gross Margin Net Incomearrow_forwardNonearrow_forwardKingbird Company has used the dollar-value LIFO method for inventory cost determination for many years. The following data were extracted from Kingbird's records. Price Ending Inventory Date Index at Base Prices Ending Inventory at Dollar-Value LIFO December 31, 2025 105 $92,700 $86,600 December 31, 2026 ? 97,700 92,150 Calculate the index used for 2026 that yielded the above results. Index used for 2026arrow_forward

- * Your answer is incorrect. Whispering Winds Corp. had the following records: Ending inventory Cost of goods sold 6.8 times 6.4 times 2021 What is Whispering's inventory turnover for 2022?(rounded) O 7.2 times 6.9 times: 2022 $32600 $29000 209500 211200arrow_forwardes Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2024 are as follows: Beginning inventory Purchases Freight-in Purchase returns. Net markups Net markdowns Normal spoilage ormal spoilage Sales Sales returns Cost $ 97,000 363,000 9,700 7,700 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 5,546 Retail $ 187,000 587,000 11,700 16,700 12,700 3,700 8,700 547,000 10,700 The company records sales net of employee discounts. Employee discounts for 2024 totaled $4,700. 2. Estimate Sparrow's ending inventory and cost of goods sold for the year using the retail inventory method and the conventional application. Note: Round Cost-to-retail percentage to 2 decimal places and final answers to the nearest whole dollar amount. Conventional applicationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education