Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

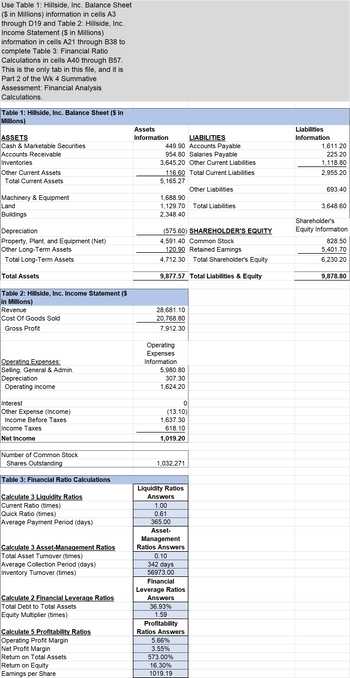

Transcribed Image Text:Use Table 1: Hillside, Inc. Balance Sheet

($ in Millions) information in cells A3

through D19 and Table 2: Hillside, Inc.

Income Statement ($ in Millions)

information in cells A21 through B38 to

complete Table 3: Financial Ratio

Calculations in cells A40 through B57.

This is the only tab in this file, and it is

Part 2 of the Wk 4 Summative

Assessment: Financial Analysis

Calculations.

Table 1: Hillside, Inc. Balance Sheet ($ in

Millions)

ASSETS

Cash & Marketable Securities

Accounts Receivable

Inventories

Other Current Assets

Total Current Assets

Machinery & Equipment

Land

Buildings

Depreciation

Property, Plant, and Equipment (Net)

Other Long-Term Assets

Total Long-Term Assets

Total Assets

Table 2: Hillside, Inc. Income Statement ($

in Millions)

Revenue

Cost Of Goods Sold

Gross Profit

Operating Expenses:

Selling, General & Admin.

Depreciation

Operating income

Interest

Other Expense (Income)

Income Before Taxes

Income Taxes

Net Income

Number of Common Stock

Shares Outstanding

Table 3: Financial Ratio Calculations

Calculate 3 Liquidity Ratios

Current Ratio (times)

Quick Ratio (times)

Average Payment Period (days)

Calculate 3 Asset-Management Ratios

Total Asset Turnover (times)

Average Collection Period (days)

Inventory Turnover (times)

Calculate 2 Financial Leverage Ratios

Total Debt to Total Assets

Equity Multiplier (times)

Calculate 5 Profitability Ratios

Operating Profit Margin

Net Profit Margin

Return on Total Assets

Return on Equity

Earnings per Share

Assets

Information

ILITIES

449.90 Accounts Payable

954.80 Salaries Payable

3,645.20 Other Current Liabilities

116.60 Total Current Liabilities

5,165.27

1,688.90

1,129.70 Total Liabilities

2,348.40

(575.60) SHAREHOLDER'S EQUITY

4,591.40 Common Stock

120.90 Retained Earnings

4,712.30 Total Shareholder's Equity

9,877.57 Total Liabilities & Equity

28,681.10

20,768.80

7,912.30

Operating

Expenses

Information

5,980.80

307.30

1,624.20

0

(13.10)

1,637.30

618.10

1,019.20

1,032,271

Liquidity Ratios

Answers

1.00

0.61

365.00

Asset-

Management

Ratios Answers

Other Liabilities

0.10

342 days

56973.00

Financial

Leverage Ratios

Answers

36.93%

1.59

Profitability

Ratios Answers

5.66%

3.55%

573.00%

16.30%

1019.19

Liabilities

Informa

1,611.20

225.20

1.118.80

2,955.20

693.40

3,648.60

Shareholder's

Equity Information

828.50

5,401.70

6,230.20

9,878.80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

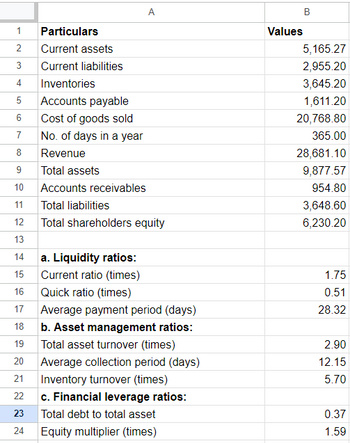

Follow-up Question

Needing assistance with the Profability Ratio Answers

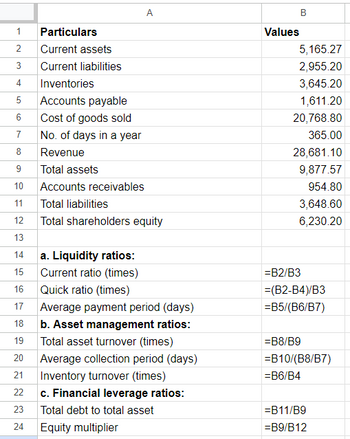

Transcribed Image Text:1 Particulars

2 Current assets

3 Current liabilities

Inventories

4

5 Accounts payable

6

Cost of goods sold

No. of days in a year

Revenue

Total assets

7

8

9

10 Accounts receivables

11

Total liabilities

12

Total shareholders equity

13

14

15

16

17

18

19 Total asset turnover (times)

85

A

20 Average collection period (days)

21 Inventory turnover (times)

222

23

a. Liquidity ratios:

Current ratio (times)

Quick ratio (times)

Average payment period (days)

b. Asset management ratios:

c. Financial leverage ratios:

Total debt to total asset

24 Equity multiplier (times)

B

Values

5,165.27

2,955.20

3,645.20

1,611.20

20,768.80

365.00

28,681.10

9,877.57

954.80

3,648.60

6,230.20

1.75

0.51

28.32

2.90

12.15

5.70

0.37

1.59

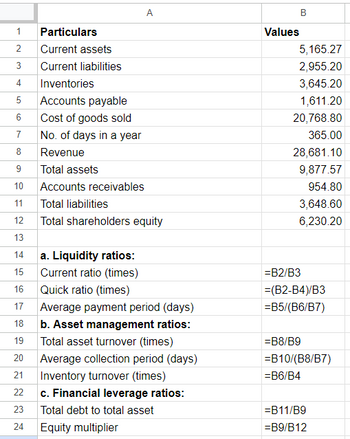

Transcribed Image Text:1 Particulars

2 Current assets

3

4 Inventories

5

6

7

لنا

Current liabilities

Accounts payable

Cost of goods sold

No. of days in a year

Revenue

9

Total assets

10 Accounts receivables

11

12

13

14

15

16

17

18

19

20

21

22

23

24

8

A

Total liabilities

Total shareholders equity

a. Liquidity ratios:

Current ratio (times)

Quick ratio (times)

Average payment period (days)

b. Asset management ratios:

Total asset turnover (times)

Average collection period (days)

Inventory turnover (times)

c. Financial leverage ratios:

Total debt to total asset

Equity multiplier

Values

B

5,165.27

2,955.20

3,645.20

1,611.20

20,768.80

365.00

28,681.10

9,877.57

954.80

3,648.60

6,230.20

=B2/B3

=(B2-B4)/B3

=B5/(B6/B7)

=B8/B9

=B10/(B8/B7)

=B6/B4

=B11/B9

=B9/B12

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

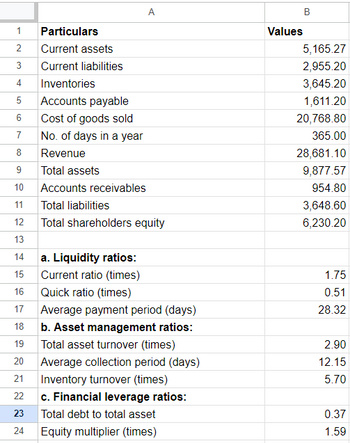

Needing assistance with the Profability Ratio Answers

Transcribed Image Text:1 Particulars

2 Current assets

3 Current liabilities

Inventories

4

5 Accounts payable

6

Cost of goods sold

No. of days in a year

Revenue

Total assets

7

8

9

10 Accounts receivables

11

Total liabilities

12

Total shareholders equity

13

14

15

16

17

18

19 Total asset turnover (times)

85

A

20 Average collection period (days)

21 Inventory turnover (times)

222

23

a. Liquidity ratios:

Current ratio (times)

Quick ratio (times)

Average payment period (days)

b. Asset management ratios:

c. Financial leverage ratios:

Total debt to total asset

24 Equity multiplier (times)

B

Values

5,165.27

2,955.20

3,645.20

1,611.20

20,768.80

365.00

28,681.10

9,877.57

954.80

3,648.60

6,230.20

1.75

0.51

28.32

2.90

12.15

5.70

0.37

1.59

Transcribed Image Text:1 Particulars

2 Current assets

3

4 Inventories

5

6

7

لنا

Current liabilities

Accounts payable

Cost of goods sold

No. of days in a year

Revenue

9

Total assets

10 Accounts receivables

11

12

13

14

15

16

17

18

19

20

21

22

23

24

8

A

Total liabilities

Total shareholders equity

a. Liquidity ratios:

Current ratio (times)

Quick ratio (times)

Average payment period (days)

b. Asset management ratios:

Total asset turnover (times)

Average collection period (days)

Inventory turnover (times)

c. Financial leverage ratios:

Total debt to total asset

Equity multiplier

Values

B

5,165.27

2,955.20

3,645.20

1,611.20

20,768.80

365.00

28,681.10

9,877.57

954.80

3,648.60

6,230.20

=B2/B3

=(B2-B4)/B3

=B5/(B6/B7)

=B8/B9

=B10/(B8/B7)

=B6/B4

=B11/B9

=B9/B12

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Question Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $33,234 Accounts receivable 67,995 Accrued liabilities 6,510 Cash 22,738 Intangible assets 35,347 Inventory 83,390 Long-term investments 101,069 Long-term liabilities 79,156 Notes payable (short-term) 27,161 Property, plant, and equipment 689,074 Prepaid expenses 2,037 Temporary investments 30,842 Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? a.3.1 b.0.8 c.1.8 d.15.4arrow_forwardJ-Mark Superstores provides the following selected financial data. Cash and cash equivalents Short-term investments Accounts receivable Inventory Property, plant and equipment Long-term investments Total asset 2024 $ 852,540 45,050 1,120,545 2023 $ 750,235 39,194 1,030,901 2,812,020 2,615,179 4,212,686 3,749,291 96,555 82,072 9,139,396 8,266,871 Total liabilities 4,204,122 3,968,098 Total stockholders' equity 4,935,274 4,298,773 Net sales 15,579,865 13,710,281 Operating income 5,452,953 4,661,496 Interest expense 157,655 148,804 Investment income 5,947 4,851 Calculate the return on investments ratio for 2024. Note: Round your answer to 1 decimal place. Answer is complete but not entirely correct. Return on investments ratio 4.2 × %arrow_forwardAccounts payable 919 Accounts receivable 631 Accumulated depreciation 1,813 Cash 729 Common stock 1,387 Cost of goods sold 7,578 Current portion of long-term debt 24 Depreciation expense 108 Dividends 13 Goodwill and other long-term assets 2,627 Income tax expense 24 Income taxes payable 12 Interest expense 54 Interest revenue 11 Inventories 930 Long-term liabilities 1,585 Prepaid expenses and other current assets 65 Property and equipment 2,389 Retained earnings 825 Sales 9,710 Selling, general, and administrative expenses 2,276 Unearned revenue 990 Wages payable 148 Prepare the balance sheet.arrow_forward

- Prepare a blance sheetarrow_forwardCurrent assets: Cash and marketable securities Accounts receivable Inventory Total Assets Fixed assets: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets Total Total assets Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses 2024 VALIUM'S MEDICAL SUPPLY CORPORATION Balance Sheet as of December 31, 2024 and 2023 (in millions of dollars) $ 72 187 312 $ 571 Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2023 $ 71 181 291 $ 543 $ 1,073 146 $ 927 134 $ 1,061 $ 1,632 $ 1,446 $ 882 113 $ 769 134 $ 903 Liabilities and Equity Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total Long-term debt Stockholders' equity: Preferred stock (6 thousand shares) Common stock and paid-in surplus (100 thousand shares) Retained earnings Total VALIUM'S MEDICAL SUPPLY CORPORATION Income Statement for Years Ending December 31, 2024 and…arrow_forwardperience p....pptm ^ Type here to search w X # 3 E Coronado Company's condensed financial statements provide the following information. C Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses Total current assets Property, plant, and equipment (net) Total assets Current liabilities ACC341-2022-Ho....xlsx $ 4 Bonds payable R F % 5 O CORONADO COMPANY BALANCE SHEET T At O+ 6 V B ▶ music 2.jpeg n H & 7 Dec. 31, 2020 $52,100 197,700 80,800 442,700 3,000 $776,300 849,900 $1,626,200 237,700 401,800 U 20 8 J Dec. 31, 2019 $60,200 O 80,800 39,600 N M 360,200 $547,700 849,900 $1,397,600 6,900 155,700 ( 401,800 9 W K F11 ) O 0 888 P Home End C Rair Insearrow_forward

- Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment Less: Depreciation Net plant and equipment Other long-term assets Total Total assets Net sales (all credit) Less: Cost of goods sold Gross profits Less: Other operating expenses Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2821 $ 75 115 200 $390 ROA ROE $580 110 $470 50 $520 $910 Less: Depreciation Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings Per (common) share data: 96 96 Earnings before interest, taxes, depreciation, and amortization (EBITDA) 2020 $ 65 110 198 $365 DuPont Analysis times times $471 100 $371 LAK OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2021 and 2020…arrow_forwardAssets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forwardmework i 0 ences Mc Graw Hill INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets a. Free cash flow b. Additional tax c. Free cash flow million million million $ 27,571 17,573 1,406 $ 8,592 521 2022 8,071 1,695 $ 6,376 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) 2021 $ 2,340 1,379 126 1,093 $ 4,938 $ 24,681 2,808 2,987 $ 35,414 $ 2,340 1,339 121 620 $ 4,420 Saved $ 22,839 2,657 3,103 Liabilities and Shareholders' Equity Current liabilities Debt due for repayment Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity $ 33,019 Total liabilities and…arrow_forward

- Assets Current assets: Cash Marketable securities Accounts receivable (net) Inventory Total current assets Investments Plant and equipment Less: Accumulated depreciation Net plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders' equity Preferred stock, $ 50 par value Common stock, $ 1 par value Capital paid in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 611,000 272,000 $ 52,500 22,500 178,000 290,000 $ 543,000 66,200 339,000 $948,200 $ 95,100 78,700 12,000 $ 185,800 159,400 $ 345,200 $ 100,000 80,000 190,000 233,000 $ 603,000 $948,200arrow_forwardBalance Sheet as at As at 30/9/16 As at 30/9/15 $ $ Assets Current assets- Cash 8,200 9,400 Accounts Receivable 107,000 103,500 Inventory 82,700 71,300 Non-current assets less accumulated depreciation 242,600 245,700 Total assets 440,500 429,900 Liabilities and Owners' equity Current liabilities 117,000 120,000 Loan (repayable in 2019) 152,000 150,000 Total liabilities 269,000 270,000 Owners' equity 171,500 159,900 Total Liabilities and Owners' equity 440,500 429,900 Summarised Income Statement of Bishan Enterprise for the year ended 30 September 2016 $ Sales 990,000 Cost of goods sold 580,000 Gross profit 410,000 Operating expenses 350,000 Net profit 60,000 · Note - The owner withdrew $48,400 during 2016. Required: Calculate…arrow_forwardsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education