FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

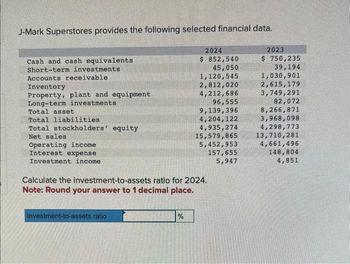

Transcribed Image Text:J-Mark Superstores provides the following selected financial data.

Cash and cash equivalents

Short-term investments

Accounts receivable

Inventory

Property, plant and equipment

Long-term investments

Total asset

2024

$ 852,540

45,050

1,120,545

2023

$ 750,235

39,194

1,030,901

2,812,020

2,615,179

4,212,686

3,749,291

96,555

82,072

9,139,396

8,266,871

Total liabilities

4,204,122

3,968,098

Total stockholders' equity

4,935,274

4,298,773

Net sales.

15,579,865

13,710,281

Operating income

5,452,953

4,661,496

Interest expense

157,655

5,947

148,804

4,851

Investment income

Calculate the investment-to-assets ratio for 2024.

Note: Round your answer to 1 decimal place.

Investment-to-assets ratio

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cash Accounts Receivable Inventory Property Plant & Equipment Other Assets Total Assets Valley Technology Balance Sheet As of March 11, 2020 (amounts in thousands) 9,700 Accounts Payable 4,500 Debt 3,800 Other Liabilities 16,400 Total Liabilities 1,700 Paid-In Capital Retained Earnings Total Equity 36,100 Total Liabilities & Equity 1,500 2,900 800 5,200 7,300 23,600 30,900 36,100 Use T-accounts to record the transactions below, which occur on March 12, 2020, close the T-accounts, and construct a balance sheet to answer the question. 1. Buy $15,000 worth of manufacturing supplies on credit 2. Issue $85,000 in stock 3. Borrow $63,000 from a bank 4. Pay $5,000 owed to a supplier 5. Receive payment of $12,000 owed by a customer What is the final amount in Total Liabilities? Please specify your answer in the same units as the balance sheet.arrow_forwardssarrow_forwardPlease do not provide answer in image format thank youarrow_forward

- Question Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $33,234 Accounts receivable 67,995 Accrued liabilities 6,510 Cash 22,738 Intangible assets 35,347 Inventory 83,390 Long-term investments 101,069 Long-term liabilities 79,156 Notes payable (short-term) 27,161 Property, plant, and equipment 689,074 Prepaid expenses 2,037 Temporary investments 30,842 Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? a.3.1 b.0.8 c.1.8 d.15.4arrow_forwardJ-Mark Superstores provides the following selected financial data. Cash and cash equivalents Short-term investments Accounts receivable Inventory Property, plant and equipment Long-term investments Total asset 2024 $ 852,540 45,050 1,120,545 2023 $ 750,235 39,194 1,030,901 2,812,020 2,615,179 4,212,686 3,749,291 96,555 82,072 9,139,396 8,266,871 Total liabilities 4,204,122 3,968,098 Total stockholders' equity 4,935,274 4,298,773 Net sales 15,579,865 13,710,281 Operating income 5,452,953 4,661,496 Interest expense 157,655 148,804 Investment income 5,947 4,851 Calculate the return on investments ratio for 2024. Note: Round your answer to 1 decimal place. Answer is complete but not entirely correct. Return on investments ratio 4.2 × %arrow_forwardCondensed financial data of Larkspur, Inc. follow. Larkspur, Inc.Comparative Balance SheetsDecember 31 Assets 2022 2021 Cash $105,900 $47,000 Accounts receivable 92,700 33,100 Inventory 112,800 101,000 Prepaid expenses 29,200 25,500 Long-term investments 139,400 114,200 Plant assets 274,500 241,400 Accumulated depreciation (46,800 ) (52,400 ) Total $707,700 $509,800 Liabilities and Stockholders’ Equity Accounts payable $111,900 $67,800 Accrued expenses payable 16,000 17,300 Bonds payable 117,200 149,500 Common stock 219,100 175,300 Retained earnings 243,500 99,900 Total $707,700 $509,800 Larkspur, Inc.Income StatementFor the Year Ended December 31, 2022 Sales revenue $392,600 Less:…arrow_forward

- Please do not give solution in image format thankuarrow_forwardCondensed financial data of Concord Inc. follow. CONCORD INC.Comparative Balance SheetsDecember 31 Assets 2022 2021 Cash $80,500 $48,700 Accounts receivable 87,900 38,600 Inventory 111,900 102,100 Prepaid expenses 29,400 27,900 Long-term investments 139,800 113,700 Plant assets 284,200 241,900 Accumulated depreciation (47,700) (49,100) Total $686,000 $523,800 Liabilities and Stockholders’ Equity Accounts payable $106,000 $63,700 Accrued expenses payable 16,500 21,200 Bonds payable 117,100 149,500 Common stock 219,000 175,100 Retained earnings 227,400 114,300 Total $686,000 $523,800 CONCORD INC.Income StatementFor the Year Ended December 31, 2022 Sales revenue $382,500 Less: Cost of goods sold…arrow_forwardCurrent assets: Cash and marketable securities Accounts receivable Inventory Total Assets Fixed assets: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets Total Total assets Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses 2024 VALIUM'S MEDICAL SUPPLY CORPORATION Balance Sheet as of December 31, 2024 and 2023 (in millions of dollars) $ 72 187 312 $ 571 Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2023 $ 71 181 291 $ 543 $ 1,073 146 $ 927 134 $ 1,061 $ 1,632 $ 1,446 $ 882 113 $ 769 134 $ 903 Liabilities and Equity Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total Long-term debt Stockholders' equity: Preferred stock (6 thousand shares) Common stock and paid-in surplus (100 thousand shares) Retained earnings Total VALIUM'S MEDICAL SUPPLY CORPORATION Income Statement for Years Ending December 31, 2024 and…arrow_forward

- perience p....pptm ^ Type here to search w X # 3 E Coronado Company's condensed financial statements provide the following information. C Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses Total current assets Property, plant, and equipment (net) Total assets Current liabilities ACC341-2022-Ho....xlsx $ 4 Bonds payable R F % 5 O CORONADO COMPANY BALANCE SHEET T At O+ 6 V B ▶ music 2.jpeg n H & 7 Dec. 31, 2020 $52,100 197,700 80,800 442,700 3,000 $776,300 849,900 $1,626,200 237,700 401,800 U 20 8 J Dec. 31, 2019 $60,200 O 80,800 39,600 N M 360,200 $547,700 849,900 $1,397,600 6,900 155,700 ( 401,800 9 W K F11 ) O 0 888 P Home End C Rair Insearrow_forwardUse the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below.] Cash Accounts receivable Equipment, net Land Total assets QS 13-6 (Algo) Vertical analysis LO P2 Current Year $ 8,400 56,000 48,000 93,500 $ 205,900 Cash Accounts receivable Equipment, net Express the items in common-size percents. (Round your percentage answers to one decimal place.) Land Total assets Current Year % % % Prior Year $ 9,600 20,400 43,200 68,000 $ 141,200 % % Prior Year % % % %arrow_forwardHow do you find the red numbers on the balance sheet and income statement?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education