Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

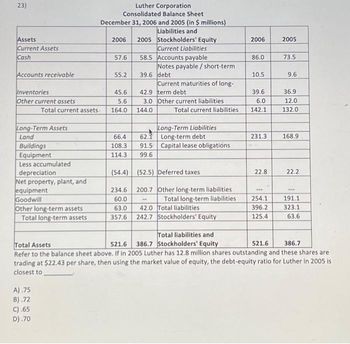

Transcribed Image Text:23)

Assets

Current Assets

Cash

Accounts receivable

Inventories

Other current assets

Total current assets

Long-Term Assets

Land

Buildings

Equipment

Less accumulated

depreciation

Net property, plant, and

equipment

Goodwill

Other long-term assets

Total long-term assets

A).75

B).72

C).65

D).70

Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and 2005 (in $ millions)

Liabilities and

2005 Stockholders' Equity

2006

57.6

55.2

45.6

5.6

164.0

66.4

108.3

114.3

Current Liabilities

58.5 Accounts payable

234.6

60.0

63.0

357.6

Notes payable/ short-term

39.6 debt

Current maturities of long-

42.9 term debt

3.0 Other current liabilities

144.0

Total current liabilities

Long-Term Liabilities

Long-term debt

62.1

91.5 Capital lease obligations

99.6

(54.4) (52.5) Deferred taxes

200.7 Other long-term liabilities

Total long-term liabilities

42.0 Total liabilities

242.7 Stockholders' Equity

2006

86.0

10.5

39.6

6.0

142.1

231.3

22.8

-

254.1

396.2

125.4

2005

73.5

9.6

36.9

12.0

132.0

168.9

22.2

www

191.1

323.1

63.6

Total liabilities and

Total Assets

521.6 386.7 Stockholders' Equity

521.6

386.7

Refer to the balance sheet above. If in 2005 Luther has 12.8 million shares outstanding and these shares are

trading at $22.43 per share, then using the market value of equity, the debt-equity ratio for Luther in 2005 is

closest to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- perience p....pptm ^ Type here to search w X # 3 E Coronado Company's condensed financial statements provide the following information. C Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses Total current assets Property, plant, and equipment (net) Total assets Current liabilities ACC341-2022-Ho....xlsx $ 4 Bonds payable R F % 5 O CORONADO COMPANY BALANCE SHEET T At O+ 6 V B ▶ music 2.jpeg n H & 7 Dec. 31, 2020 $52,100 197,700 80,800 442,700 3,000 $776,300 849,900 $1,626,200 237,700 401,800 U 20 8 J Dec. 31, 2019 $60,200 O 80,800 39,600 N M 360,200 $547,700 849,900 $1,397,600 6,900 155,700 ( 401,800 9 W K F11 ) O 0 888 P Home End C Rair Insearrow_forwardAssets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forwardThe current ratio for the following is ..... Group of answer choices .43 .23 .73 .53arrow_forward

- Use attachment to answer the following Assume all assets are operating assets; all current liabilities are operating liabilities. Return on net operating assets for 2006 is: a) 11.30% b) 11.03% c) 9.93% d) 11.19arrow_forwardcorrect answers ?arrow_forwardAlcoser Corporation's most recent balance sheet appears below: Comparative Balance Sheet Ending Balance Beginning Balance Assets: Cash and cash equivalents $ 34 $ 29 Accounts receivable 32 36 Inventory 53 66 Property, plant, and equipment 554 480 Less accumulated depreciation 208 206 Total assets $ 465 $ 405 Liabilities and stockholders' equity: Accounts payable $ 41 $ 50 Accrued liabilities 17 16 Income taxes payable 28 30 Bonds payable 217 200 Common stock 75 70 Retained earnings 87 39 Total liabilities and stockholders' equity $ 465 $ 405 Net income for the year was $60. Cash dividends were $12. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) investing activities for the year was: Multiple Choice $74 $(74)…arrow_forward

- Cash Short-term investments Current receivables Inventory Prepaid expenses Total current assets Current liabilities Camaro $ 2,400 0 260 2,175 300 $ 5,135 $ 2,220 GTO $ 230 0 510 2,020 600 $ 3,360 $ 1,320 Torino $ 1,300 600 500 3,050 900 $ 6,350 $ 3,550 a. Compute the acid-test ratio for each of the separate cases above. b. Which company is in the best position to meet short-term obligations?arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education