Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

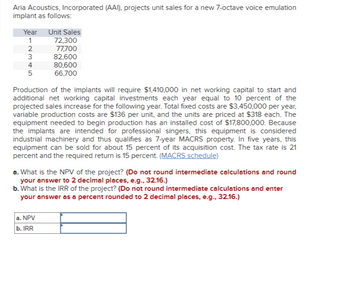

Transcribed Image Text:Aria Acoustics, Incorporated (AAI), projects unit sales for a new 7-octave voice emulation

implant as follows:

Year Unit Sales

1

2345

2

3

5

72,300

77,700

82,600

80,600

66,700

Production of the implants will require $1,410,000 in net working capital to start and

additional net working capital investments each year equal to 10 percent of the

projected sales increase for the following year. Total fixed costs are $3,450,000 per year,

variable production costs are $136 per unit, and the units are priced at $318 each. The

equipment needed to begin production has an installed cost of $17,800,000. Because

the implants are intended for professional singers, this equipment is considered

industrial machinery and thus qualifies as 7-year MACRS property. In five years, this

equipment can be sold for about 15 percent of its acquisition cost. The tax rate is 21

percent and the required return is 15 percent. (MACRS schedule)

a. What is the NPV of the project? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

b. What is the IRR of the project? (Do not round intermediate calculations and enter

your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. NPV

b. IRR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Danford Company, a manufacturer of farm equipment, currently produces 20,000 units of gas filters per year for use in its lawn-mower production. The costs, based on the previous year's production, are reported below. It is anticipated that gas-filter production will last five years. If the company continues to produce the product in-house, annual direct material costs will increase $3000/year (For example, annual material costs during the first production year will be $63,000.) Direct labor will also increase by $5000/year. However, variable overhead costs will increase at the rate of $2000/year and the fixed overhead will remain at its current level over the next five years. John Holland Company has offered to sell Danford 20,000 units of gas filters for $25 per unit. If Danford accepts the offer, some of the manufacturing facilities currently used to manufacture the filter could be rented to a third party for $35,000 per year. The firm's interest rate is known to be 15%. What is the…arrow_forwardImperial Devices (ID) has offered to supply the state government with one model of its security screening device at “cost plus 20 percent.” ID operates a manufacturing plant that can produce 66,000 devices per year, but it normally produces 60,000. The costs to produce 60,000 devices follow: Total Cost Cost perDevice Production costs: Materials $ 4,500,000 $ 75 Labor 9,000,000 150 Supplies and other costs that will vary with production 2,700,000 45 Indirect cost that will not vary with production 2,700,000 45 Variable marketing costs 1,800,000 30 Administrative costs (will not vary with production) 5,400,000 90 Totals $ 26,100,000 $ 435 Based on these data, company management expects to receive $522 (= $435 × 120 percent) per monitor for those sold on this contract. After completing 500 monitors, the company sent a bill (invoice) to the government for $261,000…arrow_forwardRevenues generated by a new fad product are forecast as follows: Year Revenues $45,000 1 2 35,000 3 25,000 4 20,000 Thereafter 0 Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $60,000 in plant and equipment.arrow_forward

- The sales and finance team of a car company is evaluating a new proposed luxury model of itsbrand that will require an investment of $1Billion in a new machine for car interior decoration.Demand for the company’s car is expected to begin at 100,000 units in year 1, with 10% annualgrowth thereafter. Production cost will be $35,000 per unit in the first year, and increase by a rateof either 3% or 5% per year as a result of wage increase. Selling price will start at $37,000 andincrease by 4% of the production cost. The model will be phased out at the end of year 10. Inaddition, 0.3%, 2% and 1.5% of before tax profit per year will be spent on social corporateresponsibility, commercial (including promotions) and recalls respectively. Assume taxes will be30% of yearly profit and that inflation will remain at 0% per year throughout the 10 year ofproduction. Also assume interest rate is expected to be 3% per year in the first 5 years and 5% inthe last 5 years.a. Based on present worth…arrow_forwardAria Acoustics, Incorporated (AAI), projects unit sales for a new 7-octave voice emulation implant as follows: Year Unit Sales 1 74,400 2345 79,800 85,400 82,700 69,500 Production of the implants will require $1,480,000 in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are $3,800,000 per year, variable production costs are $143 per unit, and the units are priced at $325 each. The equipment needed to begin production has an installed cost of $18,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as 7-year MACRS property. In five years, this equipment can be sold for about 20 percent of its acquisition cost. The tax rate is 23 percent and the required return is 17 percent. (MACRS schedule) a. What is the NPV of the project? (Do not round intermediate calculations and…arrow_forwardThe cost to manufacture a firing system component used in a rapid deployment missile defense system was $20,000 the first year; however, the company expects the cost to increase by 2% each year. Calculate the present worth of this cost over a 5-year period at an interest rate of 10% per year compounded weekly. The present worth of the cost is $arrow_forward

- Two equipments A and B have initial costs of $100,000 and $120,000 and expected to generate annual savings during the first year of $88,000 and $98,000 respectively. The value of these annual savings is expected to increase by 10% per year (over previous period). Assume service life of 2 years, operating hours per year of 4500, Determine the $ savings/ hour for each equipment and select the optimal equipment based on your results. Use i = 10%.arrow_forwardA company is considering two types of equipment for its manufacturing plant. Pertinent data are as follows in the given figure below. If the minimum required rate of return is 15%, which equipment should be selected ? Use present worth cost method.arrow_forwardThe Datum Co. has recently completed a $200, 000, two - year marketing study. Based on the results of the study, Datum has estimated that 6, 000 units of its new electro - optical data scanner could be sold annually over the next 8 years, at a price of $8, 000 each. Variable costs per unit are $4,400, and fixed costs total $5.4 million per year. Start - up costs include $17.6 million to build production facilities, $1.5 million for land, and $4 million in net working capital. The $17.6 million facility will be depreciated on a straight - line basis to a value of zero over the eight — year life of the project. At the end of the projects life, the facilities (including the land) will be sold for an estimated $4.7 million. The value of the land is not expected to change during the eight year period. Finally, start — up would also entail tax - deductible expenses of $0.4 million at year zero. Datum is an ongoing, profitable business and pays taxes at a 35% rate on all income and capital…arrow_forward

- The cost for manufacturing a component used in intelligent interface converters was $23,000 the first year. The company expects the cost to increase by 2% each year. Calculate the present worth of this cost over a five-year period at an interest rate of 10% per year.arrow_forwardAylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Year Unit Sales 1 101,000 2 115,000 3 125,000 4 145,000 5 90,000 Production of the implants will require $753,000 in net working capital to start and additional net working capital investments each year equal to 15% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5, there is no NWC cash flow occurring for Year 4.) Total fixed costs are $177,000 per year, variable production costs are $309 per unit, and the units are priced at $360 each. The equipment needed to begin production has an installed cost of $10.0 million. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus falls into Class 8 for tax purposes (20%). In five years, this equipment can be sold for about 20% of its acquisition cost. AIY is in the 40% marginal tax bracket and has a required…arrow_forwardAria Acoustics, Incorporated (AAI), projects unit sales for a new seven-octave voice emulation implant as follows: Year 1 2 3 4 5 Unit Sales 74, 000 87, 000 106, 250 98, 500 67, 800 Production of the implants will require $1,750,000 in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are $3,700,000 per year, variable production costs are $260 per unit, and the units are priced at $390 each. The equipment needed to begin production has an installed cost of $17,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. In five years, this equipment can be sold for about 20 percent of its acquisition cost. The tax rate is 25 percent and the required return is 17 percent. MACRS schedule a. What is the NPV of the project? Note: Do not round intermediate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education