Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

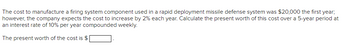

Transcribed Image Text:The cost to manufacture a firing system component used in a rapid deployment missile defense system was $20,000 the first year;

however, the company expects the cost to increase by 2% each year. Calculate the present worth of this cost over a 5-year period at

an interest rate of 10% per year compounded weekly.

The present worth of the cost is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- New equipment costs $847,000 and is expected to last for five years with the salvage value of 10% of the equipment cost. During this time the company will use a 20% CCA rate. The new equipment will save $280,000 annually before taxes. If the company's required rate of return is 5.35%, determine the PVCCATS of the purchase. Assume a tax rate of 35%. Please show all the calculations by which you came up with the final answer.arrow_forwardA construction firm can achieve a $15,000 cost savings in Year 1, increasing by $3000 each year for the next 5 years, by converting their diesel engines for biodiesel fuel. At an interest rate of 15%, what is the equivalent annual worth of the savings?arrow_forward(engineering economic) a company considers purchasing a machine for $3000. The tool is planned to be used for 10 years and after that it will be sold for 25% of its purchase price. With the purchase of the tool, the company must incur operating costs of $ 400 per year. If the owner of the company wants a return of 10% annually on the investment made, what is the uniform annual income for at least 10 years that must be obtained from the heavy equipment so that the wishes of the owner of the company are fulfilled?arrow_forward

- The operating and maintenance expenses for a mining machine are expected to be $13000 in the first year and increase by $900 per year during the 25-year life of the machine. What uniform series of payments would cover these expenses over the life of the machine? Interest is 9%/year compounded annually.arrow_forwardGreen Power Company is considering acquiring a new machine that will last 14 years and it can be purchased right now for 116,319 dollars; maintenance will cost 23,444 dollars the first year, increasing by 6,434 dollars per year thereafter (e.g. maintenance at the end of year two is equal to 23,444 plus 6,434 dollars). If the interest rate is 7% per year, compounded annually, how much money should the company set aside now to purchase and provide for the future maintenance of this machine (NPV)? (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)arrow_forwardThe cost for manufacturing a component used in intelligent interface converters was $23,000 the first year. The company expects the cost to increase by 2% each year. Calculate the present worth of this cost over a five-year period at an interest rate of 10% per year.arrow_forward

- A machine cost P20,000 today and has an estimated scrap value of P2,000 after 8 years. Inflation is 2% per year. The effective annual interest rate earned on money invested is 8%. How much money needs to be set aside each year to replace the machine with an identical model 8 years from now?arrow_forwardEquipment maintenance costs for manufacturing explosion-proof pressure switches are projected to be $125,000 in year one and increase by 3% each year through year five. What is the equivalent annual worth of the maintenance costs at an interest rate of 10% per year, compounded bi-monthly (compounded once in two months)? The equivalent annual worth is $arrow_forwardThe operating and maintenance expenses for a mining machine are expected to be $11000 in the first year and increase by $700 per year during the 25-year life of the machine. What uniform series of payments would cover these expenses over the life of the machine? Interest is 10%/year compounded annually. $4arrow_forward

- Costs associated with the manufacture of miniature high-sensitivity piezoresistive pressure transducers is $85,000 per year. A clever industrial engineer found that by spending $19,000 now to reconfigure the production line and reprogram two of the robotic arms, the cost will go down to $52,000 next year and $58,000 in years 2 through 5. Using an interest rate of 15% per year, determine the present worth of the savings due to the reconfiguration. The present worth of the savings is determined to be $arrow_forwardAndes, Inc. is considering the replacement of its manual material handling equipment with autonomous vehicles at a net initial cost of $12 million. The expected annual savings in operating costs are as shown below. MARR is 10% per year compounded annually. End of Year 1 2 3 4 5 6 3 4.5 4.5 Annual savings (millions) | 2.25 | 2.25 | 3 Compute the simple payback period for this replacement option. Determine the discounted payback period (DPBP). It is enough if you determine in which year the DPBP falls.arrow_forwardJones Company is considering investing in a new piece of equipment that costs $600,000. The new equipment should provide cost savings of $150,000 per year over its 5-year useful life. What is the payback period (in years) for the new equipment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education