Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

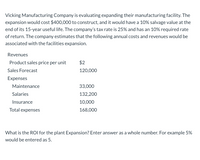

Transcribed Image Text:**Vicking Manufacturing Company Project Evaluation**

Vicking Manufacturing Company is evaluating the expansion of their manufacturing facility. The expansion would cost $400,000 to construct, and it would have a 10% salvage value at the end of its 15-year useful life. The company's tax rate is 25%, and it has a 10% required rate of return. The company estimates that the following annual costs and revenues would be associated with the facilities expansion.

**Revenues:**

- Product sales price per unit: $2

- Sales Forecast: 120,000 units

**Expenses:**

- Maintenance: $33,000

- Salaries: $132,200

- Insurance: $10,000

- Total expenses: $168,000

**Question:**

What is the ROI for the plant Expansion? Enter the answer as a whole number. For example, 5% would be entered as 5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A machine costs $600,000 and is expected to yield an after-tax net income of $23,000 each year. Management predicts this machine has a 12-year service life and a $120,000 salvage value, and it uses straight-line depreciation. Compute this machine's accounting rate of return. Choose Numerator: Annual after-tax net income $ 1 23,000 / Accounting Rate of Return Choose Denominator: Annual average investment $ = 360,000 = Insertarrow_forwardThe engineering team at Manuel’s Manufacturing, Inc., is planning to purchase an enterprise resource planning (ERP) system. The software and installation from Vendor A costs $380,000 initially and is expected to increase revenue $125,000 per year every year. The software andinstallation from Vendor B costs $280,000 and is expected to increase revenue $95,000 per year. Manuel’s uses a 4-year planning horizon and a 10%/year MARR. Solve, a. What is the future worth of each investment?b. What is the decision rule for determining the preferred investment basedon future worth ranking? c. Which (if either) ERP system should Manuel purchase?arrow_forwardYour company is considering taking on a new project that will cost $200,000. It is estimated that the system will increase sales/revenues by $150,000 annually for Years 1-6. Operating expenses, other than depreciation, are expected to be equal to 60 percent of sales in each year. The system will be depreciated on a MACRS basis over 5 years (depreciation rates are 20%, 32%, 19%, 12% 11%, and 6%) to a zero book value, but the expected salvage at Year 6 is $40,000. The firm will also be required to invest $25,000 in net working capital at Year 0, but will recapture this amount at Year 6. You may assume that the tax rate on ordinary income is 40 percent (record negative taxes as a positive cash flow). As you can calculate, the IRR for this project is 13.02%. If we assume that the firm's cost of capital for this project is 11 percent, then what is the NPV for this project? $29,055.63 O $37.201.15 $6,874.69 $21,301.58 O $13,915.29arrow_forward

- Steele's Enterprises has purchased a new machine tool which will allow the company to improve the efficiency of its operations. On an annual basis, the machine will produce 19,000 units with an expected selling price of $23, prime costs of $10 per unit, and a fixed cost allocation of $2 per unit. Annual depreciation on the machine is $13,000, and the tax rate of the company is 32%. What is the annual cash flow generated from the new machine? A. $146,280 B. $159,120 C. $172,120 D. $133,280arrow_forwardNatural Foods Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to generate additional annual sales of 7,600 units at $38 each. The new manufacturing equipment will cost $123,500 and is expected to have a 10-year life and a $9,500 residual value. Selling expenses related to the new product are expected to be 5% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Direct labor $6.50 Direct materials 21.00 Fixed factory overhead-depreciation 1.50 Variable factory overhead 3.30 Total $32.30 Determine the net cash flows for the first year of the project, Years 2–9, and for the last year of the project. Use the minus sign to indicate cash outflows. Do not round your intermediate calculations but, if required, round your final answers to the nearest dollar. Natural Foods Inc.Net Cash Flows Year 1 Years 2-9 Last Year Initial investment $fill in the blank 1…arrow_forward(engineering economic) a company considers purchasing a machine for $3000. The tool is planned to be used for 10 years and after that it will be sold for 25% of its purchase price. With the purchase of the tool, the company must incur operating costs of $ 400 per year. If the owner of the company wants a return of 10% annually on the investment made, what is the uniform annual income for at least 10 years that must be obtained from the heavy equipment so that the wishes of the owner of the company are fulfilled?arrow_forward

- The engineering team at Manuel's Manufacturing, Inc., is planning to purchase an enterprise resource planning (ERP) system. The software and installation from Vendor A costs $410,000 initially and is expected to increase revenue $110,000 per year every year. The software and installation from Vendor B costs $290,000 and is expected to increase revenue $95,000 per year. Manuel's uses a 4- year planning horizon and a 12.0% per year MARR. Part a 8 Your answer is incorrect. What is the present worth of each investment? Vendor A: $ Vendor B: $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±20.arrow_forwardConsider a project to supply Detroit with 27,000 tons of machine screws annually for automobile production. You will need an initial $6,000,000 investment in threading equipment to get the project started; the project will last for 6 years. The accounting department estimates that annual fixed costs will be $1,450,000 and that variable costs should be $275 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 6-year project life. It also estimates a salvage value of $825,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $392 per ton. The engineering department estimates you will need an initial net working capital investment of $580,000. You require a return of 11 percent and face a tax rate of 22 percent on this project. a-1. What is the estimated OCF for this project? (Do not round intermediate calculations. and round your answer to the nearest whole number,…arrow_forwardConsider a project to supply Detroit with 28,000 tons of machine screws annually for automobile production. You will need an initial $5,800,000 investment in threading equipment to get the project started; the project will last for 6 years. The accounting department estimates that annual fixed costs will be $1,400,000 and that variable costs should be $265 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 6-year project life. It also estimates a salvage value of $775,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $380 per ton. The engineering department estimates you will need an initial net working capital investment of $560,000. You require a return of 14 percent and face a tax rate of 25 percent on this project. a-1. What is the estimated OCF for this project? (Do not round intermediate calculations and round your answer to the nearest whole…arrow_forward

- Philadelphia Swim Club is planning for the coming year. Investors would like to earn a 10% return on the company's $ 38 comma 000 comma 000$38,000,000 of assets. The company primarily incurs fixed costs to maintain the swimming pools. Fixed costs are projected to be $ 12 comma 900 comma 000$12,900,000 for the year. About 550 comma 000550,000 members are expected to swim each year. Variable costs are about $ 14$14 per swimmer. Philadelphia Swim Club is a priceminus−taker and won't be able to charge more than its competitors who charge $ 38$38 for a membership. What profit will it earn as a percent of assets?arrow_forwardWinthrop Company has an opportunity to manufacture and sell a new product for a five-year period. To pursue this opportunity, the company would need to purchase a plece of equipment for $130,000. The equipment would have a useful life of five years and a $10,000 salvage value. The CCA rate for the equipment is 30%. After careful study. Winthrop estimated the following annual costs and revenues for the new product: Sales revenues: Variable expenses Fixed expenses $250,000 $130,000 $ 70,000 The company's tax rate is 30% and its after-tax cost of capital is 10%. Required: 1. Compute the net present value of the project. (Hint Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and PV factor. Round the final answers to the nearest whole dollar. Negative value should be indicated with minus sign.) 2. Would you recommend that the project be undertaken? 1. Net present value 2 Would you recommend that the project be undertaken?arrow_forwardA manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education