FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

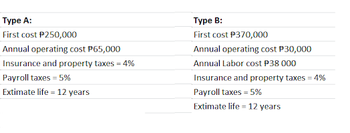

A company is considering two types of equipment for its manufacturing plant. Pertinent data are as follows in the given figure below. If the minimum required

Transcribed Image Text:Type A:

First cost P250,000

Annual operating cost P65,000

Insurance and property taxes = 4%

Payroll taxes = 5%

Extimate life = 12 years

Type B:

First cost $370,000

Annual operating cost $30,000

Annual Labor cost P38 000

Insurance and property taxes = 4%

Payroll taxes = 5%

Extimate life = 12 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- needs to follow for benchmarking. International Machine Manufacturing Company is preparing to build a new plant by considering three potential processes for it. Intermational Machine Manufacturing Company has identified three process alternatives and developed costs as well The fixed and variable costs for the three altermatrve processes are presented below. Process A, B and C are the name of three process alternatives. The cost data are as follows: Process A 350,000 OMR 100,000 OMR 16 Process B 350,000 OMR 250,000T OMR 12 Process C 350.000 OMR 550.000 OMR T0 Calculate the Annual Contracted Units Annual fixed cost Vanable cost (Per Unit) following by the data given: using a. Identify the best process to be followed by the International Machine Manufacturing Company. b.Determine the Economical Volume for each process. c.Determine the best process for each of the following volumes: (i) 100,000 (11) 275,000 (i11) 325,000 4. The following data girerarrow_forwardget fast answer as per possibility..arrow_forwarda) Based on the information provided, calculate the operating income in good format. Show all calculations. b) Calculate the individual and net Growth Component. c) Calculate the individual and net Price Recovery. d) Calculate the Productivity Component e) Show the reconciliation of the Operating Incomearrow_forward

- You have been asked to decide about one of two mutually exclusive alternatives (A & B). The following table gives the initial costs, annual savings in labor costs, and the expected life of two pieces of equipment. Plot PW vs. i for each equipment on the same graph and identify the AAIRR from the graph (i for the intersection). Then, highlight the corresponding value of i in yellow in your spreadsheet. High-cost Equipment (A) Low-cost Equipment (B) Initial Cost $137,910 $100,000 Savings in Labor Costs $42,000 / year $32,000 / year Life 5 years 5 yearsarrow_forwardMartin Company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) Required: 1. Compute the markup percentage on absorption cost required to achieve the desired ROI. 2. Compute the selling price per unit. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. 1. Markup percentage on absorption cost 2. Selling price per unit 12,000 $26.00 $ 26,400 $ 300,000 12% %arrow_forwardIf variable manufacturing costs are $9 per unit and total fixed manufacturing costs are $224,000, what is the manufacturing cost per unit if: a. 4,000 units are manufactured and the company uses the variable costing concept? $ b. 5,600 units are manufactured and the company uses the variable costing concept? c. 4,000 units are manufactured and the company uses the absorption costing concept? $ d. 5,600 units are manufactured and the company uses the absorption costing concept?arrow_forward

- Determine this onearrow_forwardHelpful Division of X Company makes two products, Small and Large. The company has always used Conventional Costing (for financial reporting purposes), but this period wants to try using Activity-Based Costing to make better decisions. Information related to the current period is as follows: REQUIRED: (#1) Since the company has three activities, what are the three overhead application rates the company would use for activity-based costing? (ROUND EACH RATE TO THE NEAREST CENT and be sure to label the rates appropriately.) (#2) Using activity-based costing, what was the cost to manufacture one Small unit? (#3) Using activity-based costing, what was the cost to manufacture one Large unit? (#4) Based on what you learned about activity-based costing this week, how might Helpful Division managers use the new cost information from its activity-based costing system to better manage its operations? Helpful Resource: https://www.youtube.com/watch?v=PU3U_aMbKwsarrow_forwarda) Classify each cost as fixed, variable or mixed, using production volume as the cost driver. b) Use the high-low method to separate mixed costs into their fixed and variable components and prepare the cost formula for each of the mixed costs. C. If Green Corridor Company expects a production volume of 30,000 bicycles in the coming quarter, prepare the production cost formula for the quarter and predict the total production cost.arrow_forward

- Need ANSWER please provide Solutionsarrow_forwardRelyaTech Corporation manufactures a number of products at its highly automated factory. The products are very popular, with demand far exceeding the factory's capacity. To maximize profit, management should rank products based on their selling price gross margin contribution margin per unit of the constrained resource contribution marginarrow_forward1. Top-down versus bottom-up estimates. pts. a. Describe the methods and uses of each of the approaches. 2. Compare the advantages and disadvantages of each of the approaches. 3. What are the three types of costs discussed in the text? Define them. 4. For a small project requiring 120 hours at $50/hr and having a direct overhead rate of 40%, calculate the direct cost (Exercise 1 in Chapter 5). To that add indirect costs (G&A) at 20% and then profit at 20% for a total project price. What are the estimated costs for: Design Programming In-house testing Which “approach to estimating” is this? What weaknesses are inherent in this approach? 5. Take another look at Exercise #5. Use Exercise Figure 5.1 on page 160. But now you are asked to do a bottom-up estimate based on the following data and compare it with the top-down estimate of $800,000. If confronted with these two estimates, what, if any, actions would you take? Deliverables Estimated Hours Rate:…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education