FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

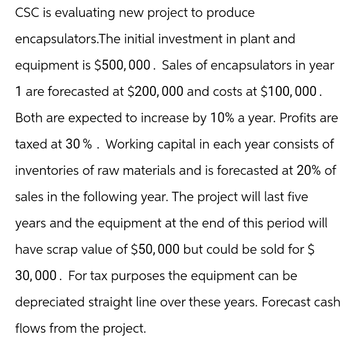

Transcribed Image Text:CSC is evaluating new project to produce

encapsulators.The initial investment in plant and

equipment is $500,000. Sales of encapsulators in year

1 are forecasted at $200,000 and costs at $100,000.

Both are expected to increase by 10% a year. Profits are

taxed at 30%. Working capital in each year consists of

inventories of raw materials and is forecasted at 20% of

sales in the following year. The project will last five

years and the equipment at the end of this period will

have scrap value of $50, 000 but could be sold for $

30,000. For tax purposes the equipment can be

depreciated straight line over these years. Forecast cash

flows from the project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $189,000 per year. Once in production, the bike is expected to make $283,500 per year for 10 years. Assume the cost of capital is 10%. a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? b. By how much must the cost of capital estimate deviate to change the decision? (Hint: Use Excel to calculate the IRR.) c. What is the NPV of the investment if the cost of capital is 15%? Note: Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7.arrow_forwardBetter Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6.3 million. The equipment will be depreciated straight-line over 6 years, but, in fact, it can be sold after 6 years for $549,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year’s forecast sales. The firm estimates production costs equal to $1.60 per trap and believes that the traps can be sold for $6 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm’s tax bracket is 40%, and the required rate of return on the project is 10%. Year: 0 1 2 3 4 5 6 Thereafter Sales (millions of traps) 0 0.6 0.8 1.0 1.0 0.5 0.3 0 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV? (Do not round your intermediate…arrow_forwardManagement of Crane Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $209,550 and will generate cash flows of $83,750 over each of the next six years. If the cost of capital is 11 percent, what is the MIRR on this project?arrow_forward

- Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6 million. The equipment will be depreciated straight-line over 6 years but, in fact, it can be sold after 6 years for $500,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year's forecast sales. The firm estimates production costs equal to $1.50 per trap and believes that the traps can be sold for $4 each. Sales forecasts are given in the following table. The project will come to an end in 5 years, when the trap becomes technologically obsolete. The firm's tax bracket is 40%, and the required rate of return on the project is 12%. Year: Sales (millions of traps) 0 1 0.5 Increase in NPV 0.0651 million ✔ Answer is complete and correct. 2 0.6 3 1.0 4 1.0 5 0.6 6 0.2 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV? Note:…arrow_forwardBetter Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6 million. The equipment will be depreciated straight-line over 6 years but, in fact, it can be sold after 6 years for $500,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year's forecast sales. The firm estimates production costs equal to $1.50 per trap and believes that the traps can be sold for $4 each. Sales forecasts are given in the following table. The project will come to an end in 5 years, when the trap becomes technologically obsolete. The firm's tax bracket is 40%, and the required rate of return on the project is 12%. Year: Sales (millions of traps) Increase in NPV 0 0 million 1 0.5 2 0.6 3 1.0 4 1.0 5 0.6 6 0.2 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV? Note: Do not round your intermediate…arrow_forwardCheese & Cake Factory is looking at a project with the following forecasted sales: first-yearsales quantity of 35,000 with an annual growth rate of 5% over the next 5 years. The sales priceper unit is $40 and will grow at 3% per year. The production costs are expected to be 50% ofthe current year's sales price. The manufacturing equipment to aid this project will have a totalcost (including installation) of $1,000,000. It will be depreciated using MACRS and has aseven-year MACRS life classification. Fixed costs are $300,000 per year.The change in net operating working capital is $10,000 and will be recovered at the end of year5. Cheese & Cake Factory has a tax rate of 40%. At the end of year 5, the manufacturingequipment can be sold for $150,000 and the cost of capital for this project is 10%. What are the operating cash flow for years one and two?arrow_forward

- An initial $400,000 investment in new production equipment will yield annual positive cash flows of $150,000 in year 1. Annual cash flows will decrease by $25,000 each year thereafter. The new equipment has a useful life of 7 years. MARR is 10% per year. Determine the DPBP of this project.arrow_forwardJacob Inc. is considering a capital expansion project. The initial investment of undertaking this project is $188,500. This expansion project will last for five years. The net operating cash flows from the expansion project at the end of year 1, 2, 3, 4 and 5 are estimated to be $28,500, $38,780, $58,960, $77,680 and $95,380 respectively. Jacob has a weighted average cost of capital of 18%. What is the modified internal rate of return if Jacob undertakes this project. Assuming that the positive cash inflow from undertaking this project will be reinvested at the weighted average cost of capital.arrow_forwardhelparrow_forward

- Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $5.4 million. The equipment will be depreciated straight-line over 6 years, but, in fact, it can be sold after 6 years for $682,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year's forecast sales. The firm estimates production costs equal to $1.30 per trap and believes that the traps can be sold for $5 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm's tax bracket is 40%, and the required rate of return on the project is 8%. Year: Sales (millions of traps) 0 0 Increase in NPV 1 0.5 million 2 0.7 3 0.8 4 0.8 5 0.7 6 0.5 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV? Note: Do not round your intermediate…arrow_forwardYou are responsible to manage an IS project with a 4-year horizon. The annal cost of the project is estimated at $40,000 per year, and a one-time costs of $120,000. The annual monetary benefit of the project is estimated at $96,000 per year with a discount rate of 6 percent. a. Calculate the overall return on investment (ROI) of the project. b. Perform a break-even analysis (BEA). At what year does break-even occur?arrow_forwardTesla is considering an investment into a project which it intends to operate for 6 years. The project requires an initial outlay of $7 million. The project will generate cash sales of $3.5 million in the first year. Sales will grow by $1.5 million each year in the following two years. After the third year, sales will grow by 8%. Cash operating costs, excluding depreciation, will be 22% of sales. Depreciation expenses will be 11% of sales. There are no cash flows associated with the salvage value or the net working capital. Tesla’s tax rate is 35%. What is the IRR of this project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education