FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

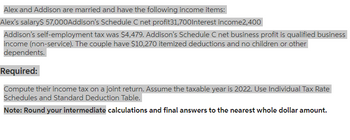

Transcribed Image Text:Alex and Addison are married and have the following income items:

Alex's salary$ 57,000Addison's Schedule C net profit31,700Interest income2,400

Addison's self-employment tax was $4,479. Addison's Schedule C net business profit is qualified business

income (non-service). The couple have $10,270 itemized deductions and no children or other

dependents.

Required:

Compute their income tax on a joint return. Assume the taxable year is 2022. Use Individual Tax Rate

Schedules and Standard Deduction Table.

Note: Round your intermediate calculations and final answers to the nearest whole dollar amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A married couple with 4 children is filing taxes jointly. They have a gross income of $436,202, and they made the following tax-deductible purchases: • Charitable contributions: $6,826 • Medical expenses: $2,712 • Mortgage interest: $5,973 Compute their final income tax using the following information: Married Individuals Filing Joint Returns and Surviving Spouses If Taxable Income Is Between: The Tax Due Is: 0- $19,750 10% of taxable income $19,751 - $80,250 $1,975 + 12% of the amount over $19,750 $80,251 - $171,050 $9,235 + 22% of the amount over $80,250 $171,051 - $326,600 $29,211 + 24% of the amount over $171,050 $326,601 - $414,700 $66,543 + 32% of the amount over $326,600 $414,701 - $622,050 $94,735 + 35% of the amount over $414,700 $622,051 $167,307.50 + 37% of the amount over $622,050 Round your answer to the nearest dollar. Recall the standard deduction for married filers: $24,800arrow_forwardAlan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, and they have legitimate itemized deductions totaling $27,500. Their total income from wages is $233,400. Assume the following tax table is applicable: Married Couples Filing Joint Returns If Your Taxable Income Is You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base Average Tax Rate at Top of Bracket Up to $19,750 $0.00 10.0% 10.0% $19,750-$80,250 1,975.00 12.0 11.5 $80,250-$171,050 9,235.00 22.0 17.1 $171,050-$326,600 29,211.00 24.0 20.4 $326,600-$414,700 66,543.00 32.0 22.8 $414,700-$622,050 94,735.00 35.0 26.9 Over $622,050 167,307.50 37.0 37.0 What is their marginal tax rate?arrow_forwardDomesticarrow_forward

- Karen Most has a federal tax levy of $2,100.50 against her. If Most is single with two personal exemptions and had a take-home pay of $499.00 this week, how much would her employer take from her to satisfy part of the tax levy?arrow_forwardDavid and Lilly Fernandez have determined their tax liability on their joint tax return to be $3,100. They have made prepayments of $2,390 and also have a child tax credit of $2,000. What is the amount of their tax refund or taxes due? Toal tax prepayment child tax credit Tax refundarrow_forwardBoyd Salzer, an unmarried individual, has $246,400 AGI consisting of the following items: Salary Interest income $ 214,000 3,800 Dividend income 11,100 Rental income from real property 17,500 1. Compute Mr. Salzer's Medicare contribution tax. 2. Compute the Medicare contribution tax if Boyd Salzer files a joint income tax return with his wife Harriet.arrow_forward

- Jaylen and Zan are married, filing jointly. Their total adjusted gross income was $81,000 and they qualified for the standard deduction of $24,000. Use the following 2018 tax rate schedule to calculate their 2018 federal income tax. If your filing status is married, filing jointly or surviving spouses; and taxable income is more than: but not over: your tax is: $ 0 $19,050 10% OF the taxable income $19,050 $77,400 $1905 plus 12% of the excess over $19,050 $77,400 $165,000 $8907 plus 22% of the excess over $77,400 $165,000 $315,000 $28,179 plus 24% of the excess over $165,000 $315,000 $400,000 $64,179 plus 32% of the excess over $315,000 $400,000 $600,000 $91,379 plus 35% of the excess over $400,000 $600,000 _______ $161,379 plus 37% OF THE AMOUNT OVER $600,000 Jaylen and Zan's 2018 Federal income tax is: $(Round to the nearest dollar.)What is Jaylen and Zan's effective tax rate? [Tax paid divided by taxable income]%(Write as a percent, rounded to one decimal place.)arrow_forwardArno and Bridgette are married and have combined W-2 income of $89,361. They received a refund of $128 when they filed their taxes. How much income tax did their employers withhold during the year? $9,582. $9,326. $9,454. The answer cannot be determined with the information provided.arrow_forwardWhich of the following taxpayers is/are subject to the net investment income tax?None of the taxpayers have any investment expenses allocable to their investment income. Brian and Erika. They are married and will file a joint return. Their only income consists of a $2,000 capital gain distribution from a mutual fund they own and income from wages. Their 2023 modified adjusted gross income is $265,000. Cassandra. She will use the single filing status. All her income is from wages, although she did purchase a painting for $25,000 at the beginning of the year. At the end of the year, she was thrilled to learn that its appraised value was $30,000. She continues to hold the painting, hoping it will increase in value even more. Cassandra's 2023 modified adjusted gross income is $245,000. Jordan. He is married but will file a separate return. His only income consists of a $5,000 capital gain from the sale of stock and income from wages. Jordan's 2023 modified adjusted gross income is…arrow_forward

- Terrell, an unmarried individual, has the following income items: Schedule C net profit Salary NOL carryforward deduction Interest income $ 31,900 55,120 (9,190) 725 Terrell's self-employment tax was $4,507. Terrell had $6,270 in itemized deductions and one dependent child (age 9) who lives with Terrell. Terrell's Schedule C net business profit is qualified business income (non-service). Required: Compute Terrell's income tax (before credits). Assume the taxable year is 2023. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. > Answer is complete but not entirely correct. Amount $ 76,302 AGI Taxable Income Income Tax $ 38,042 X $ 4,251 xarrow_forwardLily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2021, she sells the following long-term assets used in her business: Asset Building Equipment Sales Price $ 233,400 83,400 Description Taxable income Tax liability Lily's taxable income before these transactions is $193,900. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Cost $ 203,400 151,400 $ Amount Accumulated Depreciation $ 55,400 26,400 237,700arrow_forwardUse the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education