Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

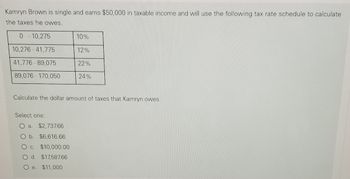

Transcribed Image Text:Kamryn Brown is single and earns $50,000 in taxable income and will use the following tax rate schedule to calculate

the taxes he owes.

0-10,275

10%

10,276-41,775

12%

41,776-89,075

22%

89,076-170,050

24%

Calculate the dollar amount of taxes that Kamryn owes.

Select one:

O a. $2,737.66

O b. $6,616.66

O c. $10,000.00

O d. $17,587.66

O e. $11,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Determine the amount of the child tax credit in each of the following cases: > Answer is complete but not entirely correct. a. A single parent with modified AGI of $214,600 and one child age 4. b. A single parent with modified AGI of $79,200 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $409,133 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,255 and one child, age 13. Child Tax Credit Allowed $ $ $ $ 1,250 ✓✔ 9,600 X 3,544 x 3,000arrow_forwardJared Goff, of Los Angeles, determined the following tax information: gross salary, $85,000; interest earned, $2,500; IRA contribution, $4,500; and standard deduction, $12,200. Filing single, calculate Jared's taxable income and tax liability.arrow_forwardCody and Serena are MFJ taxpayers with two children, Emma, age 10, and Ella, age 21. Ella is a full time student at NAU and Cody and Serena provide all of her support. Cody and Serena have an AGI of $65,000. What is the amount of the other dependent tax credit they can claim for the current year? А. $1,000 В. $500 С. $0 D. $1,500arrow_forward

- Jane Doe is single and claims 2 withholding allowances. If her weekly gross earning is $1,450, then determine the Federal Withholding Tax a. none of the cholices b.239.31 c.146.16 d.1000arrow_forwardCompute her income tax payable in her Annual ITR? a. 613,400 b. 638,400 c. 920,400 d. 628,200arrow_forwardPlease answer these two questions correctly. Refer to Publication 15-T for answersarrow_forward

- Manabhaiarrow_forwardA woman is in the 15% tax bucket and itemizes her deductions. How much will her tax bill be reduced if she makes a$200 tax deductible contribution to charity A. $30 B. $200 C. $0 D. $170arrow_forwardCalculate the total tax (FICA and income taxes) owed by each individual in the following pair. Compare their overall tax rates. Assume that each individual is singleand takes the standard deduction. Use the tax rates in the table to the right and the special rates for the dividends and capital gains. Pierre earned $140,000 in wages. Katarina earned $140,000, all from dividends and long-term capital gains. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 For 2017, the FICA tax rates were 7.65% on the first $127,200 of income from wages and 1.45% on any income from wages in excess of $127,200. The tax rates for long-term capital gains and dividends were 0% for income in the 10% and 15% tax…arrow_forward

- sch.3arrow_forwardMrs. Nunn, who has a 24 percent marginal tax rate on ordinary income, earned $3,670 interest on a debt instrument this year. Required: Compute her federal income tax on this interest assuming that the debt instrument was: Note: For all requirements, round your final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "0" wherever required. a. An unsecured note from her son, who borrowed money from his mother to finance the construction of his home. b. A certificate of deposit from a federal bank. c. A 30-year General Electric corporate bond. d. A U.S. Treasury note. e. A City of Memphis municipal bond. a. Federal income tax b. Federal income tax c. Federal income tax d. Federal income tax e. Federal income tax Amountarrow_forwardThe Chungs are married with one dependent child. They report the following information for 2022: Schedule C net profit $ 66,650 Interest income from certificate of deposit (CD) 2,100 Self-employment tax on Schedule C net profit 9,418 Dividend eligible for 15% rate 12,000 Lila Chung's salary from Brants Company 75,000 Dependent care credit 500 Itemized deductions 27,000 Required: Compute AGI, taxable income, and total tax liability (including self-employment tax). Assume that Schedule C net profit is qualified business income (non-service income) under Section 199A. Assume the taxable year is 2022. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education