FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

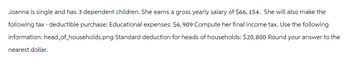

Transcribed Image Text:Joanna is single and has 3 dependent children. She earns a gross yearly salary of $66, 154. She will also make the

following tax-deductible purchase: Educational expenses: $6,909 Compute her final income tax. Use the following

information: head_of_households.png Standard deduction for heads of households: $20,800 Round your answer to the

nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Sarah is a cash-method, calendar-year taxpayer, and she is considering making the following cash payments related to her business. Calculate the after-tax cost of each payment assuming she is subject to a 37 percent marginal tax rate. Note: Do not round intermediate calculation. Problem 9-54 Part-b (Algo) b. $4,600 to reimburse the cost of meals at restaurants incurred by employees while traveling for the business.arrow_forwardCompute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, earns wages of $450,600. His additional Medicare tax is $ b. George and Shirley are married and file a joint return. During the year, George earns wages of $242,300, and Shirley earns wages of $363,450. Their additional Medicare tax is $ c. Simon has net investment income of $54,360 and MAGI of $271,800 and files as a single taxpayer. Simon's additional Medicare tax is $arrow_forward2. Dustin Ambrose is married and claims 3 allowances. His gross weekly pay is $628.00. Each week he pays federal, Social Security, and Medicare taxes, $52.00 for medical insurance, and $23.50 toward his retirement fund. 3. Andre Quinn earns $600 per week. He is married and daims 2 allowances. Weekly deductions indude federal, Social Security, and Medicare taxes, a state tax of 2.5 percent on gross carnings, a local tax of I percent on gross earnings, and medical insurance The commny nat 65 percent of the $3.975 annnalarrow_forward

- Ruth has asked for help in determining whether she should receive her $32,500 bonus check in the current year or next year. In the current year, her marginal tax rate is 24% and she anticipates she will be in the 32% marginal tax bracket next year. What advice can you give Ruth? Net revenue from bonus $ Current year Ruth should choose to receive her bonus in the ✓year. Next yeararrow_forwardCalculate federal and state income tax withholding for a number of employees of TCLH Industries, a manufacturer of cleaning products. Use the wage-bracket method when it is possible to do so, and use the percentage method in all other instances. Assume the state income tax withholding rate to be 5% of taxable pay (which is the same for federal and state income tax withholding). 4)Michael Sierra contributes $50 to a flexible spending account each period. He is married, claims four federal withholding allowances and three state withholding allowances, and his weekly gross pay was $2,450. The year is 2021. Federal income tax withholding=$___ State income tax withholding=$120.00arrow_forwardMarilyn earns $1,400.00 bi-weekly. She has a bi-weekly taxable car allowance of $70.00 and a bi-weekly group term life taxable benefit of $25.00. Union dues of $18.00 are deducted from each pay. Her TD1 and TD1AB forms have claim code 1. Calculate the federal and provincial taxes.arrow_forward

- For each of the following situations, indicate how much the taxpayer is required to include in gross income: Note: Leave no answer blank. Enter zero if applicable. Required: a. Steve was awarded a $9,150 scholarship to attend State Law School. The scholarship pays Steve's tuition and fees. b. Hal was awarded a $17,300 scholarship to attend State Hotel School. All scholarship students must work 30 hours per week at the School residency during the term. Complete this question by entering your answers in the tabs below. Required A Required B Steve was awarded a $9,150 scholarship to attend State Law School. The scholarship pays Steve's tuition and fees. Amount to be included in gross income Required B >arrow_forwardTimmy Tappan is single and had $189,000 in taxable income. Use the rates from Table 2.3. a. Calculate his income taxes. (Do not round intermediate calculations.) b. What is the average tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the marginal tax rate? (Do not round intermediate calculations.) Answer is complete but not entirely correct. $ a. Income taxes b. Average tax rate c. Marginal tax rate 47,843 X 478.43 X % 32 %arrow_forwardSergei owns some property that has an assessed value of $242,675. Calculate the tax due if the tax rate is 51.50 mills. (Round your answer to the nearest cent if necessary)arrow_forward

- Reagan earned $1500last week. He is married and is paid biweekly. Using the percentage method, (use tables in the handbook), his income tax is:arrow_forwardCody and Serena are MFJ taxpayers with two children, Emma, age 10, and Ella, age 21. Ella is a full time student at NAU and Cody and Serena provide all of her support. Cody and Serena have an AGI of $65,000. What is the amount of the other dependent tax credit they can claim for the current year? А. $1,000 В. $500 С. $0 D. $1,500arrow_forwardPlease do not give image format and solve full details..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education