FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

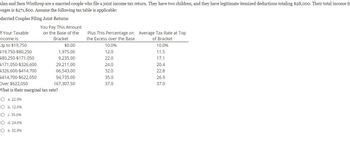

Transcribed Image Text:Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, and they have legitimate itemized deductions totaling $28,000. Their total income fr

wages is $271,800. Assume the following tax table is applicable:

Married Couples Filing Joint Returns

You Pay This Amount

on the Base of the

Bracket

If Your Taxable

Income Is

Up to $19,750

$19,750-$80,250

$80,250-$171,050

$171,050-$326,600

$326,600-$414,700

$414,700-$622,050

Over $622,050

What is their marginal tax rate?

O a. 22.0%

O b. 12.0%

O c. 35.0%

O

d. 24.0%

O e. 32.0%

$0.00

1,975.00

9,235.00

29,211.00

66,543.00

94,735.00

167,307.50

Plus This Percentage on Average Tax Rate at Top

the Excess over the Base

of Bracket

10.0%

10.0%

12.0

11.5

22.0

17.1

20.4

22.8

26.9

37.0

24.0

32.0

35.0

37.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In the current year, Shrek and Princess Fiona are married and file a joint tax return claiming their two children, ages 5 and 7 as dependents. Assuming their AGI is $135,000, Shrek and Fiona's child tax credit is: O $2,000. O $0. O $4,000. O $2,500.arrow_forwardHavel and Petra are married and will file a joint tax return. Havel has W-2 income of $38,840, and Petra has W-2 income of $49,642. Use the appropriate Tax Tables and Tax Rate Schedules. Required: What is their tax liability using the Tax Tables? What is their tax liability using the Tax Rate Schedule? Note: Round your intermediate computations and final answers to 2 decimal places.arrow_forwardUse the marginal tax rates in the table below to compute the tax owed in the following situation. Winona and Jim are married filing jointly, with a taxable income of $332,000. They are entitled to a $7000 tax credit. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Jointly up to $18,650 up to $75,900 up to $153,100 up to $233,350 up to $416,700 up to $470,700 above $470,700 $12,700 $4050 The tax owed is $. (Type an integer or a decimal.)arrow_forward

- Paul and Olivia file a joint tax return and reported modified AGI of $142,000. They have two qualifying children, ages seven and nine, for the purpose of the child tax credit. What is the amount of their child tax credit? What is the amount of the credit if they're modified AGI is $167,000? What is the amount of their credit if their modified AGI is $432,000?arrow_forwardJenni is married filling separately with taxable income of $68,000. How much tax does she owe? ( round to the nearest cent as needed) Tax Rate. Single 10% up to $9,325 15% up to $ 37, 950 25% up to $91, 900 The tax owed is $....arrow_forwardDetermine the taxable amount of social security benefits for the following situations. If an amount is zero, enter "$0".a. Erwin and Eleanor are married and file a joint tax return. They have adjusted gross income of $36,000, no tax-exempt interest, and $12,400 of Social Security benefits. As a result, $ of the Social Security benefits are taxable.b. Assume Erwin and Eleanor have adjusted gross income of $12,000, no tax-exempt interest, and $16,000 of Social Security benefits. As a result, $ of the Social Security benefits are taxable.c. Assume Erwin and Eleanor have adjusted gross income of $85,000, no tax-exempt interest, and $15,000 of Social Security benefits. As a result, $ of the Social Security benefits are taxable.arrow_forward

- Maureen Smith is a single individual. She claims a standard deduction of $12,400. Her salary for the year was $73,850. Assume the following tax table is applicable. Single Individuals If Your Taxable Income is Up to $9,875 $9,875-$40,125 $40,125-$85,525 $85,525-$163,300 $163,300-$207,350 You Pay This Amount on the Base of the Bracket O a $9,309.00 Ob $12,037.00 O c $4,617.50 Od $7.176.50 e $13.519.00 $0.00 987.50 4,617.50 14,605.50 33,271.50 47,367.50 156,235.00 $207 350-$518,400 Over $518,400 What is her federal tax liability? Plus This Percentage on the Excess over the Base 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20,4 22.8 30,1 37.0arrow_forwardDavid and Lilly Fernandez have determined their tax liability on their joint tax return to be $3,100. They have made prepayments of $1,900 and also have a child tax credit of $2,000. What is the amount of their tax refund or taxes due?arrow_forward@arrow_forward

- Determine the amount of the child tax credit in each of the following cases: a. A single parent with modified AGI of $215,300 and one child age 4. b. A single parent with modified AGI of $79,900 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $409,833 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,955 and one child, age 13. Child Tax Credit Allowedarrow_forwardSusan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $320,000. Do not round Intermediate calculation. a. What is their federal tax liability? Round your answer to the nearest dollar. $ b. What is their marginal tax rate? Round your answer to the nearest whole number. % c. What is their average tax rate? Round your answer to two decimal places. %arrow_forwardXavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as married filing jointly. They had a total of $7,910 withheld from their paychecks for federal income tax. Using the 22% from the tax table, Indicate whether the amount is a refund or additional tax.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education