FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

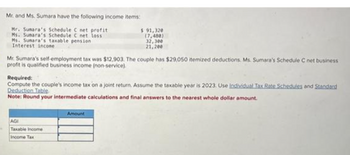

Transcribed Image Text:Mr. and Ms. Sumara have the following income items:

Mr. Sumara's Schedule C net profit

Ms. Sunara's Schedule C net loss

Ms. Sunara's taxable pension

Interest income

Mr. Sumara's self-employment tax was $12,903. The couple has $29,050 itemized deductions. Ms. Sumara's Schedule C net business

profit is qualified business income (non-service).

$ 91,320

(7,480)

32,300

21,200

Required:

Compute the couple's income tax on a joint return. Assume the taxable year is 2023. Use Individual Tax Rate Schedules and Standard

Deduction Table

Note: Round your intermediate calculations and final answers to the nearest whole dollar amount.

AGI

Taxable Income

Income Tax

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A-1arrow_forwardCalculate Jared's taxable income and tax liabiity filing single according to the following tax information: Gross Income $160,000 Interest Earned $2,000 IRA Contribution $5,000 Personal Exemption $4,050 Itemized Deduction $8,000arrow_forwardKarla has the following incomes and tax deductionsNet Employment Income$62,350.00Capital Gains$97,650.00Allowable Capital Losses$2,715.00Contribution to RRSP$4,560.00Loss in Business$11,560.00 What is the Taxable Income for Karla?arrow_forward

- a. Tyler and Candice are married and file a joint tax return. They have adjusted gross income of $42,200 before considering their Social Security benefits, no tax-exempt interest, and $14,770 of Social Security benefits. As a result, s X of the Social Security benefits are taxable. h Arrumadaandarrow_forward7arrow_forward3. Fess receives wages totaling $75,700 and has net earnings from self-employment amounting to $61,300. In determining her taxable self-employment income for the OASDI tax, how much of her net self-employment earnings must Fess count?arrow_forward

- Which taxpayer would be able to deduct the entire amount of their investment interest expense on Schedule A (Form 1040), Itemized Deductions? o Jenny. She had an investment interest expense of $800 and taxable investment income of $900. o Mark. He had an investment interest expense of $1,200 and taxable investment income of $1,100. o Nancy. She had an investment interest expense of $1,900 and taxable investment income of $1,350. o Peter. He had an investment interest expense of $1,400. He had taxable investment income of $1,200 and nontaxable investment income of $300. (The $300 of nontaxable investment income was from municipal bond interest.)arrow_forwardTerrell, an unmarried individual, has the following income items: Schedule C net profit Salary NOL carryforward deduction Interest income $ 31,900 55,120 (9,190) 725 Terrell's self-employment tax was $4,507. Terrell had $6,270 in itemized deductions and one dependent child (age 9) who lives with Terrell. Terrell's Schedule C net business profit is qualified business income (non-service). Required: Compute Terrell's income tax (before credits). Assume the taxable year is 2023. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. > Answer is complete but not entirely correct. Amount $ 76,302 AGI Taxable Income Income Tax $ 38,042 X $ 4,251 xarrow_forwardThe following Data relates to Stephanie Garner, a resident taxpayer. Stephanie derives income from a public relations business and is also a partner in a marketing business Assessable business Income 2019/20 2020/21 2021/22 $93,400. $126,000 $133,400 General Business Deductions Share of Partnership Net Income (Loss). Superannuation and Gifts Net Exempt income 80,000 129,000 119,200 (21,800) 14,900 (5,600) 11,000 8,000 3,000 2,000 4,000 1,500 General Business deductions are separate from personal superannuation, gifts, partnership lossess and losses of previous years. For each year, determine Stephanie's Taxable Income and any losses that may be carried forwardarrow_forward

- Subject : - Accountarrow_forwardCompute the taxable income for 2023 in each of the following independent situations. Click here to access the Exhibits 3.4 and 3.5 to use if required. a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized deductions of $29,000. AGI Less: Itemized deductions Taxable income b. Sybil, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000. AGI Less: Standard deduction Taxable income AGI Less: Standard deduction c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $76,800 and itemized deductions of $10,100. Taxable income $125,000 AGI Less: Standard deduction $80,000 d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She has…arrow_forwardThe following information relates to Stewart, a single taxpayer, age 18: (Click the icon to view the information.) (Click the icon to view the standard deduction amounts.) Read the requirements. Requirement a. Compute Stewart's taxable income assuming he is self-supporting. (Complete all input fields. For amounts of zero or less, enter "0" in the appropriate cell.) Adjusted gross income Taxable incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education