FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

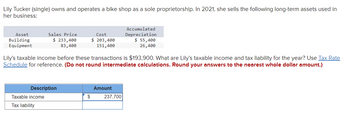

Transcribed Image Text:Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2021, she sells the following long-term assets used in

her business:

Asset

Building

Equipment

Sales Price

$ 233,400

83,400

Description

Taxable income

Tax liability

Lily's taxable income before these transactions is $193,900. What are Lily's taxable income and tax liability for the year? Use Tax Rate

Schedule for reference. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Cost

$ 203,400

151,400

$

Amount

Accumulated

Depreciation

$ 55,400

26,400

237,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mr. and Mrs. Wilson are married (MFJ) with one dependent child. They report the following information for 2020: Schedule C net profit Interest income from certificate of deposit (CD) Self-employment tax on Schedule C net profit Dividend eligible for 15% rate Mrs. Wilson's salary from Brants Company Dependent care credit Itemized deductions S 66,650 2,100 9,418 12,000 75,000 500 27,000 Required: Compute AGI, taxable income, and total tax liability (including self-employment tax). Assume that Schedule C net profit is qualified business income (non-service income) under Section 199A. Assume the taxable year is 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. (Do not round intermediate computations. Round your final answers to the nearest whole dollar amount.)arrow_forwardIn 2020, Mary Kelly drove her personal car 2,800 miles for business purposes. She also incurred $182 in parking fees and $191 in turnpike tolls connected with her business trips. Compute Mary’s deduction for automobile expenses on her current year tax return, assuming all of the above expenses are valid and she elects to use the standard mileage allowance method to compute her deduction for automobile expenses. Assume Mary is self-employed.arrow_forwardMs. Venus is the owner of Bebe Party Favors store She also works as a party host. The following results were shown during 2018: Store's gross sales amounted to P1,200,000 Gross receipts as party host amounted to P450,000 Ms. Venus has signified her intention to be treated at 8% income tax rate in her first quarter income tax return. 1. Ms. Venus's taxable income for 2018 is 2 Ms. Venus's income tax liability for 2018 is Assume that Ms. Venus failed to signify her intention to be taxed 8% income tax rate on gross sales/receipts in her first quarter income tax return. Cost of sales incurred in 2018 amounted to P850,000 while operating expenses P380,000. 3. In the second scenario, Ms. Venus taxable income due for 2018 is 4. Ms. Venus income tax liability in this case is Answer the following. Be sure to follow the correct format (see SAMPLE below) to get credit for your answers. Peso sign are not required. Centavos are not required. If your computation is with centavo, round your answer to…arrow_forward

- Subject: acountingarrow_forwardHow does the tax benefit rule apply in the following cases? a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the 35% marginal tax bracket in 2021. Orange Furniture must include $fill in the blank 102a7e000ffcfe0_1 in gross income as the recovery of a prior deduction. The timing of the income and deductions cost Orange $fill in the blank 102a7e000ffcfe0_2. b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received a…arrow_forwardSubject : Accountingarrow_forward

- Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. This year, she sells the following long-term assets used in her business: Asset Sales Price Cost Accumulated Depreciation Building $230,000 $200,000 $52,000 Equipment 80,000 148,000 23,000 Lily's taxable income before these transactions is $160,500. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Taxable Income= Tax Liability=arrow_forwardVikrambhaiarrow_forwardDogarrow_forward

- Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2018, she sells the following long-term assets used in her business: Sales Asset Price Cost Building $234,200 $204,200 Equipment 84,200 152,200 Accumulated Depreciation $56,200 27,200 Lily's taxable income before these transactions is $164,700. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)arrow_forwardlly Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2022, she sells the following long-term assets used in her business: Asset Building Equipment Sales Price $ 235,000 85,000 Cost $ 205,000 153,000 Accumulated Depreciation $ 57,000 28,000 lly's taxable income before these transactions is $195,500. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. Note: Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount. Description Taxable income Tax liability Amount $ 242,500arrow_forwardUse the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education