FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

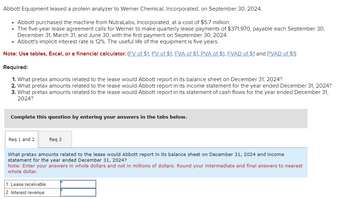

Transcribed Image Text:Abbott Equipment leased a protein analyzer to Werner Chemical, Incorporated, on September 30, 2024.

• Abbott purchased the machine from NutraLabs, Incorporated, at a cost of $5.7 million.

• The five-year lease agreement calls for Werner to make quarterly lease payments of $371,970, payable each September 30,

December 31, March 31, and June 30, with the first payment on September 30, 2024.

⚫ Abbott's implicit interest rate is 12%. The useful life of the equipment is five years.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

1. What pretax amounts related to the lease would Abbott report in its balance sheet on December 31, 2024?

2. What pretax amounts related to the lease would Abbott report in its income statement for the year ended December 31, 2024?

3. What pretax amounts related to the lease would Abbott report in its statement of cash flows for the year ended December 31,

2024?

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

What pretax amounts related to the lease would Abbott report in its balance sheet on December 31, 2024 and income

statement for the year ended December 31, 2024?

Note: Enter your answers in whole dollars and not in millions of dollars. Round your intermediate and final answers to nearest

whole dollar.

1. Lease receivable

2. Interest revenue

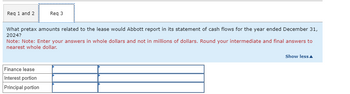

Transcribed Image Text:Req 1 and 2

Req 3

What pretax amounts related to the lease would Abbott report in its statement of cash flows for the year ended December 31,

2024?

Note: Note: Enter your answers in whole dollars and not in millions of dollars. Round your intermediate and final answers to

nearest whole dollar.

Finance lease

Interest portion

Principal portion

Show less▲

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- k t nces NutraLabs, Incorporated, leased a protein analyzer to Werner Chemical, Incorporated, on September 30, 2024. • NutraLabs manufactured the machine at a cost of $4.85 million. • The five-year lease agreement calls for Werner to make quarterly lease payments of $375,234, payable each September 30, December 31, March 31, and June 30, with the first payment on September 30, 2024. NutraLabs' implicit interest rate is 8%. . The useful life of the equipment is five years. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Determine the price at which NutraLabs is "selling" the equipment (present value of the lease payments) on September 30, 2024. 2. What pretax amounts related to the lease would NutraLabs report in its balance sheet on December 31, 2024? 3. What pretax amounts related to the lease would NutraLabs report in its income statement for the year ended December 31, 2024? 4. What pretax amounts…arrow_forwardAbbott Equipment leased a protein analyzer to Werner Chemical, Incorporated, on September 30, 2024. Abbott purchased the machine from NutraLabs, Incorporated, at a cost of $5.95 million. The five-year lease agreement calls for Werner to make quarterly lease payments of $420,972, payable each September 30, December 31, March 31, and June 30, with the first payment on September 30, 2024. Abbott's implicit interest rate is 16%. The useful life of the equipment is five years. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: What pretax amounts related to the lease would Abbott report in its balance sheet on December 31, 2024? What pretax amounts related to the lease would Abbott report in its income statement for the year ended December 31, 2024? What pretax amounts related to the lease would Abbott report in its statement of cash flows for the year ended December 31, 2024?arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. ⚫ The lease agreement specified annual payments of $44,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. • The company had the option to purchase the machine on December 30, 2026, for $53,000 when its fair value was expected to be $68,000, a sufficient difference that exercise seems reasonably certain. • The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 9%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare the…arrow_forward

- Abbott Equipment leased a protein analyzer to Werner Chemical, Incorporated, on September 30, 2024. Abbott purchased the machine from NutraLabs, Incorporated, at a cost of $6 million. The five-year lease agreement calls for Werner to make quarterly lease payments of $391,548, payable each September 30, December 31, March 31, and June 30, with the first payment on September 30, 2024. Abbott's implicit interest rate is 12%. The useful life of the equipment is five years. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: What pretax amounts related to the lease would Abbott report in its balance sheet on December 31, 2024? What pretax amounts related to the lease would Abbott report in its income statement for the year ended December 31, 2024? What pretax amounts related to the lease would Abbott report in its statement of cash flows for the year ended December 31, 2024? Complete this question by…arrow_forwardVishuarrow_forwardNutraLabs, Incorporated, leased a protein analyzer to Werner Chemical, Incorporated, on September 30, 2024. NutraLabs manufactured the machine at a cost of $5.1 million. The five-year lease agreement calls for Werner to make quarterly lease payments of $385,022, payable each September 30, December 31, March 31, and June 30, with the first payment on September 30, 2024. NutraLabs’ implicit interest rate is 16%. The useful life of the equipment is five years. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Determine the price at which NutraLabs is “selling” the equipment (present value of the lease payments) on September 30, 2024. What pretax amounts related to the lease would NutraLabs report in its balance sheet on December 31, 2024? What pretax amounts related to the lease would NutraLabs report in its income statement for the year ended December 31, 2024? What pretax amounts related to the lease…arrow_forward

- Please help me. Thankyou.arrow_forwardSkarrow_forwardBlossom Manufacturing Ltd. has signed a lease agreement with Crane Leasing Inc. to lease some specialized manufacturing equipment. The terms of the lease are as follows: ⚫ The lease is for 5 years commencing January 1,2023. • ⚫ Blossom must pay Crane $54,114 on January 1 of each year, beginning in 2023. • • Equipment of this type normally has an economic life of 6 years. • Crane has concluded, based on its review of Blossom's financial statements, that there is no unusual credit risk in this • situation. Crane will not incur any further costs with regard to this lease. ⚫ Crane purchases this equipment directly from the manufacturer at a cost of $214,026, and normally sells the equipment for $251,626. • ⚫ Blossom's borrowing rate is 7%. Crane's implied interest rate is 6%, which is known to Blossom at the time of negotiating the lease. • • Blossom uses the straight-line method to depreciate similar equipment. ⚫ Both Blossom and Crane have calendar fiscal years (year end December 31),…arrow_forward

- Federated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. • The lease agreement specified annual payments of $44,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. • The company had the option to purchase the machine on December 30, 2026, for $53,000 when its fair value was expected to be $68,000, a sufficient difference that exercise seems reasonably certain. • The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 9%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare the…arrow_forwardVinubhaiarrow_forwardFederated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026 • The lease agreement specified annual payments of $47,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. The company had the option to purchase the machine on December 30, 2026, for $56,000 when its fair value was expected to be $71,000, a sufficient difference that exercise seems reasonably certain. • The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 12%. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education