Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Give correct total assets

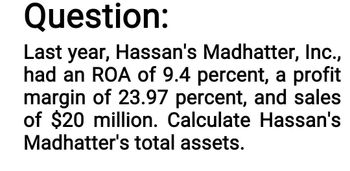

Transcribed Image Text:Question:

Last year, Hassan's Madhatter, Inc.,

had an ROA of 9.4 percent, a profit

margin of 23.97 percent, and sales

of $20 million. Calculate Hassan's

Madhatter's total assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question: Last year, Hassan's Madhatter, Inc., had an ROA of 9.4 percent, a profit margin of 23.97 percent, and sales of $20 million. Calculate Hassan's Madhatter's total assets.arrow_forwardCalculatearrow_forwardLast year, Hassan's Madhatter, Incorporated had an ROA of 6.8 percent, a profit margin of 12.24 percent, and sales of $20 million. Calculate Hassan's Madhatter's total assets. Note: Enter your answer in millions. Total assets millionarrow_forward

- Last year, Hassan's Madhatter, Inc. had an ROA of 6 percent, a profit margin of 12.80 percent, and sales of $15 million. Calculate Hassan's Madhatter's total assets. (Enter your answer in dollars, rounded to the nearest dollar.) Total assetsarrow_forwardLast year, Hassan’s Madhatter, Inc. had an ROA of 9 percent, a profit margin of 14.70 percent, and sales of $30 million. Calculate Hassan’s Madhatter’s total assets. (Enter your answer in millions.) Total Assets = ____________ millionsarrow_forwardTotal Assets = ?arrow_forward

- Total assetsarrow_forward(Profitability analysis) Last year Triangular Resources earned $4.6 million in net operating income and had an operating profit margin of 19.7 percent. If the firm's total asset turnover ratio was 1.56, what was the firm's investment in total assets? The company's total assets are $ million. (Round to one decimal place.)arrow_forwardProvide the Correct answer of this Questionarrow_forward

- Flitter reported net income of $23,500 for the past year. At the beginning of the year the company had $212,000 in assets and $62,000 in liabilities. By year end, assets had increased to $312,000 and liabilities were $87,000. Calculate its return on assets: Multiple Choice 11.1%. 9.0%. 7.5%. 35.7%. 26.0%.arrow_forwardThe balance sheet of ATLF, Inc. reports total assets of $1,950,000 and $2,050,000 at the beginning and end of the year, respectively. Net income and sales for the year are $150,000 and $1,000,000, respectively. What is ATLF's profit margin? Select one: a. 10% Ob. 8% O c. 7.5% O d. 15% e. 12%arrow_forwardPlease provide this question answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning