Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need help

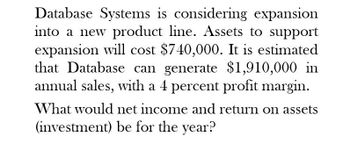

Transcribed Image Text:Database Systems is considering expansion

into a new product line. Assets to support

expansion will cost $740,000. It is estimated

that Database can generate $1,910,000 in

annual sales, with a 4 percent profit margin.

What would net income and return on assets

(investment) be for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Mason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardFalkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardCaduceus Company is considering the purchase of a new piece of factory equipment that will cost $565,000 and will generate $135,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return In Excel, see Appendix C.arrow_forward

- Database Systems is considering expansion into a new product line. Assets to support expansion will cost $ 500,000. It is estimated that Database can generate $ 1,200,000 in annual sales, with a 6 percent profit margin. What would net income and return on assets ( investment) be for the year? (Round your return on assets to 1 decimal place. Omit the "$" and "%" signs in your response.)arrow_forwardGive correct solutionarrow_forwardDatabase Systems is considering expansion into a new product line. Assets to support expansion will cost $890,000. It is estimated that Database can generate $1,860,000 in annual sales, with an 13 percent profit margin. What would net income and return on assets (investment) be for the year? (Input your return on assets answer as a percent rounded to 2 decimal places.) Net Income Return on assets 96arrow_forward

- Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.97 million. The product is expected to generate profits of $1.15 million per year for 10 years. The company will have to provide product support expected to cost $95,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 6.1%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.2% and 16.5%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment?arrow_forwardInnovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.97 million. The product is expected to generate profits of $1.08 million per year for ten years. The company will have to provide product support expected to cost $99,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 6.2%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.2%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment?arrow_forwardSuppose Francine Dunkleberg's Sweets is considering investing in warehouse management software that costs $450,000, has $35,000 residual value, and should lead to cost savings of $130,000 per year for its five-year life. In calculating the ROR, which of the following figures should be used as the equation's denominator (average amount invested in the asset)? a) $485,000 b) $242,500 c) $207500 d)$225000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College