Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give answer

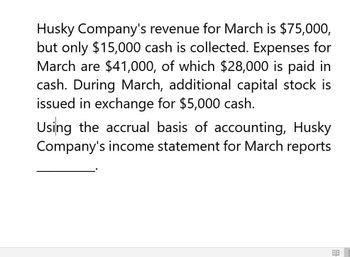

Transcribed Image Text:Husky Company's revenue for March is $75,000,

but only $15,000 cash is collected. Expenses for

March are $41,000, of which $28,000 is paid in

cash. During March, additional capital stock is

issued in exchange for $5,000 cash.

Using the accrual basis of accounting, Husky

Company's income statement for March reports

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardGregg Corp. reported revenue of $1,450,000 in its cash basis income statement for the year ended Dec. 31, Year 7. Additional information was as follows: Accounts receivable, Jan 1, Year 7 $400,000 Accounts receivable, Dec 31, Year 7 $530,000 Under the accrual basis, Gregg would report revenue of O $1,580,000 O $1,035,000 $1,335,000 O $1,505,000arrow_forwardBailey Co earns $27,792 of revenue on account and in $6,256 cash revenue transactions in Year 1. Cash collections of receivables amount to $7,152 in Year 1 with the remainder being collected in Year 2. Based on this information alone the company’s financial statements would show Total Revenue in Year 1 of $_arrow_forward

- Sheridan Company obtains $36,800 in cash by signing a 7%, 6-month, $36,800 note payable to First Bank on July 1. Sheridan's fiscal year ends on September 30. What information should be reported for the note payable in the annual financial statements? In the balance sheet, Notes Payable of $ reported as In the income statement, Interest Expense of $ and Interest Payable of $ should be reported under should bearrow_forwardSandhill Electronics reported the following information at its annual meetings: The company had cash and marketable securities worth $1,235,455, accounts payables worth $4,159,357, inventory of $7,158,300, accounts receivables of $3,469,000, short-term notes payable worth $1,128,000, and other current assets of $121,455. What is the company's net working capital?Excel Template(Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you’ve been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Net working capital $enter the Net working capital in dollarsarrow_forwardDuring 2020, Best Corporation had cash and credit sales of $36,420 and $18,560, respectively. The company also collected accounts receivable of $10,350 and incurred operating expenses of $39,600, 80% of which were paid during the year. In addition, Best prepaid $4,500 for an 18 month advertising campaign that began September 30. Best Company's accrual basis net income (loss) for the year ending December 31, 2020 was: Group of answer choices A. $8,535 B. $240 C. $14,630 D. $18,800arrow_forward

- ABC Company Ltd. has annual revenues of $750 million and annual cost of goods sold of $450 million. Annual cash flows from operations are $51 minion, while daly credit sales were $163,548. It published its annual report for the financial year 2021-22 ending, with the following balance sheet items as at 31 march 2022: Ending inventory: $82 million Ending accounts receivable: $56 million Ending accounts payable: $43 million ABC Co. Lid, treasurers forecast the following balance pattern for monthly collections: Month 0: 5% Month 1: 40% Month 2 35% Month 3: 15% Month 4: 5% Required: a) Calculate the Cash Conversion Cycle (CCC) for the company and discuss measures the company could adopt to shorten its CCC. b) What percentage of outstanding sales proceeds are yet to be collected as receivables 3 months after the sales were invoiced?arrow_forwardDuring 2020, Rumbo Corporation had cash and credit sales of $21,760 and $15,225, respectively. The company also collected accounts receivable of $9,765 and incurred operating expenses of $27,700, 80% of which were paid during the year. In addition, Rumbo prepaid $4,500 for an 18-month advertising campaign that began September 30. Rumbo’s accrual basis net income (loss) for the fiscal year ending December 31, 2020, was: a $14,075 b $9,285 c $8,535 d ($775)arrow_forwardOn September 1. Year 1, Western Company loaned $36,600 cash to Eastern Company. The one year note carried a 6% rate of interest. The amount of interest revenue on the income statement and the amount of cash flow from operating activities shown on Western's Year 2 financial statements would be Multiple Choice $732 interest revenue and $2196 cash inflow from operating activmes $1.464 imerest revenue and $2,196 cash inflow from operating activitiesarrow_forward

- During 2020, Reliable Corporation had cash and credit sales of $21,760 and $15,225, respectively. The company also collected accounts receivable of $9,765 and incurred operating expenses of $27,700, 80% of which were paid during the year. In addition, Reliable prepaid $4,500 for an 18 month advertising campaign that began September 30. Reliable’s accrual basis net income (loss) for the year ending December 31, 2020 was: Group of answer choices A. $8,535 B. $14,075 C. ( $775) D. $9,285arrow_forwardFestivus Company has working capital of $140,680 on December 30. On December 31 it has the following transactions: 1) An account payable for $10,000 is paid off 2) An account receivable of $1,000 is written off (Festivus does not use the direct write-off method) 3) $16,600 more inventory is purchased on account. Assume a 365 day year. Sales for the period amounted to $1,700,000 and the average mark up is 25%. Required 1: What is the working capital on December 31st after all transactions took place? $[ Required 2: The working capital turnover for the period ended on December 31st is: Required 3: If Account Payable balance on December 30th is $10,000 what is the Accounts Payable Turnover? Use ending balance of AP instead of the average. Required 4: If Account Payable balance on December 30th is $10,000 what is the Days Accounts Payable are outstanding? Use ending balance of AP instead of the average. Required 5: Festivus' Gross profit percentage is (report it as multiplied by 100 to…arrow_forwardCain Corp. reported accrued investment interest receivable of 38,000 and 46,500 at January 1 and December 31, year 1, respectively. During year 1, cash collections from the investments included the following: Capital gains distributions= 145,000; Interest= 152,000. What amount should Cain Corp report as interest revenue from investments for year 1? *arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning