FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

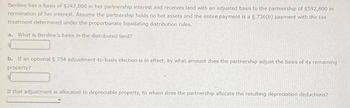

Transcribed Image Text:Berdine has a basis of $247,000 in her partnership interest and receives land with an adjusted basis to the partnership of $592,800 in

termination of her interest. Assume the partnership holds no hot assets and the entire payment is a § 736(b) payment with the tax

treatment determined under the proportionate liquidating distribution rules.

a. What is Berdine's basis in the distributed land?

b. If an optional § 754 adjustment-to-basis election is in effect, by what amount does the partnership adjust the basis of its remaining

property?

If that adjustment is allocated to depreciable property, to whom does the partnership allocate the resulting depreciation deductions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A26.arrow_forwardJennifer transfers properties to Mump Co. in an exchange that meets all the requirements of Code Sec. 351. Several of the transferred properties are subject to liabilities. Will property transfers of this sort cause gain recognition for Jennifer?arrow_forward1) C is admitted in the partnership of A and B by investing P120,000 for an interestequal to P150,000. Assuming that the net assets of the partnership prior to C'sadmission are fairly valued, this transaction would result in A. a decrease of P30,000 in the total partnership assets B. a decrease in the capital balances of A and B C. an increase in the capital balances of A and B D. the recognition of goodwill by the partnership 2) A partnership records the admission of a new partner through purchase of interest bycrediting the purchaser's capital and debiting A. capital account of other partners B. bonus account C. cash account D. capital account of the selling partnerarrow_forward

- Please do not give solution in image format ?arrow_forwardWhat are the amount and character of Kimberly's recognized gain or loss on the distribution? What is Kimberly's remaining basis in KST after the distribution? What is KST's basis in the land Kimberly contributed after Kimberly receives this distribution?arrow_forwardSubject: acountingarrow_forward

- What is the difference between the aggregate and entity theory of partnership taxation? Can you please provide two examples of how partnership tax rules reflect the aggregate theory and two examples of how they reflect the entity theory.arrow_forwardThe following two independent cases deal with a partnership and/or partners that are insolvent.(attached)Assuming that the partners share profits and losses equally, prepare a response to each of the following independent questions:1. Given Case A, if all of the assets were sold for $165,000, how much of personal assets could Partner B contribute toward their capital balance?2. Given Case A, if all of the assets were sold for $126,000, how much could Partner C contribute toward the remaining partnership liabilities, assuming the unsatisfied partnership creditors first seek recovery against Partner A?3. Given Case B, if all of the assets were sold for $135,000 and all partners with deficit capital balances contributed personal assets toward those deficits, how much, if anything, would Partner A have to contribute toward unsatisfied partnership creditors?4. Given the same facts as item (3) above, what amount could Partner A’s unsatisfied personal creditors receive from A’s interest in…arrow_forwardHow does a newly formed partnership handle the contribution of previously depreciated assets?A. continues the depreciation life as if the owner had not changedB. starts over, using the contributed value as the new cost basisC. shortens the useful life of the asset per the partnership agreementD. does not depreciate the contributed assetarrow_forward

- d1.arrow_forwardA and B form the equal AB partnership. A contributes cash of $20,000. B con- tributes land with a basis of $9,000 and a fair market value of $20,000. The land is a capital asset to B and has been held for over one year. Describe the tax consequences under each of the three I.R.C. §704(c) allocation methods if the partnership sells the land for either $21,000 or $19,000, assuming the partnership has adequate other income and deductions, if necessary.arrow_forwardThe sum of the partners’ ending tax basis amounts equals the partners’ ending tax basis capital account balances. These amounts are shown on the partnership's Schedule K. Group of answer choices True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education