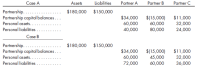

The following two independent cases deal with a

Assuming that the partners share

1. Given Case A, if all of the assets were sold for $165,000, how much of personal assets could Partner B contribute toward their capital balance?

2. Given Case A, if all of the assets were sold for $126,000, how much could Partner C contribute toward the remaining partnership liabilities, assuming the unsatisfied partnership creditors first seek recovery against Partner A?

3. Given Case B, if all of the assets were sold for $135,000 and all partners with deficit capital balances contributed personal assets toward those deficits, how much, if anything, would Partner A have to contribute toward unsatisfied partnership creditors?

4. Given the same facts as item (3) above, what amount could Partner A’s unsatisfied personal creditors receive from A’s interest in the partnership?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 18 images

- A. Queen B. Reed C. Reed and Queen equally D. Stacarrow_forwardThe December 31, 2008, balance sheet of the Datamation Partnership is shown below. Datamation PartnershipBalance Sheet December 31, 2008 Assets Cash.............$ 80,000 Accounts Receivable......80,000 Inventory..........62,000 Equipment.........290,000 Total Assets.........$512,000 Liabilities and Partners’ Equity Accounts Payable...............$ 60,000 Notes Payable to Dave, 8% dated September 1, 2008..22,000 Dave, Capital..................220,000 Allen, Capital..................110,000 Matt, Capital..................100,000 Total Liabilities and Partners’ Equity..........$512,000 Dave, Allen, and Matt share profits and loses in the ratio of 50:30:20. The inventory on December 31 has a fair value of $68,000; accrued interest on the note payable to Dave is to be recognized as of December 31. The book values of all the other accounts are equal to their fair values. Allen withdrew from the partnership on December 31, 2008. Required: Prepare the journal entry or entries to record the…arrow_forwardThe partnership of Hendrick, Mitchum, and Redding has the following account balances: Cash . . . . . . . . . . . . . . . . . . . $ 50,000 Liabilities . . . . . . . . . . . . .. . . $ 30,000Noncash assets . . . . . . . . . 135,000 Hendrick, capital . . . . . . . . . . 100,000 Mitchum, capital . . . . . . . . . . . 70,000 Redding, capital . . . . . . . . . . . .(15,000) This partnership is being liquidated. Hendrick and Mitchum are each entitled to 40 percent of all profits and losses with the remaining 20 percent going to Redding.a. What is the maximum amount that Redding might have to contribute to this partnership because of the deficit capital balance?b. How should the $20,000 cash that is presently available in excess of liabilities be distributed?c. If the noncash assets are sold for a total of $50,000, what is the minimum amount of cash that Hendrick could receive?arrow_forward

- The balance sheet for the Delphine, Xavier, and Olivier partnership follows: Cash . . . . . . . . . . . . . . . . . . . $ 60,000 Liabilities . . . . . . . . . . . . . . . $ 40,000Noncash assets . . . . . . . . . 100,000 Delphine, capital . . . . . . . . .. 60,000Xavier, capital . . . . . . . . . . . 40,000Olivier, capital . . . . . . . . . . . 20,000 Delphine, Xavier, and Olivier share profits and losses in the ratio of 4:4:2, respectively. The partners have agreed to terminate the business and estimate that $12,000 in liquidation expenses will be incurred.a. What is the amount of cash that safely can be paid to partners prior to liquidation of noncash assets?b. How should the safe amount of cash determined in (a) be distributed to the partners?arrow_forwardA partnership begins its first year with the following capital balances:Alexander, Capital . . . . . . . . . . . . . . . . . . . . . . . . $ 90,000Bertrand, Capital . . . . . . . . . . . . . . . . . . . . . . . . . 100,000Coloma, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . 160,000 The articles of partnership stipulate that profits and losses be assigned in the following manner:∙ Each partner is allocated an interest equal to 5 percent of the beginning capital balance.∙ Bertrand is allocated compensation of $45,000 per year.∙ Any remaining profits and losses are allocated on a 3:3:4 basis, respectively.∙ Each partner is allowed to withdraw up to $25,000 cash per year.Assuming that the net income is $115,000 and that each partner withdraws the maximum amountallowed, what is the balance in Coloma’s capital account at the end of the year?a. $143,000b. $135,000c. $168,000d. $164,000arrow_forwardA partnership has assets of $210,000 and liabilities of $95,000. The capital information for the current partners is as follows: Partner A Partner B Partner CProfit and loss percentages . . . . . . . . . . . . 50% 30% 20%Capital balances . . . . . . . . . . . . . . . . . . . . $70,000 $30,000 $15,000Given the above information, respond to each of the following independent fact situations:1. Assuming new Partner D acquired 20% of Partner B’s interest from B for consideration of $15,000, what is Partner B’s capital balance after this transaction?2. Assume that the above assets are understated by $25,000. If new Partner D were to acquire a 30% interest in the partnership by making a contribution of assets to the partnership, what would be the suggested value of the consideration?3. If the above assets were overstated by $25,000, what amount of consideration should new Partner D convey to the…arrow_forward

- no.27arrow_forwardThe E.N.D. partnership has the following capital balances as of the end of the current year: Pineda . . . . . . . . . . . . . . . .. . $230,000Adams . . . . . . . . . . . . . . . . . . 190,000Fergie . . . . . . . . . . . . . . . . . . 160,000Gomez . . . . . . . . . . . . . . . . . 140,000Total capital . . . . . . . . . . . . . $720,000 Answer each of the following independent questions:a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $190,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners?b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $280,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners?arrow_forwardUse the following account balance information for Granobfin Partnership with income ratios of 2:4:4 for Robert, Noble, and Finn, respectively. Cash Assets $50400 Accounts receivable 133000 Inventory O $286740. O $311100. O $204000. O $520500. 437900 $621300 Liabilities and Owner's Equity. Accounts payable $125200 Robert, Capital Noble, Capital Finn, Capital 137400 47600 311100 $621300 Assume that, as part of liquidation proceedings, Granobfin sells its noncash assets for $510000. The amount of cash that would ultimately be distributed to Finn would bearrow_forward

- 13. The partnership has the following accounting amounts: Sales 70,000 Interest paid to banks 2,000 Cost of goods sold 40,000 Partners' withdrawals 8,000 Operating expenses 10,000 Salary allocations to partners 13,000 The partnership net income (loss) is: C. 5,000 D. (3,000) А. 20,000 В. 18,000arrow_forwardA4arrow_forwardProblem 41: The following condensed balance sheet is presented for the partnership of A and B, who share profits and losses in the ratio of 6:4 respectively: Cash Non-cash assets B, loan 135,000 1,875,000 90,000 2,100,000 Accounts payable А, сapital В, сapital 360,000 1,044,000 696,000 2,100,000 All assets and liabilities are fairly valued, A and B decided to admit C as a new partner with 20% interest. No bonus or revaluation is recorded. What amount should C contributes in the firm? а. 330,000 b. 348,000 c. 420,000 d. 435,000 Problem 42: The following capital accounts pertain to A and B: P&L ratio Capital 200,000 240,000 A 40% в 60% C is admitted by purchase of ½ interest of both A and B, for P240,000, the P240,000 is divided between A and B, respectively: а. 96,000; 144,000 b. 108,000; 132,000 с. 109,090; 130,910 d. 120,000; 120,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education