FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Bryan and Cody each contributed $120,000 to the newly formed BC Partnership in exchange for a 50% interest. The partnership used the

available funds to acquire equipment costing $200,000 and to fund current operating expenses. The partnership agreement provides that

depreciation will be allocated 80% to Bryan and 20% to Cody. All other items of income and loss will be allocated equally between the

partners.

Upon liquidation of the partnership, property will be distributed to the partners in accordance with their § 704(b) book capital account

balances. Any partner with a negative capital account must contribute cash in the amount of the negative balance to restore the capital

account to $0.

In its first year, the partnership reported an ordinary loss (before depreciation) of $80,000 and depreciation expense of $36,000. In its

second year, the partnership reported $40,000 of income from operations (before depreciation), and it reported depreciation expense of

$57,600.

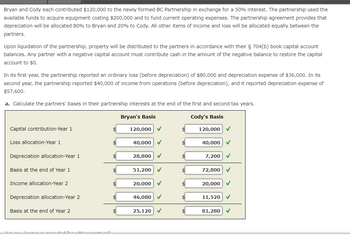

a. Calculate the partners' bases in their partnership interests at the end of the first and second tax years.

Bryan's Basis

Cody's Basis

Capital contribution-Year 1

Loss allocation-Year 1

Depreciation allocation-Year 1

Basis at the end of Year 1

Income allocation-Year 2

Depreciation allocation-Year 2

Basis at the end of Year 2

sa va a cabeza a ca

$

$

$

120,000 ✓

40,000

28,800 ✓

51,200 ✓

20,000 ✓

46,080 ✓

25,120

✓

120,000 ✓

40,000

7,200 ✔

72,800

✓

20,000 ✓

11,520 ✓

81,280

✓

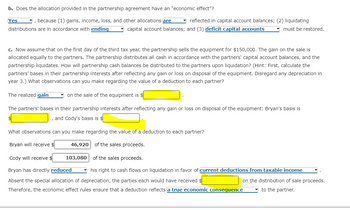

Transcribed Image Text:b. Does the allocation provided in the partnership agreement have an "economic effect"?

, because (1) gains, income, loss, and other allocations are

distributions are in accordance with ending

Yes

reflected in capital account balances; (2) liquidating

capital account balances; and (3) deficit capital accounts

must be restored.

c. Now assume that on the first day of the third tax year, the partnership sells the equipment for $150,000. The gain on the sale is

allocated equally to the partners. The partnership distributes all cash in accordance with the partners' capital account balances, and the

partnership liquidates. How will partnership cash balances be distributed to the partners upon liquidation? (Hint: First, calculate the

partners' bases in their partnership interests after reflecting any gain or loss on disposal of the equipment. Disregard any depreciation in

year 3.) What observations can you make regarding the value of a deduction to each partner?

The realized gain

on the sale of the equipment is $

The partners' bases in their partnership interests after reflecting any gain or loss on disposal of the equipment: Bryan's basis is

, and Cody's basis is

What observations can you make regarding the value of a deduction to each partner?

Bryan will receive $

46,920 of the sales proceeds.

Cody will receive $

103,080 of the sales proceeds.

Bryan has directly reduced

his right to cash flows on liquidation in favor of current deductions from taxable income

Absent the special allocation of depreciation, the parties each would have received $

on the distribution of sale proceeds.

Therefore, the economic effect rules ensure that a deduction reflects a true economic consequence

to the partner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Coy and Matt are equal partners in the Matcoy Partnership. Each partner has a basis in his partnership interest of $33,000 at the end of the current year, prior to any distribution. On December 31, each receives an operating distribution. Coy receives $13,000 cash. Matt receives $3,850 cash and a parcel of land with a $9,150 fair market value and a $5,000 basis to the partnership. Matcoy has no debt or hot assets. a. What is Coy's recognized gain or loss? What is the character of any gain or loss?arrow_forwardA and B form the equal AB partnership on January 1 of Year 1. A contributes equipment with a tax basis of $8,000 and a fair market value of $20,000. The equipment has been on a 10-year recovery period and has four years remaining. (Were the equipment newly acquired at the time fo the contribution to the partnership, the recovery period would again be 10 years.) B contributes $20,000, which the partnership uses to buy land. The partnership's income equals expenses except for depreciation deductions. Assuming the partnership uses the remedial allocation method, describe how depreciation deductions will be allocated to A and B from the equipment. Ignore any applicable first year depreciation conventions.arrow_forwardThe partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $14,100, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 91,500 7,500 (53,500) (15,600) (11,100) (5,300) 5,450 (5,100) Note: Negative amounts should be indicated by a minus sign. Required: a-1. How much ordinary income (loss) is allocated to Gary for the year? a-2. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income (loss). Complete this question by entering your answers in the tabs below. Required A1 Required A2 How much ordinary income (loss) is allocated to Gary for the year? Note: Round your intermediate computations to the nearest…arrow_forward

- When Abe's outside basis in the Vacuna Partnership is $211,000, the partnership distributes to him $36,000 cash, three accounts receivable (fair market value of $61,000, inside basis to the partnership of $0), and a parcel of land (fair market value of $484,000, inside basis to the partnership of $420,000). Abe remains a partner in the partnership, and the distribution is proportionate to the partners. If an amount is zero, enter "0". a. Does the partnership recognize a gain or loss as a result of this distribution? (gain, loss, no gain or loss) b. As a result of the distribution, Abe recognizes .(a gain, a loss, neither a gain or loss) c. In what order are the assets distributed to Abe? (land, accounts receivable, cash) Calculate Abe's basis in the land, in the accounts receivable, and in his partnership interest immediately following the distribution.Accounts receivable: Land: Partnership interest:arrow_forwardPartner Bob’s basis in his partnership interest is $50,000. What gain or loss is recognized, and what are Bob’s basis in the property received and his basis in his partnership interest, if the partnership makes the following independent proportionate nonliquidating distributions? Partnership distributes $40,000 in cash. Partnership distributes $60,000 cash. Partnership distributes $40,000 cash and accrual basis accounts receivable with a $20,000 basis and value.arrow_forwardEhrlich (beginning capital, $110,000) and Haar (beginning capital $85,000) are partners. During 2022 the partnership earned net income of $60,000. Ehrlich made drawings of $25,000 while Haar made drawings of $10,000. Instructions Assume the partnership income-sharing agreement calls for income to be divided with a salary of $22,000 to Ehrlich and $25,000 to Haar, interest of 10% on beginning capital, and the remainder divided 70%-30%. Prepare a schedule of the income allocation to each partner. Prepare the journal entry to record the allocation of net income. Compute Ehrlich's ending capital balancearrow_forward

- Shirley contributes property to a new partnership with a value of $1,000,000 and a basis of $400,000 that is secured by a $500,000 nonrecourse note. Under the terms of the partnership agreement, Shirley will be allocated 25% of all profits. The partnership agreement also states that "excess nonrecourse liabilities" will be allocated to partners according to profit ratios. How much of the nonrecourse liability will be allocated to Shirley? please dont provide answer in images thank youarrow_forwardMilton has a basis in his partnership of $300,000, including his $80,000 share of partnership liabilities. At the end of the current year the partnership pays off the liabilities and makes a proportionate current distribution to its partners. Milton receives a parcel of land (partnership basis of $120,000 and FMV of $135,000) and inventory (partnership basis of $160,000 and FMV of $180,000). Following the distribution what is Milton's basis in the inventory? I'm not sure if it's 160,000 or notarrow_forwardTyler and Sarah formed the equal TS Partnership on January 1 of the current year. A contributed $100,000 of cash and land with a fair market value of $112,500 and an adjusted basis of $93,750. Sarah contributed equipment with a fair market value of S212,500 and an adjusted basis of $25,000. Sarah had used the equipment in his sole proprietorship. Compute the following: Tyler's gain realized: 212,500 Sarah's gain realized: 212,500 Tylers's gain recognized: 118,750 Sarah's gain recognized: TS's gain recognized: Tyler's basis in his partnership interest: Sarah's basis in his partnership interest:arrow_forward

- Required information [The following information applies to the questions displayed below.] Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $124,000 and Keon transferred an acre of undeveloped land to the partnership. The land had a tax basis of $56,000 and was appraised at $180,000. The land was also encumbered with a $56,000 nonrecourse mortgage for which no one was personally liable. All three partners agreed to split profits and losses equally. At the end of the first year, Blue Bell made a $7,200 principal payment on the mortgage. For the first year of operations, the partnership records disclosed the following information: $ 480,000 470,000 70,000 1,500 600 Sales revenue Cost of goods sold Operating expenses Long-term capital gains §1231 gains Charitable contributions 300 Municipal bond interest Salary paid as a guaranteed payment to Deanne (not included in expenses) 300 3,000 c. Using the…arrow_forwardGeorgia's Interest in the equal GFH Partnership is liquidated when the GFH Partnership makes a Liquidating Distribution to Georgia and the remaining Partners assume Georgia's share of the Partnership Liabilities. Georgia receives $12,000 in Cash, Accounts Receivable of $21,000 (Fair Market Value) and Equipment worth (Fair Market Value) of $47,000. On the date of the Liquidation, the Partnership's Cash Basis Balance Sheet reflected the following: Cash (Adjusted Basis- $60,000; Fair Market Value - $60,000); Unrealized Receivable (Adjusted Basis-S-0-; Fair Market Value - $63,000); Equipment (Adjusted Basis- $72,000; Fair Market Value - $141,000) (Total Assets: Adjusted Basis- $132,000; Fair Market Value - $264,000); Notes Payable (Adjusted Basis - $24,000; Fair Market Value - $24,000); Capital Accounts: Georgia Capital (Adjusted Basis - $36,000, Fair Market Value - $80,000); Freddie Capital (Adjusted Basis- $36,000; Fair Market Value - $80,000); Helen Capital (Adjusted Basis- $36,000;…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education