FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

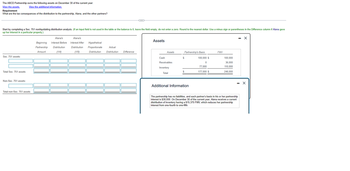

Transcribed Image Text:The ABCD Partnership owns the following assets on December 30 of the current year:

View the assets.

View the additional information.

Requirement

What are the tax consequences of the distribution to the partnership, Alana, and the other partners?

Start by completing a Sec. 751 nonliquidating distribution analysis. (If an input field is not used in the table or the balance is 0, leave the field empty; do not enter a zero. Round to the nearest dollar. Use a minus sign or parentheses in the Difference column if Alana gave

up her interest in a particular property.)

Sec. 751 assets:

Total Sec. 751 assets

Non-Sec. 751 assets:

Total non-Sec. 751 assets

Beginning

Partnership

Amount

Alana's

Interest Before

Distribution

(1/4)

Alana's

Interest After Hypothetical

Distribution Proportionate

(1/5)

Distribution

(…)

Actual

Distribution Difference

Assets

Assets

Cash

Receivables

Inventory

Total

$

Partnership's Basis

$

Additional Information

100,000 $

0

77,000

177,000 $

FMV

100,000

36,000

110,000

246,000

The partnership has no liabilities, and each partner's basis in his or her partnership

interest is $30,000. On December 30 of the current year, Alana receives a current

distribution of inventory having a $15,375 FMV, which reduces her partnership

interest from one-fourth to one-fifth.

X

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. A partnership has four equal partners who share profits and losses in accordance with their respective interests. It has $400,000 in taxable income but doesn't distribute any cash to the partners. a. What amount of income will the partnership report on its tax return? None. There is no business income tax on a partnership. b. What amount of the partnership's taxable income will be subject to tax at the partnership level? c. Will each partner recognize taxable income from their interest in the partnership? If so, how much? d. If ABC was a corporation with four equal owners, how would this change your answers in parts (a)- (c)?arrow_forwardSEE ATTACHEDarrow_forwardHi, can someone help me with this question please?arrow_forward

- For Industry H, determine each partner's share of income assuming the partners agree to share income by giving a $67,700 per year salary allowance to Price, a $126,100 per year salary allowance to Waterhouse, a $113,700 per year salary allowance to Coopers, a 15% interest on their initial capital investments, and the remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.) Important! Be sure to click the correct Industry at the top of the dashboard. Net income (loss) Salary allowances Balance of income (loss) Interest allowances Balance of income (loss) Balance allocated equally Balance of income (loss) Shares of each partner Initial partnership investments Net income Allocation of Partnership Income Price Total net income Total 0 Waterhouse $ $ PRICE, WATERHOUSE, AND COOPERS Statement of Partners' Equity For Year Ended December 31 Price Coopers 0 0 Waterhouse 0 0 0 $ For Industry H, prepare a statement of partners' equity for the…arrow_forwardJefferson has a capital balance of $65,000 and devotes full time to a partnership. Washington has a capital balance of $45,000 and devotes half time to the partnership. If no other information is available regarding distributions, how should net income be divided?arrow_forward2022 tax rulesarrow_forward

- Haresharrow_forwardFor purposes of the election to defer Federal estate tax payments relative to an interest in a closely held business, an interest in a closely held business does not include: Oa. A16% intemst in a partnership that has 36 partners Ob. A10% interest in a partnership that har 48 partoers Oc. A 22 temst in a partnership that has 50 parthers Od. A sole preprietorshiparrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. a. Journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. If an amount box does not require an entry, leave it blank. Cash Grayson Jackson, Capital Harry Barge, Capital Lewan Gorman, Capital b. What are the capital balances of each partner after the admission of the new partner? Partner Balance Grayson Jackson $ Harry Barge $ Lewan Gorman $arrow_forward

- Hh1. Accountarrow_forwardAnswer pleasearrow_forwardThe XYZ Partnership is being formed by three partners. Their ownership in the partnership, and tax year ends are listed below. Using the least aggregate deferral method in the table below, determine which tax year the partnership can elect. June 30 Sept 30 Dec 31 deferral deferral deferral (# Total Total (# months) months) (# months) Total June X 30% 0 0 30 6 1.8 Sept Y 30% 3 0.9 9 2.7 30 Dec Z 40% 6 2.4 31 Total 3.3 0 0 4.5 Which tax year can the partnership elect without IRS permission? 6/30 or 9/30 or 12/31?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education