FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:At the beginning of the current year, Cameron and Harold formed the CH Partnership by transferring cash and property to the partnership in exchange for a partnership interest, with each having a 50% interest.

Specifically, Cameron transferred property having a $35,000 FMV, a $32,000 adjusted basis, and subject to a $5,000 liability, which the partnership assumed. Harold contributed $60,000 cash to the partnership. The

partnership also borrowed $35,000 from the bank to use in its operations. All liabilities are recourse for which the partners have an equal economic risk of loss. During the current year, the partnership earned

$19,000 of net ordinary income and reinvested this amount in new property.

Read the requirements.

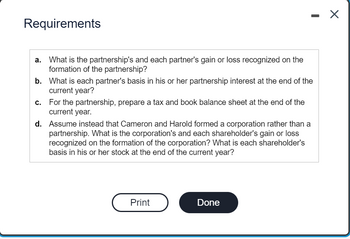

Transcribed Image Text:Requirements

a.

What is the partnership's and each partner's gain or loss recognized on the

formation of the partnership?

b. What is each partner's basis in his or her partnership interest at the end of the

current year?

c.

For the partnership, prepare a tax and book balance sheet at the end of the

current year.

d.

Assume instead that Cameron and Harold formed a corporation rather than a

partnership. What is the corporation's and each shareholder's gain or loss

recognized on the formation of the corporation? What is each shareholder's

basis in his or her stock at the end of the current year?

Print

Done

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following regarding partnership taxation is INCORRECT? Question 16 options: A partnership is a tax paying entity for Federal income tax purposes. Partnership income is comprised of ordinary partnership income or loss and separately stated items A partnership is required to file a return with the IRS. A partner’s profit-sharing percent may differ from the partner’s loss-sharing percent. All of these statements are correct.arrow_forwardTax Drill - Tax Year of a Partnership Indicate the required sequencing of rules in determining a partnership's required taxable. a. Principal partners' tax year. Applied first. b. Majority partners' tax year rule. Applied second. c. The least aggregate deferral tax year rule. Applied third.arrow_forwardSEE ATTACHEDarrow_forward

- Hi, can someone help me with this question please?arrow_forward2022 tax rulesarrow_forward1.Where a partnership records a loss for an income year for tax purposes: (Choose the most correct option) a. It will be carried forward and allowed as a deduction from future income of the partnership. b. It is only transferred to the individual partner’s tax calculation as an allowable deduction for that partner's share if the individual partner has assessable income. c. It is transferred to the individual partner’s tax calculation as an allowable deduction and if the individual partner does not have assessable income sufficient to absorb the loss the individual partner can carry forward the loss or part of the loss to future years. d. It will be of no significance for tax purposes because it cannot be used by the partnership under tax legislation. 2. Which statement below best describes the entities that can accept donations from the public and provide donors with documentation to allow them to claim a tax deduction in respect of their…arrow_forward

- All of the following regarding Schedule M-2 (Form 1065) are correct EXCEPT: When completing Schedule M-2, determine if the partnership uses financial accounting or tax accounting. Schedule M-2 tracks the partners' outside basis in the partnership. Schedule M-2 tracks the partners' capital accounts. Schedule M-2 includes capital contributed by the partners during the year.arrow_forwardTrue or False: A contributing partner's holding period for an interest in a partnership begins on the date the partnership interest is acquired.arrow_forward3. The DE partnership is equally owned by Diana and Emily. Diana's fiscal year ends on March 31, and Emily's fiscal year ends on August 31. a. Please name or describe the three tests/tiers to determine a partnership's year end. b. Please use the appropriate tests and tell me DE's appropriate year end.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education