FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What are the amount and character of Kimberly's recognized gain or loss on the distribution?

What is Kimberly's remaining basis in KST after the distribution?

What is KST's basis in the land Kimberly contributed after Kimberly receives this distribution?

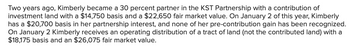

Transcribed Image Text:Two years ago, Kimberly became a 30 percent partner in the KST Partnership with a contribution of

investment land with a $14,750 basis and a $22,650 fair market value. On January 2 of this year, Kimberly

has a $20,700 basis in her partnership interest, and none of her pre-contribution gain has been recognized.

On January 2 Kimberly receives an operating distribution of a tract of land (not the contributed land) with a

$18,175 basis and an $26,075 fair market value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For estate tax purposes, what date is used for valuation purposes? Multiple Choice Property is always valued at the date of distribution, Property is valued at the date of death although a reduction is allowed if the value declines within one year of death. Property is always valued at the date of death. Property is valued at the date of death unless the alternate date, which is the date of distribution or six months after death, whichever comes first, is selected.arrow_forwardOf the following statements regarding the estate tax, which is true? O A decedent's taxable estate is never greater than the probate estate. 4 O The taxable estate is reduced by deductions for decedent liabilities, funeral costs, and administrative costs of settling the estate. O The estate tax is not reduced by transfers to the decedent's spouse. O The estate tax exclusion is not reduced by any lifetime gift tax exclusion used by the decedent.arrow_forward12. COMPUTE: Total special deductions 13. COMPUTE: Net taxable estate 14. COMPUTE: Estate tax payablearrow_forward

- Determine the correct value for each of the following questions: 1. Assuming that a single person has made taxable lifetime gifts of $1.2 million, what is the largest taxable estate that could exist and still not incur any estate tax?arrow_forwardunder what circumstances are property taxes and certain other expenses owed at death deductible on both form 706 and form 1041? a. the decedent's will did not provide instructions b. the amounts owed were paid by the estate, but could have been deducted on the decedent's return if they had been paid prior to death. c. the amounts owed were also simultaneously deducted on the decedent's final return. d. the amounts due were paid by the decedent prior to death but the payments were not received until after the decedent had passed away.arrow_forwardWhen a taxpayer has more than one business location, including the home, how can he determine which location is the principal place of business?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education