Required:

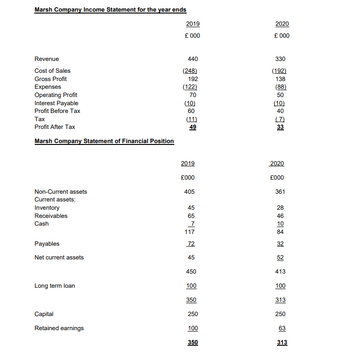

(a) You are required to calculate the following ratios:

(i) Gross profit margin

(ii) Operating profit margin

(iii) Expenses to sales

(iv) Return on Capital Employed

(v) Asset turnover

(vi) Non-current asset turnover

(vii)

(viii) Quick Ratio

(ix) Inventory days

(x) Receivables days

(xi) Payable days

(xii) Interest cover

(b) In light of your calculations comment on the performance of the company over the

last two years.

Step by stepSolved in 2 steps

is there any chance these other calculcations could be done please?

thank you :)

Return on Capital Employed

(v) Asset turnover

(vi) Non-current asset turnover

(vii)

(viii) Quick Ratio

(ix) Inventory days

(x) Receivables days

(xi) Payable days

(xii) Interest cover

is there any chance these other calculcations could be done please?

thank you :)

Return on Capital Employed

(v) Asset turnover

(vi) Non-current asset turnover

(vii)

(viii) Quick Ratio

(ix) Inventory days

(x) Receivables days

(xi) Payable days

(xii) Interest cover

- compare the current rate method and the temporal method, evaluate how each aff ects theparent company’s balance sheet and income statement, and determine which method isappropriate in various scenarios;arrow_forwardWhich of the following ratios best measures the profitability of a company? a) Return on equity b) Gross margin c) Current ratio d) Net operating asset turnoverarrow_forwardUse the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.arrow_forward

- Costco Financial Analysis. Perform the following ratio analysis for 2021, 2022, and 2023 for Costco using the attached financial statements. a. Profitability ratios b. Liquidity ratios c. Leverage ratios d. Activity ratios e. Price to earnings ratioarrow_forwardRequired: Compute the following ratios for 2020: 1. Current Ratio 2. Quick Ratio 3. Receivable Turnover 4. Average Collection Period 5. Inventory Turnover 6. Average Sales Period 7. Working Capital 8. Debt Ratio 9. Equity Ratio 10. Debt to Equity Ratio 11. Time Interest Earned 12. Gross Profit Ratio 13. Operating Profit Margin 14. Net Profit Margin 15. Return on Assetsarrow_forwardCalculate the following profitability ratios for 2018 and 2019. a. Gross profit ratio b. Return on assets c. Profit margin d. assets turnoverarrow_forward

- Provie The Correct Answer with calculationarrow_forwardPlease answer without plagiarism and explain all options thankuarrow_forwardChapter 24 discusses various methods of analyzing financial statements in terms of calculating ratios. Specifically, Return on Assets (ROA) is a very simple calculation: ROA= Net Income/Average Total Assets. Another method at arriving at this ratio is the DuPont Equation that was discussed in your textbook. In looking at the DuPont Equation, what benefits are derived by using this method rather than the most typical method that I have described above?arrow_forward

- Return on equity (ROE) using the traditional DuPont formula equals to A. (net profit margin) (interest component) (solvency ratio) B. (net profit margin) (interest component) (liquidity ratio) C. (net profit margin) (total asset turnover) (quick ratio) D. (net profit margin) (total asset turnover) (solvency ratio)arrow_forwardWhich of the following ratios would a lender find most useful in monitoring a borrower's ability to make loan payments? () PE ratio Return on assets Total asset turnover Inventory turnover () Cash coverage ratio Previous Page Next Page Page 6arrow_forwardUsing the information from 27A prepare the following ratios: gross profit margin profit margin return on assets earnings per share current ratio acid test ratio debt ratio Indicate what each is used for (ie: measuring efficiency, solvency etc)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education