Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

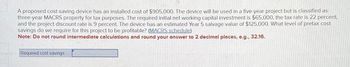

Transcribed Image Text:A proposed cost-saving device has an installed cost of $905,000. The device will be used in a five-year project but is classified as

three-year MACRS property for tax purposes. The required initial net working capital investment is $65,000, the tax rate is 22 percent,

and the project discount rate is 9 percent. The device has an estimated Year 5 salvage value of $125,000. What level of pretax cost

savings do we require for this project to be profitable? (MACRS schedule)

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Required cost savings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- You must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $290,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $48,000. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $33,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. What is the initial investment outlay for the spectrometer, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar.$ What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar.Year 1: $ Year 2: $ Year 3: $ If the WACC is 12%, should the spectrometer be…arrow_forwardThe management of Penfold Corporation is considering the purchase of a machine that would cost $360,000, would last for 10 years, and would have no salvage value. The machine would reduce labor and other costs by $50,000 per year. The company requires a minimum pretax return of 9% on all investment projects. Click here to view Exhibit 13B-1 and Exhibit 13B-2 to determine the appropriate discount factor(s) using the tables provided. The net present value of the proposed project is closest to (Ignore income taxes.): (Round your intermediate calculations and final answer to the nearest whole dollar amount.)arrow_forwardMotion Metrics is considering a four-year project to improve its production efficiency. Buying a new production equipment for $414,000 is estimated to result in $154,000 in annual pre-tax cost savings. The equipment falls into Class 8 for CCA purposes (CCA rate of 20% per year), and it will have a salvage value at the end of the project of $55,400. The project also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,500 in inventory for each succeeding year of the project. If the firm's tax rate is 35% and its discount rate is 9%. Calculate the NPV of this project. (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) O NPVarrow_forward

- Spotted Potato is evaluating project A, which would require the purchase of a piece of equipment for $550,000. During year 1, project A is expected to have relevant revenue of $312,000.00, relevant costs of $105,000.00, and some depreciation. Spotted Potato would need to borrow $550,000 for the equipment and would need to make an interest payment of $40,000 to the bank in year 1. Relevant net income for project A in year 1 is expected to be $96000.00 and operating cash flows for project A in year 1 are expected to be $167000.00. Straight-line depreciation would be used. What is the tax rate expected to be in year 1? 29.41% (plus or minus 3 bps) 13.51% (plus or minus 3 bps) 70.59% (plus or minus 3 bps) 34.53% (plus or minus 3 bps) none of the answers are within 3 bps of the correct answerarrow_forwardA five-year project has an initial fixed asset investment of $320,000, an initial NWC investment of $32,000, and an annual OCF of -$31,000. The fixed asset is fully depreciated over the life of the project and has no salvage value. If the required return is 10 percent, what is this project's equivalent annual cost, or EAC? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Equivalent annual costarrow_forwardA new project will cost $40,000 to fund today, and an additional $40,000 next year. The device built will generate revenues of $17,000 starting in year 2 which increases by 4% each year until the device is sold at the end of year 12. The device’s salvage value is $10,000. $2,000 of maintenance is required every year. What is the NPV of building this device, if the interest to borrow the funds is 15%? (Round to nearest dollar)arrow_forward

- An elective project is currently under review. It requires an initial investment of $116,000 for equipment. The profit is expected to be $28,000 each year, over the 6-year project period. The salvage value of the equipment at the end of the project period is projected to be $22,000. Assume a MARR of 10%. Find an IRR for this project.arrow_forwardBrown Company is considering purchasing a machine that would cost $320,000 and would last for 6 years. At the end of 6 years, the machine would have a salvage value of $50,000. The machine would provide annual cost savings of $75,000. The company requires a rate of return of 11% on all investment projects. What is the net present value of the proposed project? (Select the answer that is closest to your calculations.) Present value tables are provided below. Present Value of $1 Table (Exhibit 11B-1) (Partial table) Periods 4% 5% 6% 7% 8% 9% 10% 11 12% 13% 14% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 1 2. 4 5. 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.760 0.711 0.665 0.623…arrow_forwardAn electronic circuit board manufacturer is considering six mutually exclusive cost-reduction projects for its PC-board manufacturing plant. All have lives of 10 years and zero salvage value. The required investment, the estimated after-tax reduction in annual disbursements, and the gross rate of return arc given for each alternative in the following table: llte rate of return on incremental investments is given for each project as follows: Which project would you select according to the rate of return on incremental investment if it is stated that the MARR is 15%?arrow_forward

- Mountain Sounds Corp. is evaluating a cost savings project. The project's expected operational life is seven years. The project will save the firm $248,730 in net working capital, a one time savings for the life of the project. The project will require an investment in capital equipment of $5,631,945 and has an expected after-tax salvage value of $888,328. After considering the cash savings and depreciation impact the firm expects the project to generate operating cash flows of $1,034,805 each year for the life of the project. What is the NPV of the project if the firm's WACC is 8.9%?arrow_forwardPlease answer this problems manually. Thank youarrow_forwardConsider a project with a 3-year life and no salvage value. The initial cost to set up the project is $100,000. This amount is to be linearly depreciated to zero over the life of the project. The price per unit is $90, variable costs are $72 per unit and fixed costs are $10,000 per year. The project has a required return of 12%. Ignore taxes. 1. How many units must be sold for the project to achieve accounting break-even? 2. How many units must be sold for the project to achieve cash break-even? 3. How many units must be sold for the project to achieve financial break-even? 4. What is the degree of operating leverage at the financial break-even?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education