Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

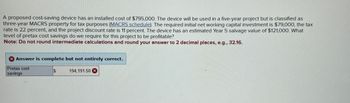

Transcribed Image Text:A proposed cost-saving device has an installed cost of $795,000. The device will be used in a five-year project but is classified as

three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $79,000, the tax

rate is 22 percent, and the project discount rate is 11 percent. The device has an estimated Year 5 salvage value of $121,000. What

level of pretax cost savings do we require for this project to be profitable?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

X Answer is complete but not entirely correct.

Pretax cost

savings

194,191.50 X

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An elective project is currently under review. It requires an initial investment of $116,000 for equipment. The profit is expected to be $28,000 each year, over the 6-year project period. The salvage value of the equipment at the end of the project period is projected to be $22,000. Assume a MARR of 10%. Find an IRR for this project.arrow_forwardAn electronic circuit board manufacturer is considering six mutually exclusive cost-reduction projects for its PC-board manufacturing plant. All have lives of 10 years and zero salvage value. The required investment, the estimated after-tax reduction in annual disbursements, and the gross rate of return arc given for each alternative in the following table: llte rate of return on incremental investments is given for each project as follows: Which project would you select according to the rate of return on incremental investment if it is stated that the MARR is 15%?arrow_forwardYou must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $150,000, and it would cost another $22, 500 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $52, 500. The applicable depreciation rates are 33%, 45% , 15%, and 7%. The equipment would require a $13, 000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $30,000 per year in before - tax labor costs. The firm's marginal federal - plus - state tax rate is 40%. What is the initial investment outlay for the spectrometer, that is, what is the Year 0 project cash flow? Round your answer to the nearest cent. Negative amount should be indicated by a minus sign. $ What are the project's annual cash flows in Years 1, 2, and 3? Round your answers to the nearest cent. In Year 1 $ In Year 2…arrow_forward

- 6. An elective project is currently under review. One alternative requires an initial investment of $116,000 for equipment. The profit is expected to be $28,000 each year, over the 6-year project period. The salvage value of the equipment at the end of the project period is projected to be $22,000. A second alternative requires an initial investment of $60,000 for equipment. The profit is projected to be $16,000 each year, over the 6-year project period. The salvage value of the equipment at the end of the project period is projected to be $14,000. The IRR of this alternative is 18.69%. Determine which alternative is preferred using the appropriate IRR method. Assume a MARR of 10%. Justify your recommendation, based on this method.arrow_forwardPlease show all your workarrow_forwardi need the answer quicklyarrow_forward

- A proposed cost-saving device has an installed cost of $765,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $67,000, the tax rate is 21 percent, and the project discount rate is 9 percent. The device has an estimated Year 5 salvage value of $103,000. What level of pretax cost savings do we require for this project to be profitable? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Pretax cost savingsarrow_forwardA proposed cost-saving device has an installed cost of $825,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $91,000, the tax rate is 23 percent, and the project discount rate is 9 percent. The device has an estimated Year 5 salvage value of $139,000. What level of pretax cost savings do we require for this project to be profitable? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Pretax cost savingsarrow_forwardPlease make sure you have the right answer! I have asked this question too many times and all the answers were wrong!!!arrow_forward

- A project requires initial asset investment of $1 million. The asset will last for 8 years, and will be depreciated for tax purposes at the CCA rate of 30%. The required return on this project is 16%, and the marginal corporate tax rate is 36%. Assuming that the asset will have a salvage value of $50,000 at the end of Year 8. what is the present value of the CCA tax shields from this project? Multiple Choice 204111.57 $215.009.97 $218.59071 $234.782.61arrow_forwardNational Integrated Systems (NIS), a global provider of heating and air conditioning is planning a project whose data is provided below. The project’s equipment has a 3 year tax life after which its salvage value will be zero. The machinery will be depreciated on a straight line basis over three years. Revenues and other operating costs are expected to be constant over the project’s life. What is the project’s cash flow in Year 1? Equipment Cost = $130,000Depreciation rate = 33.33%Annual Sales Revenue= $120,000Operating Costs (ex Depreciation) = $50,000 Tax Rate = 35%arrow_forwardYour firm needs a machine which costs $120,000, and requires $33,000 in maintenance for each year of its 5 year life. After 5 years, this machine will be replaced. The machine falls into the MACRS 5-year class life category. Assume a tax rate of 35 percent and a discount rate of 15 percent. What is the depreciation tax shield for this project in year 5?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education