Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

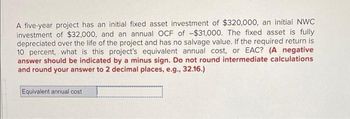

Transcribed Image Text:A five-year project has an initial fixed asset investment of $320,000, an initial NWC

investment of $32,000, and an annual OCF of -$31,000. The fixed asset is fully

depreciated over the life of the project and has no salvage value. If the required return is

10 percent, what is this project's equivalent annual cost, or EAC? (A negative

answer should be indicated by a minus sign. Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

Equivalent annual cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- We are evaluating a project that costs $735, 200, has an eight year life, and has no salvage value. Assume that depreciation is straight - line to zero over the life of the project. Sales are projected at 80, 000 units per year. Price per unit is $48, variable cost per unit is $33, and fixed costs are $730, 000 per year. The tax rate is 22 percent, and we require a return of 12 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within \pm 15 percent. Calculate the best - case and worst case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)arrow_forwardWe are evaluating a project that costs $788,400, has a nine-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 75,000 units per year. Price per unit is $52, variable cost per unit is $36, and fixed costs are $750,000 per year. The tax rate is 21 percent, and we require a return of 12 percent on this project. a-1.Calculate the accounting break-even point. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a- What is the degree of operating leverage at the accounting break-even point? (Do 2. not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) b- Calculate the base-case cash flow and NPV. (Do not round intermediate 1. calculations. Round your cash flow answer to the nearest whole number, e.g., 32. Round your NPV answer to 2 decimal places, e.g., 32.16.) b- What is the sensitivity of NPV to changes in the…arrow_forwardWe are evaluating a project that costs $1,800,000, has a 6-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 87,300 units per year. Price per unit is $38.19, variable cost per unit is $23.40, and fixed costs are $827,000 per year. The tax rate is 24 percent and we require a return of 9 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Best-case NPV Worst-case NPVarrow_forward

- Consider a three-year project with the following information: initial fixed asset investment = $710,000; straight-line depreciation to zero over the 5-year life; zero salvage value; price = $39.39; variable costs = $28.31; fixed costs = $332,000; quantity sold = 87,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) AOCF/AQarrow_forward1. An analyst offers three investment alternatives with the initial investment of A= $200,000; B= $300,000 and C= $100,000. The net annual income for these alternatives over the next 10 years includes $40,000; $55,000 and $19,000 respectively. Use IRR to choose the best alternative. MARR= 10% and no salvage values after 10 years.arrow_forwardThe expected average rate of return for a proposed investment of $44,000 in a fixed asset using straight-line depreciation, with a useful life of 4 years, no residual value, and an expected total net income of $11,000, isarrow_forward

- A firm is considering three mutually exclusive alternatives as part of an upgrade to an existing transportation network. If the MARR is 10% per year, which alternative (if any) should be chosen using the IRR analysis procedure? Use trial & error and show your calculations. A B Initial Cost Annual Revenue Annual Cost Salvage Value Useful Life 40,000 10,400 4,000 3,000 30,000 8,560 3,000 2,500 20,000 7,750 2,500 2,000 20 20 10arrow_forwardIggy Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Project Investment AnnualIncome Life ofProject 22A $243,600 $17,130 6 years 23A 271,500 20,700 9 years 24A 280,600 15,700 7 years Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Iggy Company uses the straight-line method of depreciation.(a) Determine the internal rate of return for each project. (Round answers 0 decimal places, e.g. 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project Internal Rate ofReturn 22A % 23A % 24A % If Iggy Company’s required rate of return is 11%, which projects are acceptable?arrow_forwardAn investment that costs $25,000 will produce annual cash flows of $5,000 for a period of 6 years. Further, the investment has an expected salvage value of $3,000. Given a desired rate of return of 12%, the investment will generate a (Do not round your PV factors and intermediate calculations. Round your answer to the nearest whole dollar): Multiple Choice negative net present value of $2,923. negative net present value of $1,520. negative net present value of $25,000. positive net present value of $20,557arrow_forward

- Assume a project has estimated fixed costs of $61,200, variable costs per unit of $84.29, a selling price of $199, and an initial cost of $402,000 for fixed assets. Depreciation is straight-line to zero over the project’s 4-year life. The tax rate is 30 percent, and the discount rate is 12 percent. What is the financial breakeven point?arrow_forwardIf a copy center is considering the purchase of a new copy machine with an initial investment cost of $145,800 and the center expects an annual net cash flow of $18,000 per year, what is the payback period? yearsarrow_forwardAn 8-year project is estimated to cost $384,000 and have no residual value. If the straight-line depreciation method is used and the average rate of return is 16%, determine the average annual income. $fill in the blank 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education