FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A

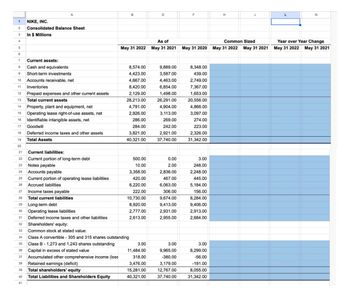

NIKE, INC.

Consolidated Balance Sheet

In $ Millions

1

2

3

4

5

6

7

Current assets:

8

Cash and equivalents

9 Short-term investments

10 Accounts receivable, net

11 Inventories

12 Prepaid expenses and other current assets

13

Total current assets

14

Property, plant and equipment, net

15 Operating lease right-of-use assets, net

16

Identifiable intangible assets, net

17 Goodwill

18 Deferred income taxes and other assets

Total Assets

19

20

21 Current liabilities:

22 Current portion of long-term debt

23

Notes payable

41

Current portion of operating lease liabilities

24 Accounts payable

25

26 Accrued liabilities

27 Income taxes payable

28

Total current liabilities

29

Long-term debt

30 Operating lease liabilities.

31

32 Shareholders' equity:

33 Common stock at stated value:

34 Class A convertible - 305 and 315 shares outstanding

35

Class B-1,273 and 1,243 shares outstanding

36 Capital in excess of stated value

37 Accumulated other comprehensive income (loss

38 Retained earnings (deficit)

39 Total shareholders' equity

40

Deferred income taxes and other liabilities

Total Liabilities and Shareholders Equity

B

8,574.00

4,423.00

4,667.00

8,420.00

2,129.00

28,213.00

4,791.00

2,926.00

286.00

284.00

3,821.00

40,321.00

500.00

10.00

As of

Common Sized

Year over Year Change

May 31 2022 May 31 2021 May 31 2020 May 31 2022 May 31 2021 May 31 2022 May 31 2021

3,358.00

420.00

6,220.00

222.00

10,730.00

8,920.00

2,777.00

2,613.00

D

3.00

11,484.00

318.00

3,476.00

15,281.00

40,321.00

9,889.00

3,587.00

4,463.00

6,854.00

1,498.00

26,291.00

4,904.00

3,113.00

269.00

242.00

2,921.00

37,740.00

0.00

2.00

2,836.00

467.00

6,063.00

306.00

9,674.00

9,413.00

2,931.00

2,955.00

F

3.00

9,965.00

-380.00

3,179.00

12,767.00

37,740.00

8,348.00

439.00

2,749.00

7,367.00

1,653.00

20,556.00

4,866.00

3,097.00

274.00

223.00

2,326.00

31,342.00

3.00

248.00

2,248.00

445.00

5,184.00

156.00

8,284.00

9,406.00

2,913.00

2,684.00

H

3.00

8,299.00

-56.00

-191.00

8,055.00

31,342.00

J

N

Transcribed Image Text:10

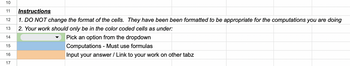

11 Instructions

12 1. DO NOT change the format of the cells. They have been been formatted to be appropriate for the computations you are doing

2. Your work should only be in the color coded cells as under:

13

14

Pick an option from the dropdown

15

Computations - Must use formulas

16

Input your answer / Link to your work on other tabz

17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please calculate the debts to assets ratio for the years 2022 and 2021, also please show your work.arrow_forwardQuestion Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $33,234 Accounts receivable 67,995 Accrued liabilities 6,510 Cash 22,738 Intangible assets 35,347 Inventory 83,390 Long-term investments 101,069 Long-term liabilities 79,156 Notes payable (short-term) 27,161 Property, plant, and equipment 689,074 Prepaid expenses 2,037 Temporary investments 30,842 Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? a.3.1 b.0.8 c.1.8 d.15.4arrow_forwardFollowing this balance sheet of chevron's company, provide me with a horizontal analysis comparative balance sheets.arrow_forward

- Calculate the following ratios from the income statement and balance sheet all are required 1-Payables Turnover 2-Debt-Equity Ratio 3-Debt Ratio 4-Total Asset Turnover 5-Fixed Asset Turnover Statement of financial positionas at 31 December 2018 2018 2017 Note RO RO ASSETS Non-current assets Property, plant and equipment 14 8,407,572 9,300,442 Deferred tax assets 12 40,977 18,550 8,448,549 9,318,992 Current assets Inventories 15 430,885 422,421 Trade and other receivables 16 1,129,440 1,235,724 Due from related parties 24 70,300 73,050 Cash and bank balances 17 6,856,734 6,439,709 Total current assets 8,487,359 8,170,904 Total assets 16,935,908 17,489,896 EQUITY…arrow_forwardPrepare a blance sheetarrow_forwardMatching answersarrow_forward

- Analysis above two financial statement, what you can observe without using financial ratio.arrow_forwardConsider the following information: Assets Cash Accounts Receivable (less allowance) Inventories Property, Plant and Equipment Long-term Investments Total Assets Liabilities Accounts Payable Current Portion of Long-Term Debt Long-Term Notes Payable Total Liabilities. Gil's Fish and Tackle, Incorporated Dalance Sheet At December 31, 2021 Stockholders' Equity Contributed Capital Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Operating Expenses Operating Income Other Expenses Interest Expense Sales Revenue Operating Expenses Salaries and Wages Expense Operating and Administrative Expenses Depreciation Expense Net Income Gil's Fish and Tackle, Incorporated Income Statement For the year ending December 31, 2021 Income Before Income Tax Expense Income Tax Expense Debt-to-Assets Ratio Times Interest Earned $ 22,200 169,100 68,300 102,800 30,000 $ 392,400 % $ 49,200 68,800 100,000 218,000 100,000 74,400 174,400 $ 392,400 $ 2,765,000 1,850,500 286,700…arrow_forwardprepare a common - size Consolidated Statements of Operations ( balance sheet)arrow_forward

- mework i 0 ences Mc Graw Hill INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets a. Free cash flow b. Additional tax c. Free cash flow million million million $ 27,571 17,573 1,406 $ 8,592 521 2022 8,071 1,695 $ 6,376 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) 2021 $ 2,340 1,379 126 1,093 $ 4,938 $ 24,681 2,808 2,987 $ 35,414 $ 2,340 1,339 121 620 $ 4,420 Saved $ 22,839 2,657 3,103 Liabilities and Shareholders' Equity Current liabilities Debt due for repayment Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity $ 33,019 Total liabilities and…arrow_forwardH1.arrow_forwardIf Net Working Capital Current Assets - Current Liabilities, what is Kelley Corp's net working capital for the year ending December 31, 2023, given the following account balances? Accounts Receivable: $40 Equipment: $20 Accumulated Depreciation: $10 Patent: $50 Inventory: $15 Accounts payable: $30 Goodwill: $65 Long-term note payable: $70 =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education