FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

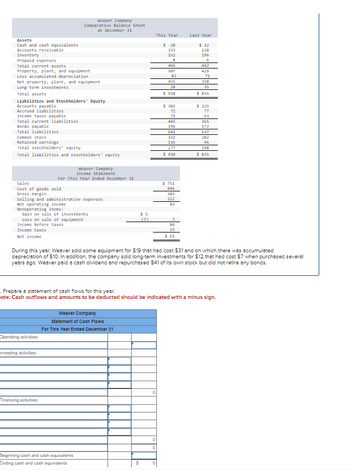

Transcribed Image Text:Assets

Cash and cash equivalents

Accounts receivable

Inventory

Prepaid expenses

Total current assets

Property, plant, and equipment

Less accumulated depreciation

Net property, plant, and equipment

Long-term investments

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Accrued liabilities

Income taxes payable

Total current liabilities

Weaver Company

Comparative Balance Sheet

at December 31

Bonds payable

Total liabilities

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

Nonoperating items:

Gain on sale of investments

Loss on sale of equipment

Income before taxes

Income taxes

Net income

Weaver Company

Income Statement

For This Year Ended December 31

Operating activities:

Investing activities:

Financing activities:

Weaver Company

Statement of Cash Flows

For This Year Ended December 31

Beginning cash and cash equivalents

Ending cash and cash equivalents

(2)

S

This Year

0

$-28

333

0

0

0

152

8

465

587

425

28

$ 918

$ 382

72

71

445

196

641

161

116

277

$ 918

$ 751

446

385

222

83

3

86

25

$ 61

During this year, Weaver sold some equipment for $19 that had cost $31 and on which there was accumulated

depreciation of $10. In addition, the company sold long-term investments for $12 that had cost $7 when purchased several

years ago. Weaver paid a cash dividend and repurchased $41 of its own stock but did not retire any bonds.

Last Year

. Prepare a statement of cash flows for this year.

lote: Cash outflows and amounts to be deducted should be indicated with a minus sign.

$12

228

196

6

442

429

71

358

35

$ 835

$ 225

77

365

172

537

282

298

$ 835

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do both part 1 and 2arrow_forwardUsing the Exhibit below, assume that the balance of Accounts Receivable was $61,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Receivable is $62,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts receivable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on…arrow_forwardThe is intended to reconcile changes in the balance sheet cash accounts. accounting statement of income accounting statement of changes in equity O capital budgeting cash flow calculation O accounting statement of cash flows Save for Later Attempts: 0 of 3 used Submit Answerarrow_forward

- State the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transac Note: Only consider the cash component of each transaction. Use the minus sign to indicate amounts that are cash out flows, cash payments, decreases in cash, or any negative adjustments. If your answer is not reported in an amount box does not require an entry, leave it blank or enter "0". a. Received $120,000 from the sale of land costing $70,000. b. Purchased investments for $75,000. c. Declared $35,000 cash dividends on stock. $5,000 dividends were payable at the beginning of the year, and $6,000 were payable at the end of the year. d. Acquired equipment for $64,000 cash. e. Declared and issued 100 shares of $20 par common stock as a stock dividend, when the market price of the stock was $32 a share. f. Recognized depreciation for the year,…arrow_forwardClark Bell started a personal financial planning business when he accepted $69,000 cash as advance payment for managing the financial assets of a large estate. Bell agreed to manage the estate for a one-year period beginning June 1, Year 1. Required Show the effects of the advance payment and revenue recognition on the Year 1 financial statements using the following horizontal statements model. In the Cash Flows column, use OA to designate operating activity, IA for investing activity, FA for financing activity, and NC for net change in cash. If the account is not affected, leave the cell blank. How much revenue would Bell recognize on the Year 2 income statement? What is the amount of cash flow from operating activities in Year 2?arrow_forwardPlease read through the questions carefully and enter answers carefully with the table providedarrow_forward

- Distribution lines on a journal entry are also shown on the Statement of Cash Flows. True or Falsearrow_forwardThe income statement and the cash flows from operating activities section of the statement of cash flows are provided below for Syntric Company. The merchandise inventory account balance neither increased nor decreased during the reporting period. Syntric had no liability for insurance, deferred income taxes, or interest at any time during the period. Sales Cost of goods sold Gross margin Salaries expense Insurance expense Depreciation expense Depletion expense Interest expense Gains and losses: Gain on sale of equipment Loss on sale of land Income before tax Income tax expense SYNTRIC COMPANY Income Statement For the Year Ended December 31, 2024 ($ in thousands) Net income Cash Flows from Operating Activities: Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for interest Cash paid for insurance Cash paid for income tax Net cash flows from operating activities $35.0 16.9 9.0 3.4 10.4 $ 271.7 (168.8) 102.9 (74.7) 19.0 (6.4) 40.8 (20.4) $ 20.4 $225.0…arrow_forwardSubject :- Accountingarrow_forward

- Help with part "a" please!arrow_forwardWhich of the following activities caused the greatest change in cash during the year? HINTS: You can find the breakdown of these activities on the Statements of Cash Flows. Multiple Choice O Operating activities Investing activities Financing activitiesarrow_forwardThe statement of cash flows is normally a required basic financial statement for each period for which an earnings statement is presented. The statement should include a separate schedule listing the financing and investing activities not involving cash. Required: What are financing and investing activities not involving cash? What are two types of financing and investing activities not involving cash? Explain what effect, if any, each of the following seven items would have on the statement of cash flows. accounts receivable inventory depreciation deferred tax liability issuance of long-term debt in payment for a building payoff of current portion of debt sale of a fixed asset resulting in a loss or gainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education