FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

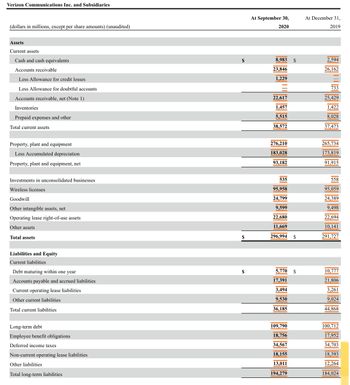

Please calculate the debts to asset ration for the year of 2019. Please show your work.

Transcribed Image Text:Verizon Communications Inc. and Subsidiaries

(dollars in millions, except per share amounts) (unaudited)

Assets

Current assets

Cash and cash equivalents

Accounts receivable

Less Allowance for credit losses

Less Allowance for doubtful accounts

Accounts receivable, net (Note 1)

Inventories

Prepaid expenses and other

Total current assets

Property, plant and equipment

Less Accumulated depreciation

Property, plant and equipment, net

Investments in unconsolidated businesses

Wireless licenses.

Goodwill

Other intangible assets, net

Operating lease right-of-use assets

Other assets

Total assets

Liabilities and Equity

Current liabilities

Debt maturing within one year

Accounts payable and accrued liabilities

Current operating lease liabilities

Other current liabilities

Total current liabilities

Long-term debt

Employee benefit obligations

Deferred income taxes

Non-current operating lease liabilities

Other liabilities

Total long-term liabilities

$

At September 30,

2020

8,983 S

23,846

1,229

22,617

1,457

5,515

38,572

276,210

183,028

93,182

535

95,958

24,799

9,599

22,680

11,669

296,994 S

5,770 S

17,391

3,494

9,530

36,185

109,790

18,756

34,567

18,155

13,011

194,279

At December 31,

2019

2,594

26,162

733

25,429

1,422

8,028

37,473

265,734

173,819

91,915

558

95,059

24,389

9,498

22,694

10,141

291,727

10,777

21,806

3,261

9,024

44,868

100,712

17,952

34,703

18,393

12,264

184,024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2019, Don accepted a note receivable from Mike’s Builders for $1,000 as a good faith promise to pay for electrical engineering services rendered that week. The terms of the note are: Face $1,000, Interest 7%, Due in 180 Days. Prepare Don’s journal entry for December 31, 2019. Pay close attention to what I am asking for.arrow_forwardUnder Home Buyers' Plan, individuals are not permitted to deduct RRSP contributions that are made and immediately withdrawn within ____ days. Question 10 options: a) Calendar year end b) 90 days c) 120 days d) Month endarrow_forwardRahul deposits $4450.00 in an account on April 1, 2019 which earns 9.5% compounded quarterly. How much is in the account on September 15, 2024 if simple interest is allowed for part of a conversion period?arrow_forward

- On July 1, 2019, Park Company leased office space for ten years to Rudd at a monthly rental of $15,000, and received the following amounts as listed in the table below. Rude made timely rent payments through November 2019; the December rent was paid, together with January 2020 rent, on January 6, 2020. At December 31, 2019, park should report rent receivable of? First Month Rent $ 15,000 Security Deposit $ 25,000 a. $0 b. $ 5,000 c. $15,000 d. $30,000arrow_forwardBased on the following information, determine the maximum loan amount available as of July 31, 2021. T The plan allows for two outstanding loans at a time. The participant took a loan of $45,000 on March 1, 2021. The participant's outstanding loan balance is $0 as of July 31, 2021. The participant's vested account balance is $150,000 . Answers: $0, $5,000, $50,000, or $75,000?arrow_forwardPrepare all necessary journal entries for 2024.arrow_forward

- Big Blue University has a fiscal year that ends on June 30. The 2019 summer session of the university runs from June 10 through July 29. Total tuition paid by students for the summer session amounted to $123,000. Required: a. How much revenue should be reflected in the fiscal year ended June 30, 2019? Amount of revenue b. Would your answer to part a be any different if the university had a tuition refund policy that no tuition would be refunded after the end of the third week of summer session classes? O Yes O Noarrow_forwardAt the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $32,200, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $12,200 of the $32,200 loan discussed above is due next year. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $27,200 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $14,200. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $6,200. No Date General Journal Debit Credit 1 Dec 31 Interest Expense 805 Interest Payable 805…arrow_forwardPrepare all journal entries and adjusting journal entries necessary to record all of Red Robin's transactions related to the note payable information below: Red Robin purchased the building on January 1, 2019, for $496,300 using a note payable. The loan is a 30-year, 5% installment loan with annual payments due every December 31. See amortization table below: Building Loan Amortization Principal Interest Years Payments/year Payment Date 31-Dec-19 31-Dec-20 31-Dec-21 31-Dec-22 31-Dec-23 31-Dec-24 31-Dec-25 31-Dec-26 31-Dec-27 31-Dec-28 31-Dec-29 31-Dec-30 31-Dec-31 31-Dec-32 31-Dec-33 31-Dec-34 31-Dec-35 31-Dec-36 31-Dec-37 31-Dec-38 31-Dec-39 31-Dec-40 31-Dec-41 31-Dec-42 31-Dec-43 31-Dec-44 31-Dec-45 31-Dec-46 31-Dec-47 31-Dec-48 $496,300 5.00% 30 1 32,285 Interest Principal Payment Balance 496,300 488,830 480,986 7,470 32,285 7,844 32,285 24,815 24,441 24,049 32,285 23,638 32,285 23,205 32,285 22,751 32,285 22,274 10,011 32,285 21,774 10,511 32,285 21,248 11,037 32,285 8,236 8,647…arrow_forward

- Pedro is about to prepare and file his annual income tax return for the year ending December 21, 2020. Pedro is an emloyed engineering manager and he practice his profession and as a consultant. What BIR Form will be used?arrow_forwardPayroll Accounting 2020 by Landin Question: Ed Myers is verifying the accuracy and amount of information contained in the employee records for his employer, Genible Industries. Which of the following items should be present in the employee information? Social Security number. checkedJob title. checkedEmployee address. checkedBirth date, if greater than 19.arrow_forwardSubject - account Please help me. Thankyou .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education